Donald Trump never ceases to surprise with his persistence and is ready to use any measure to force Kyiv and Moscow to sign a truce. The American president views Russia's continued war effort as enabled by its steady cash flow, mainly from oil and gas exports. Thus, Trump wants to cut off this dollar flow to Russia, so the Kremlin won't have the means to continue fighting. Frankly, it's hard to judge how effective such measures would be, especially since Moscow has repeatedly made it clear that sanctions will not force them to abandon their objectives.

Yet Trump's new tariffs are also under question. The US president not only wants to impose additional tariffs on India and China but also wants the European Union to adopt similar tariffs. In other words, Trump seeks Europe's support in confronting China, Russia, and India, despite previously imposing tariffs on the EU and signing a deal that imposes significant obligations on Europe, with almost none on the US.

Trump continues to extract "benefits" wherever he can. If Europe refuses to impose tariffs against China and India, Trump can always say he "did everything possible to end the war, but Europe was against it." If tariffs are introduced in some form, the American budget gets more revenue.

As is often the case, the situation is complicated and ambiguous, but all I see is Trump's powerlessness in this matter—just like with the Fed. I have no doubt he'll keep pressuring the FOMC, China, India, and Russia, because retreat makes no sense. If he steps back, what does America lose? Nothing. But Trump will be seen as a leader who promised but couldn't deliver. This extends to economics and his would-be peacekeeper role; someone else could end up with the Nobel Peace Prize. That's why I'm sure both these storylines will develop further.

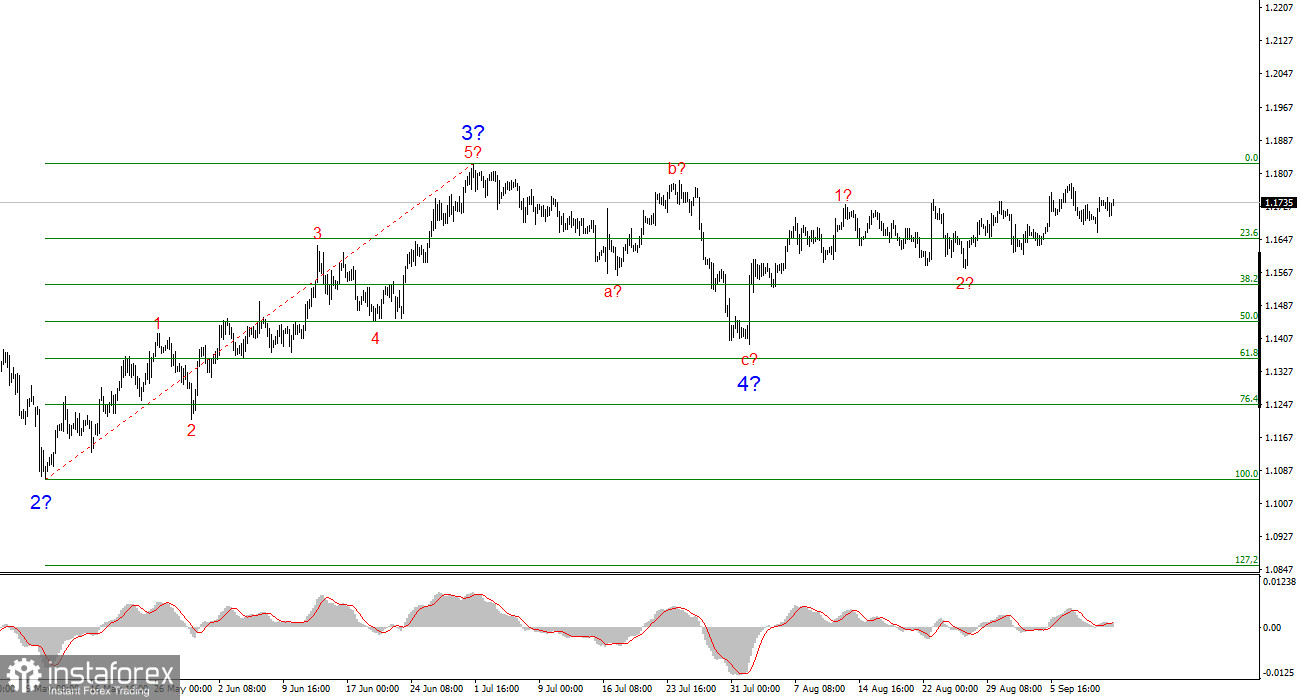

Wave Picture for EUR/USD

Based on my analysis, EUR/USD continues to develop its upward trend segment. The wave structure still completely depends on the news flow regarding Trump's decisions, as well as the external and internal politics of the new Administration. The wave's target may reach the 1.25 area. Given the consistent news environment, I continue to consider long positions, targeting levels near 1.1875 (the 161.8% Fibonacci level) and above.

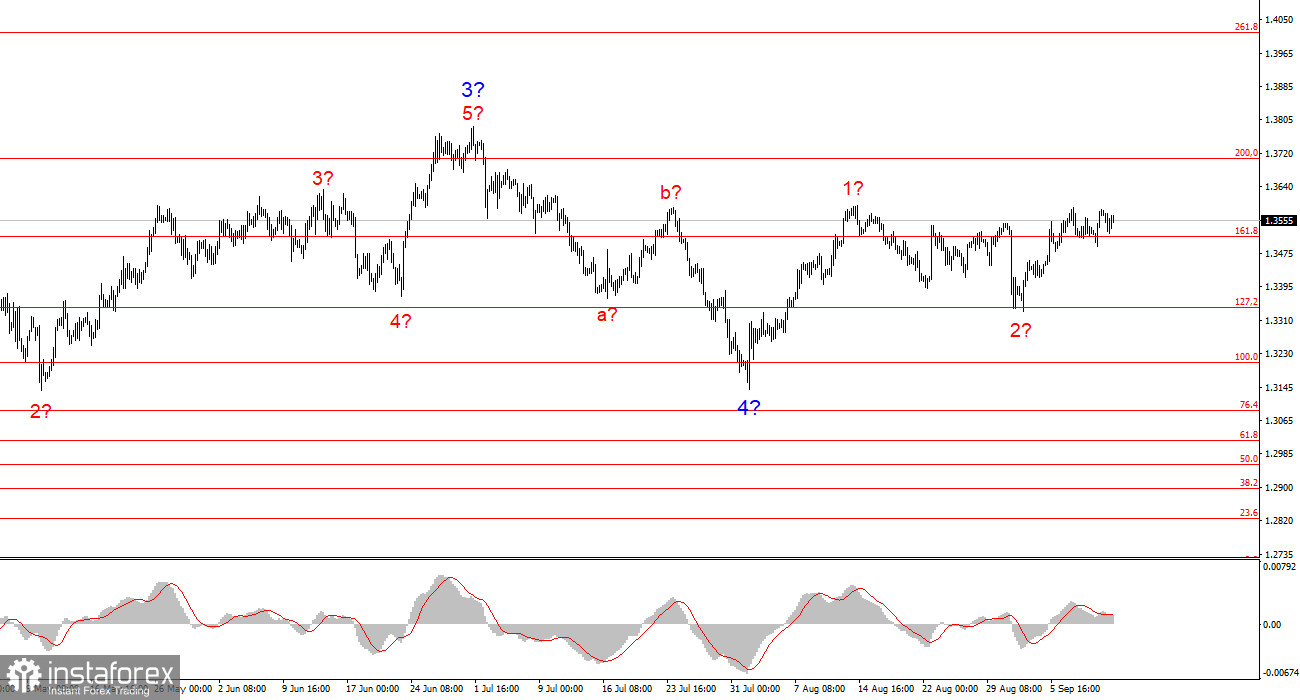

Wave Picture for GBP/USD

The wave structure for GBP/USD remains unchanged. We are dealing with an upward, impulsive trend segment. Under Trump, markets may see plenty of shocks and reversals, which could notably impact the wave pattern, but for now, the working scenario remains intact, and Trump's policy remains unchanged. The upward trend segment's targets are near the 261.8% Fibonacci level. Currently, I expect continued growth within wave 3 of 5, aiming for 1.4017.

My Key Analytical Principles:

- Wave structures should be simple and clear. Complex structures are harder to trade and tend to change.

- If you are not confident about the market situation, it's better to stay out.

- There is never 100% certainty in market direction. Do not neglect protective Stop Loss orders.

- Wave analysis can be combined with other forms of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română