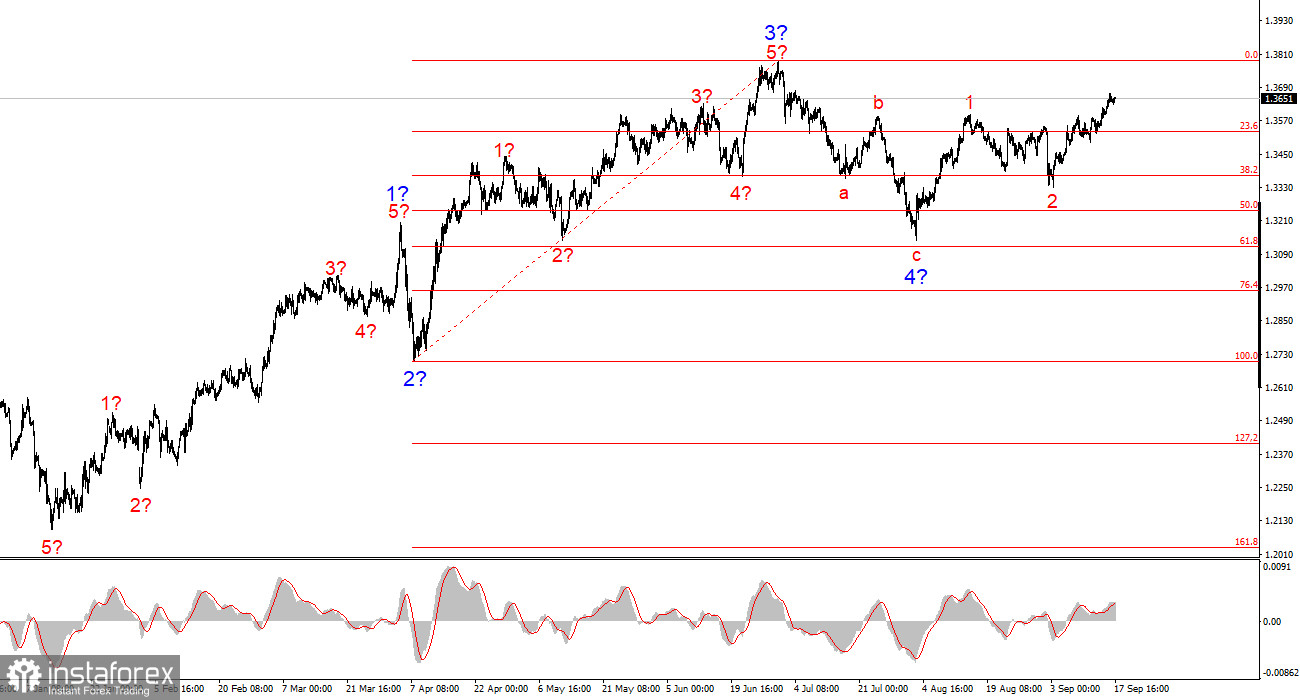

The wave structure for GBP/USD continues to indicate the formation of an upward impulsive wave sequence. The wave pattern is almost identical to EUR/USD, as the only "driver" remains the U.S. dollar. Demand for the dollar is declining across the market (in the medium term), so many instruments are showing nearly identical dynamics. At the moment, the formation of the assumed wave 5 continues, within which waves 1 and 2 have already been formed. The current wave structure raises no doubts.

It should be remembered that much in the currency market now depends on Donald Trump's policies, and not only trade policy. Occasionally, positive news emerges from the U.S., but the market keeps in mind ongoing uncertainty in the economy, contradictory decisions and statements by Trump, and the hostile, protectionist stance of the White House. The market also fears Fed easing, for which there are now more reasons than just a weak labor market.

The GBP/USD pair rose by 50 basis points during Tuesday and Wednesday, which is not much. I cannot say that the news background over these two days demanded a stronger appreciation of the British currency, but it does open additional prospects for it. Let me explain. The Bank of England has paused its cycle of monetary policy easing. Accordingly, the main question for the pound is: how long will this pause last? Its duration will depend on the state of the economy, the labor market, unemployment, and inflation. The UK economy has been growing at a modest pace for several years, but it seems the British Parliament does not expect more. The unemployment rate is rising, inflation is also rising. Based on this, I can assume that over the next year to year and a half, the Bank of England will also balance between two fires, just like the Fed.

The UK does not have a NonFarm Payrolls report, so we can judge the labor market only by the unemployment rate and reports on changes in employment/unemployment. The unemployment rate has risen by 0.7% over the past year, but inflation has more than doubled. I dare suggest that the Consumer Price Index is of greater concern to Bank of England officials than unemployment. I believe that in the near future all efforts will be directed at preventing the indicator from moving into the "above 4%" level. Therefore, a rate cut by the Bank of England before the end of the year should not be expected.

At the same time, the Fed may lower the rate at all three remaining meetings in 2025, which puts the dollar in a remarkably weak position. That is why I believe the pound's growth potential is now, if not enormous, then quite significant. Inflation in the UK in August did not increase but also did not slow down. This report can be considered positive for the pound.

General conclusions

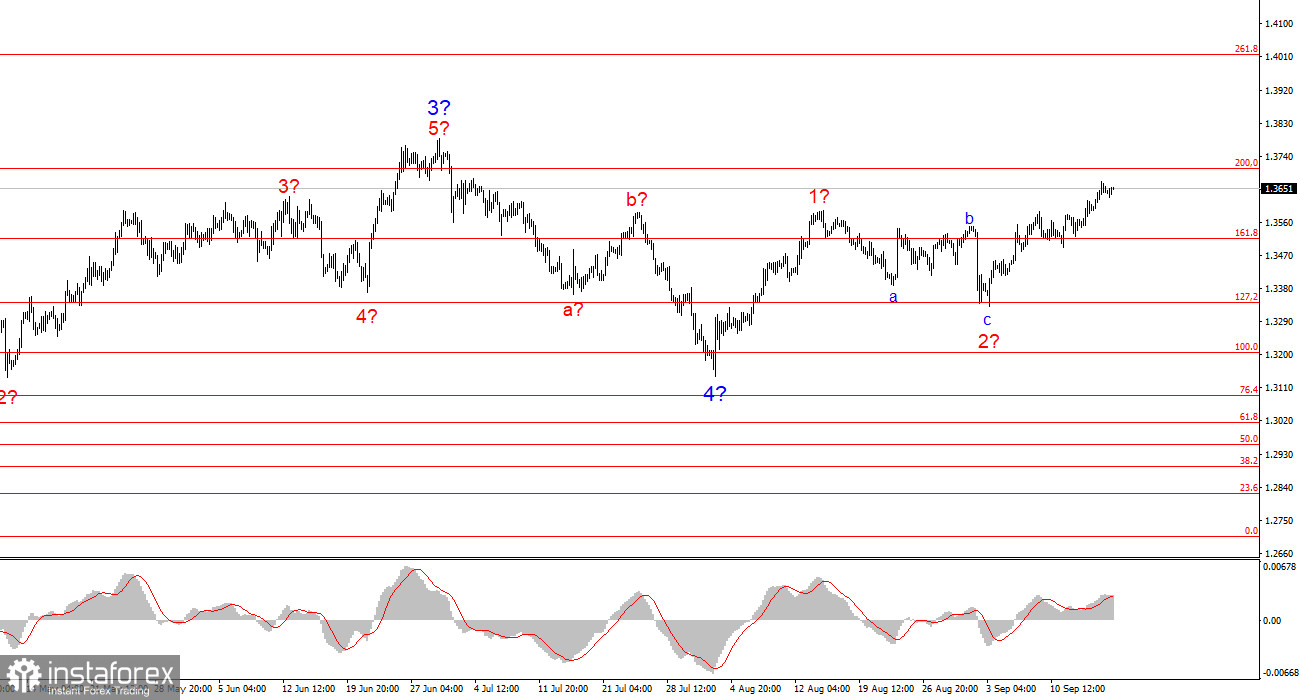

The wave pattern of GBP/USD remains unchanged. We are dealing with an upward impulsive section of the trend. Under Donald Trump, markets may still face many shocks and reversals that could significantly affect the wave structure, but at the moment the working scenario remains intact, and Trump's policy is unchanged. The targets of the upward trend section are located around the 261.8% Fibonacci level. Currently, I expect continued growth within wave 3 of 5 with a target at 1.4017.

The larger-scale wave structure looks almost perfect, even though wave 4 moved beyond the maximum of wave 1. However, let me remind you that perfect wave patterns exist only in textbooks. In practice, things are much more complicated. At present, I see no reason to consider alternative scenarios or make adjustments.

Main principles of my analysis:

- Wave structures should be simple and clear. Complex structures are hard to trade and often bring changes.

- If there is no confidence in what is happening in the market, it is better not to enter it.

- One can never have 100% certainty about the direction of movement. Do not forget protective Stop Loss orders.

- Wave analysis can be combined with other forms of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română