Tuesday Trade Review:

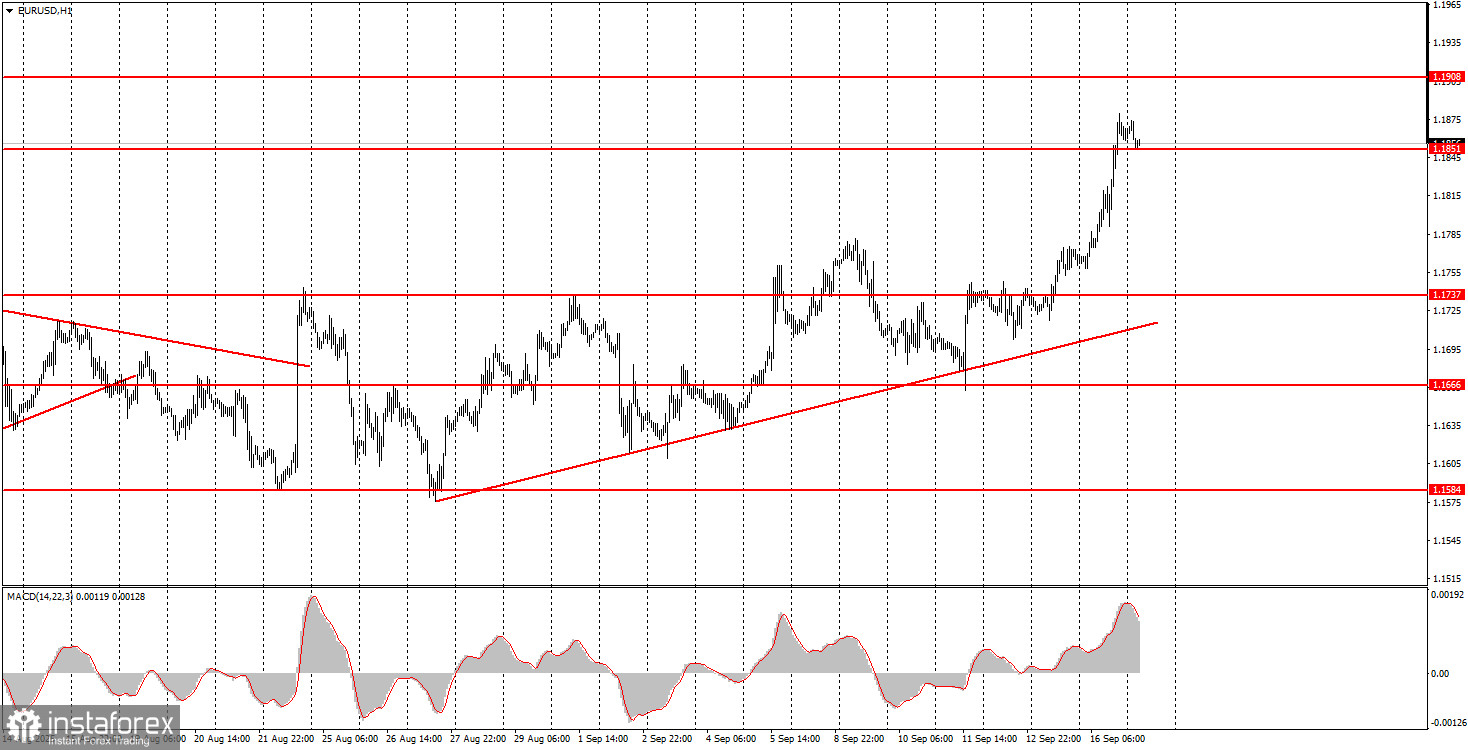

1H Chart of EUR/USD

On Tuesday, the EUR/USD pair continued its upward movement. The hourly timeframe clearly shows the formation of a new bullish trend, and on the daily timeframe, the trend of 2025 is officially back in force. There's no point even searching for new reasons behind the dollar's latest fall. None of the four somewhat important reports yesterday had anything to do with the euro's growth. US retail sales and industrial production both exceeded forecasts, which should have caused the pair to fall. However, the global fundamental backdrop continues to exert powerful pressure on the US dollar. From time to time, the dollar does correct, but overall, we continue to expect only further decline. This evening we'll get the Fed's meeting outcome, which could spark another drop in the dollar—even though the event has already been partly "priced in" by the market, for instance, on Tuesday.

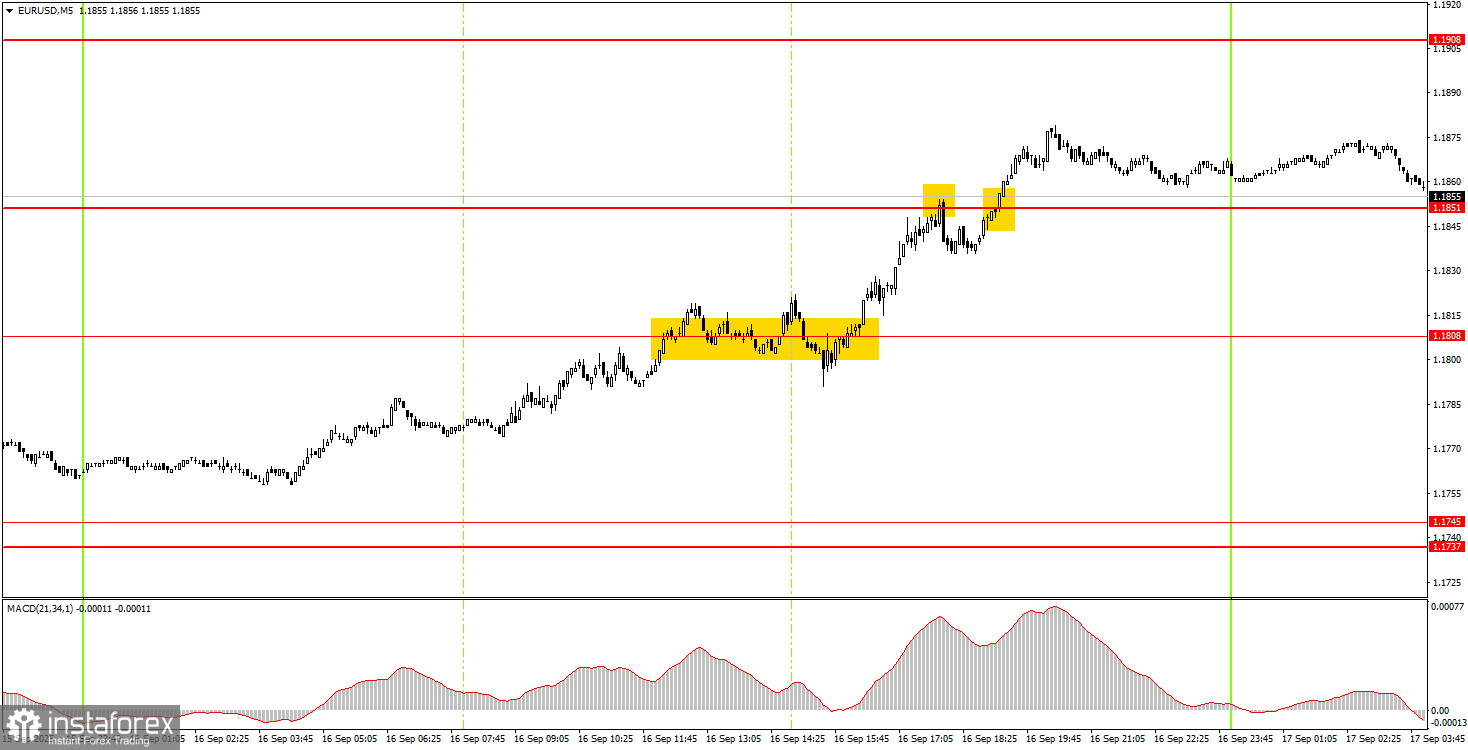

5M Chart of EUR/USD

On the 5-minute timeframe on Tuesday, movement was decent, but the trading signals themselves were not the best. The first trading signal formed during the US session after a very inaccurate and indecisive breakout of 1.1808. It's worth noting that there were no macroeconomic reasons for a strong euro rally yesterday. Next came a false sell signal around 1.1851 and a late buy signal at the same level. As a result, it was quite difficult to profit from Tuesday's movement.

How to Trade on Wednesday:

On the hourly timeframe, the EUR/USD pair has every chance to continue the uptrend that's been forming since the start of this year. The fundamental and macro backdrop remains negative for the dollar, so we still do not expect a reversal to USD strength. In our view, as before, the dollar can only hope for technical corrections. A consolidation below the trendline would signal a new phase of technical decline, but for now, the pair is about 100 pips above that line.

On Wednesday, the pair could continue its move north as the uptrend persists. From 1.1851 (with a signal), you can look for fresh longs toward 1.1908. Shorts become relevant if there's a break and close below 1.1851, targeting 1.1808.

On the 5-minute timeframe, consider the following levels: 1.1354–1.1363, 1.1413, 1.1455–1.1474, 1.1527, 1.1571–1.1584, 1.1655–1.1666, 1.1737–1.1745, 1.1808, 1.1851, 1.1908, 1.1970–1.1988. On Wednesday, in the Eurozone, there will be another speech from Christine Lagarde as well as the second estimate of August inflation—both are secondary events. In the US, several minor reports and the Fed meeting are on the agenda.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română