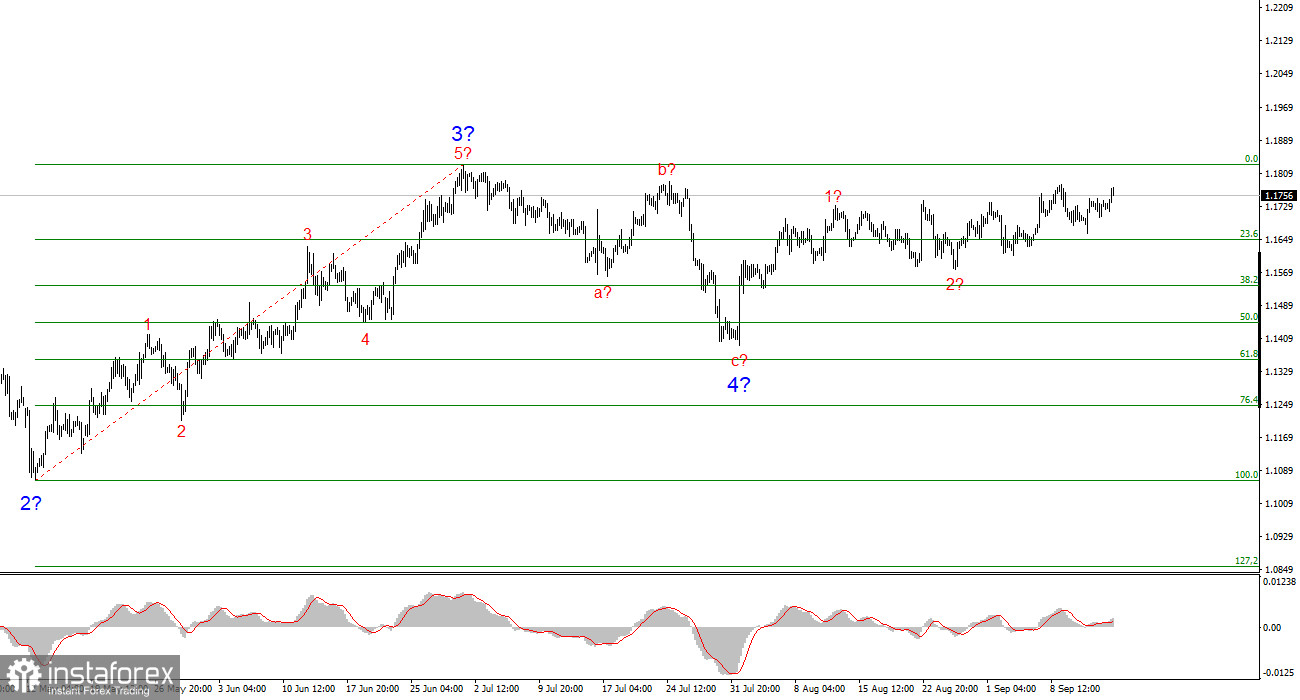

The wave structure of the 4-hour EUR/USD chart has remained unchanged for several months, which is encouraging. Even when corrective waves form, the overall structure holds together. This makes accurate forecasting possible. It should be noted that wave patterns do not always look like textbook examples. At the moment, the pattern looks very clear.

The upward segment of the trend continues to develop, while the news background continues to support mostly not the dollar. The trade war initiated by Donald Trump is ongoing. The confrontation with the Fed continues. Market "dovish" expectations for the Fed's rate are growing. The market's assessment of Trump's first 6–7 months remains low, even though U.S. GDP growth in Q2 reached 3%.

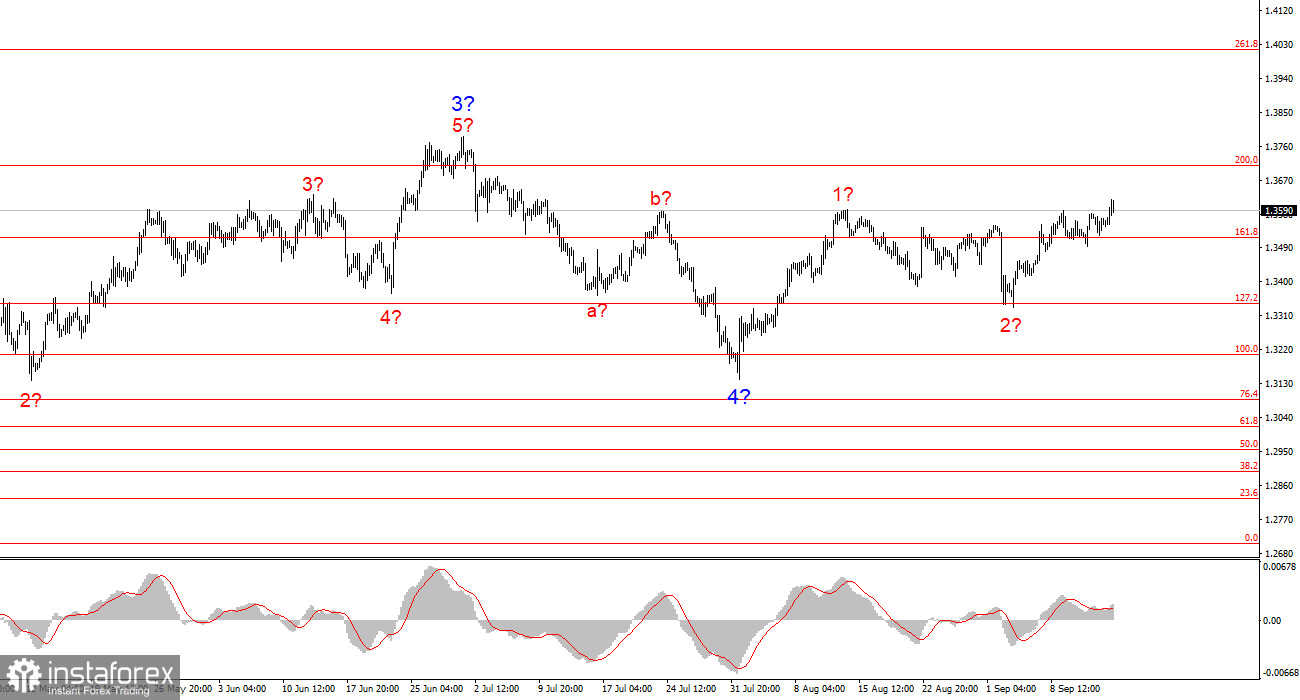

Currently, it can be assumed that the formation of impulse wave 5 continues, with potential targets extending as far as the 1.25 level. Inside this wave, the structure is somewhat complicated by the sideways movement observed over the past month. Nevertheless, waves 1 and 2 can be identified. Accordingly, I believe the instrument is now within wave 3 of 5.

The EUR/USD rate rose by 20 basis points on Monday, while trading amplitude remained weak. The news background was very limited today, but buyers still dominated the first half of the day, allowing the euro to gain slightly in value. In the second half, the New York Manufacturing Index, which is not the most important market indicator, came out at -8.7 points in September instead of the expected 5–10 points. Paradoxically, after this report demand for the U.S. dollar even ticked up slightly, though I tend to believe the market largely ignored it.

This week, there will be plenty of important events in the U.S., the EU, and the U.K. From the very beginning of trading, market participants showed they were inclined toward new purchases. What remains is for upcoming events to support the euro. This evening will feature the first of three speeches by ECB President Christine Lagarde, although this event is unlikely to affect market sentiment. Traders will be waiting for key reports that will shape central bank decisions.

The Fed meeting should be highlighted as the key event of the week. Despite the market being confident in its expectations of a 25 basis point rate cut, what matters is the tone Jerome Powell will adopt. Recently, dovish expectations in the futures market have been growing, as four consecutive Nonfarm Payrolls reports have been extremely weak. From this perspective, the real question is not whether the FOMC will cut rates in September (that is already certain), but how many times the Fed will cut rates in the near future. Dot plot charts currently suggest two cuts this year, but given the poor statistics, there could be more.

General conclusions.

Based on the EUR/USD analysis, I conclude that the instrument continues to build an upward segment of the trend. The wave structure still largely depends on the news background related to Trump's decisions and the foreign and domestic policy of the new Administration. The trend's potential targets may extend up to the 1.25 level. With the news background developing as it is, I continue to consider buy positions, with initial targets around 1.1875, corresponding to the 161.8% Fibonacci extension, and higher.

On a smaller scale, the entire upward segment of the trend is visible. The wave structure is not textbook-standard, as corrective waves differ in size. For example, the larger wave 2 is smaller than the internal wave 2 within wave 3. However, this also happens. It should be remembered that it is best to highlight clear structures on the charts rather than tying every move to individual waves. Currently, the upward structure leaves little doubt.

The main principles of my analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often change.

- If there is no confidence in what is happening in the market, it is better to stay out.

- There can never be 100% certainty about the market's direction. Always use protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română