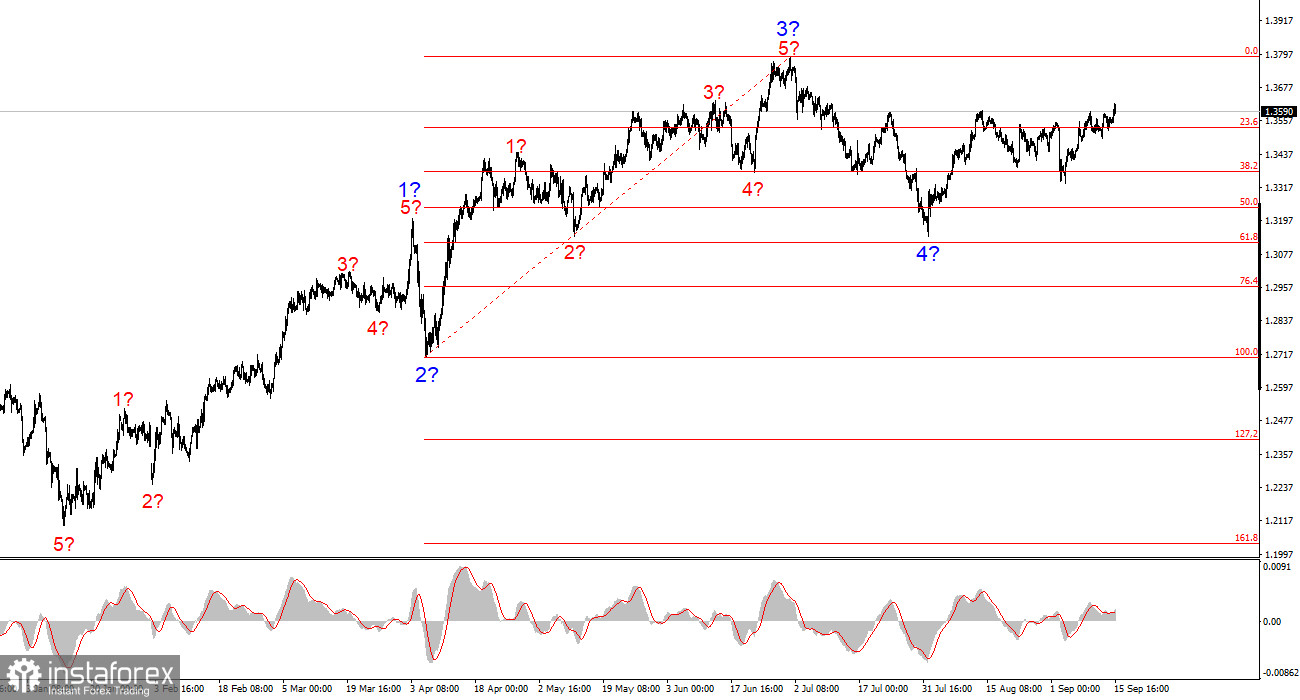

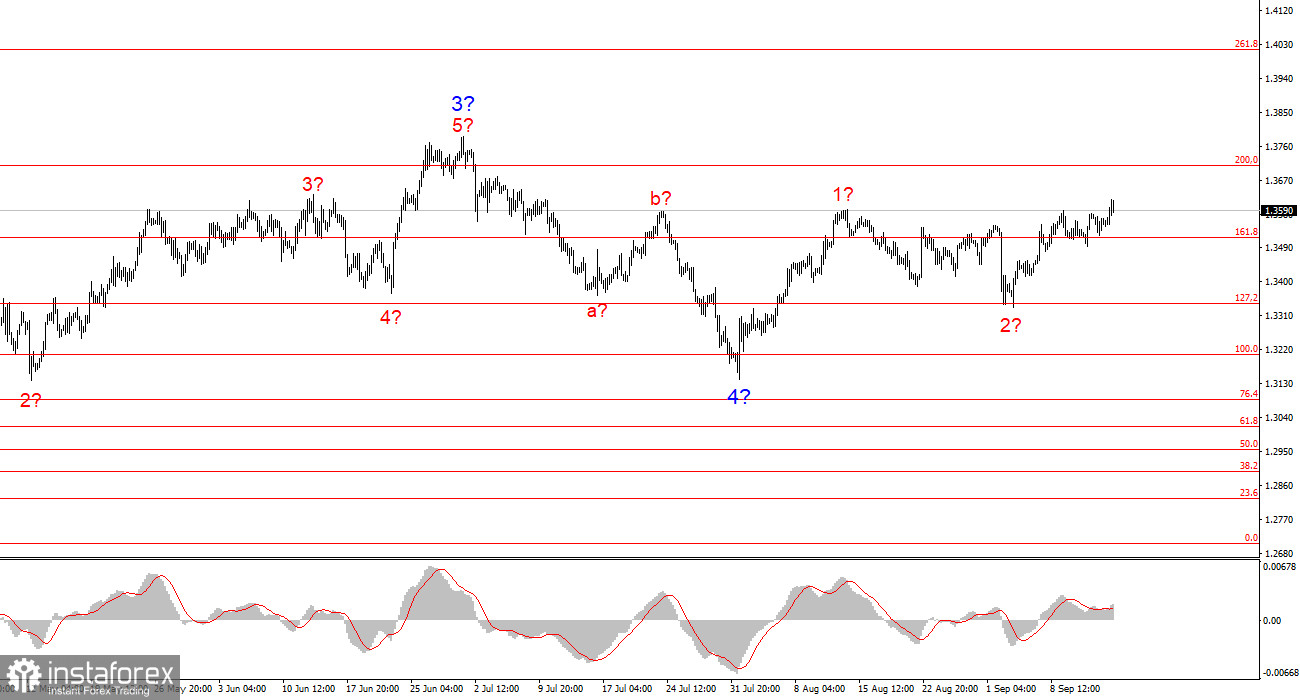

The wave pattern for GBP/USD continues to indicate the formation of a bullish impulse structure. The wave picture is almost identical to that of EUR/USD since the sole "culprit" remains the U.S. dollar. Demand for the dollar is declining across the market in the medium term, and many instruments are therefore showing nearly identical dynamics. At this stage, the presumed wave 5 is still developing, within which waves 1 and 2 have already formed. The current wave structure raises no doubts.

It should be remembered that much on the currency market now depends on Donald Trump's policies—beyond just trade. Occasionally, positive news emerges from the U.S., but the market constantly weighs economic uncertainty, contradictory decisions and statements from Trump, and the hostile, protectionist stance of the White House. There are also concerns about Fed policy easing, with more reasons for it now than just a weak labor market.

The GBP/USD rate rose by 30 basis points on Monday. Buyers are trying to break out of the sideways range they have been trading in over the past months, and it is likely they will succeed. This week will bring both Fed and Bank of England meetings, but the most important event will be the U.K. inflation report. The Bank of England continues to base its decisions on inflation data. Thus, the upcoming report will determine monetary policy and its future adjustments.

In my view, the current inflation level in Britain no longer allows the Bank of England to think in dovish terms. Inflation has been accelerating for nearly a year and is now much closer to 4% than 2%. I believe the BoE has already gone too far with easing at this point and probably rushed with its third rate cut this year. However, it should be noted that the last decision to cut rates was a close call, with a 5–4 vote. At least four BoE policymakers opposed easing.

Therefore, with CPI already at 3.8%, I do not think the next report will be decisive. Another acceleration would further reduce the likelihood of easing by year-end, while a slowdown would change little, since inflation is already high.

Taking all this into account, and given the 100% likelihood of a Fed rate cut, I believe demand for the British currency will continue to grow. Likely gradually and cautiously, but there is no reason to abandon the working wave count, which points to further growth.

General conclusions.

The wave picture for GBP/USD remains unchanged. We are dealing with an upward impulse segment of the trend. Under Donald Trump, the markets may face many more shocks and reversals that could seriously affect the wave structure, but at the moment the working scenario remains intact, and Trump's policies are not changing. The targets of the upward segment of the trend are around the 261.8% Fibonacci extension. Currently, I expect continued growth within wave 3 of 5 toward 1.4017.

The larger-scale wave pattern looks nearly perfect, although wave 4 extended beyond the peak of wave 1. But perfect wave counts exist only in textbooks—real-life markets are more complex. At the moment, I see no grounds to consider alternative scenarios or make adjustments.

The main principles of my analysis:

- Wave structures should be simple and clear. Complex ones are hard to trade and often change.

- If there is no confidence in the market situation, it is better to stay out.

- One can never have 100% certainty about the direction of movement. Always use protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română