Trade Review and Advice on Trading the Euro

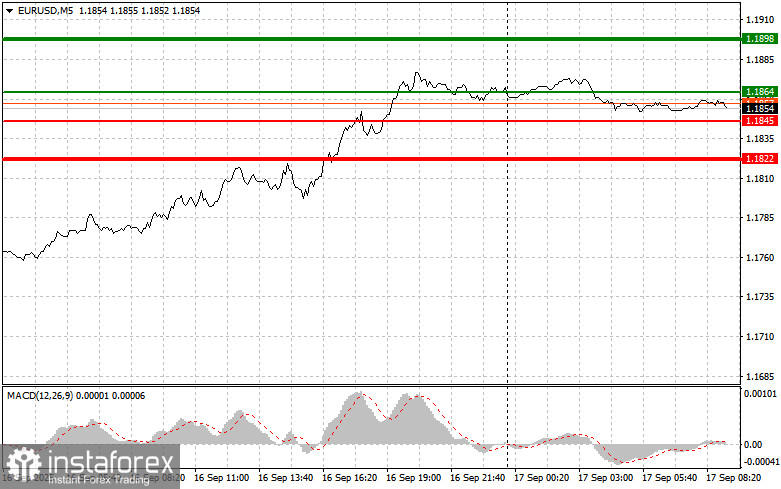

The test of the 1.1821 price occurred when the MACD indicator was just starting to move up from the zero mark, confirming the right entry point for buying the euro in line with the trend. As a result, the pair reached the target level of 1.1848.

The euro's confident climb was driven by encouraging data from Germany's ZEW institute, reflecting positive shifts in economic sentiment across the eurozone. The main driving force on the currency market then became expectations for continued dovish policy from the US Federal Reserve. Initial expectations pointed to a cautious Fed approach to rate cuts, but now many traders expect at least two rate reductions by year-end, which is bearish for the dollar.

Today is shaping up to be busy, with many events potentially impacting currency fluctuations. Market participants and experts will pay special attention to how actual CPI readings differ from economists' forecasts. If the numbers come in above expectations, this could increase pressure on the ECB to rule out further rate cuts this year, which would most likely boost the euro. Conversely, results below forecasts could trigger the opposite, prompting a euro decline. ECB President Christine Lagarde is also set to speak today. The market will closely scrutinize her comments on the inflation outlook and future ECB measures. Lagarde may use this platform to adjust current market expectations or to offer clearer guidance on the central bank's next moves.

As for the intraday strategy, I will focus more on implementing scenarios #1 and #2.

Buy Scenario

Scenario #1: Today, I plan to buy the euro if the price reaches the 1.1864 area (green line on the chart), targeting a rise to 1.1898. At 1.1898, I intend to exit longs and sell in the opposite direction, counting on a 30–35 pip move from the entry. Buying the euro is only advisable after strong stats. Important! Before buying, make sure the MACD is above zero and just starting to rise.

Scenario #2: I'll also plan to buy the euro if there are two consecutive tests of 1.1845, while the MACD is in the oversold zone. This will limit the pair's downside potential and trigger a reversal upward. Growth to the opposite levels of 1.1864 and 1.1898 can then be expected.

Sell Scenario

Scenario #1: I plan to sell the euro after it reaches 1.1845 (red line on the chart), targeting 1.1822, where I'll exit shorts and immediately buy on the rebound (expecting a 20–25 pip move in the opposite direction). Downside pressure may return to the pair today if the data is weak. Important! Before selling, ensure the MACD is below zero and just starting to decline.

Scenario #2: I'll also look to sell the euro if there are two consecutive tests of 1.1864 while the MACD is in the overbought zone. This will cap the pair's upside and trigger a reversal downward—look for declines to the opposite levels: 1.1845 and 1.1822.

What's on the Chart:

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română