Trade review and advice for trading the pound

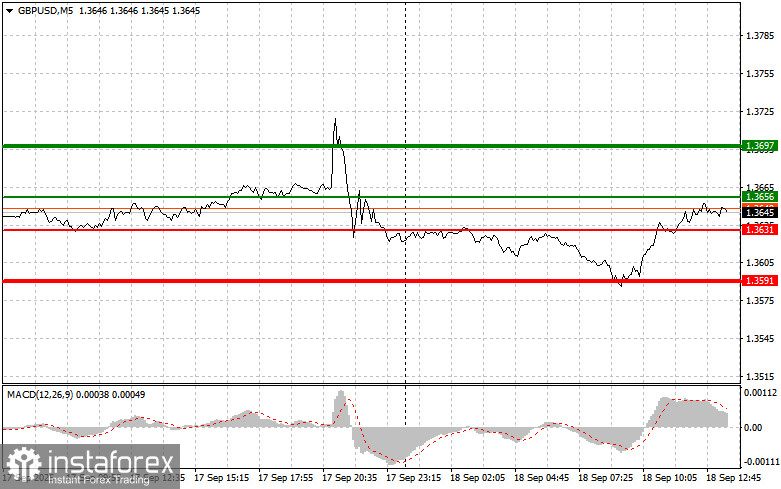

The price test at 1.3611 occurred when the MACD indicator had just begun moving upward from the zero mark, confirming the correct entry point for buying the pound. As a result, the pair rose by more than 30 points.

The European session only reinforced the intentions of major players, pushing the pound to new local highs. Optimism about the outlook for the British economy, supported by expectations that the Bank of England will maintain a cautious stance on interest rates, continues to fuel demand for the pound. Technical analysis also points to a favorable picture for the currency.

Beyond the regulator's decision, the pound may gain against the dollar later in the day following weak U.S. jobless claims data. Unexpectedly poor figures could trigger further dollar selling, positively affecting the pound's performance.

Today's Philadelphia Fed manufacturing index, reflecting business activity in the manufacturing sector, also plays a key role. A decline would confirm slowing economic growth and strengthen arguments for a more dovish monetary policy. Finally, the leading indicators index, which aggregates various macroeconomic indicators, provides an overall picture of future economic conditions. A drop in this index could serve as a warning of looming difficulties and increase pressure on the Fed to adopt stimulus measures.

As for intraday strategy, I will be relying mainly on scenarios #1 and #2.

Buy signal

Scenario #1: I plan to buy the pound today at the entry point around 1.3656 (green line on the chart) with a target at 1.3697 (thicker green line on the chart). Around 1.3697, I will exit long positions and open short ones in the opposite direction, expecting a 30–35 point pullback. A strong rise in the pound today can be expected only after weak U.S. data.Important! Before buying, make sure the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario #2: I also plan to buy the pound today in case of two consecutive tests of the 1.3631 level when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and trigger a reversal upward. Growth toward the opposite levels of 1.3656 and 1.3697 can be expected.

Sell signal

Scenario #1: I plan to sell the pound today after the 1.3631 level (red line on the chart) is updated, which will lead to a quick decline in the pair. The key target for sellers will be 1.3591, where I plan to exit short positions and immediately buy in the opposite direction, expecting a 20–25 point reversal. A drop in the pound will occur if U.S. data comes out strong.Important! Before selling, make sure the MACD indicator is below the zero mark and just beginning to decline from it.

Scenario #2: I also plan to sell the pound today in case of two consecutive tests of the 1.3656 level when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and trigger a reversal downward. A decline toward the opposite levels of 1.3631 and 1.3591 can be expected.

What's on the chart:

- Thin green line – entry price for buying the trading instrument;

- Thick green line – assumed price for placing Take Profit or locking in profit manually, as further growth above this level is unlikely;

- Thin red line – entry price for selling the trading instrument;

- Thick red line – assumed price for placing Take Profit or locking in profit manually, as further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to rely on overbought and oversold zones.

Important. Beginner Forex traders must be very cautious when making entry decisions. Before the release of major fundamental reports, it is best to stay out of the market to avoid sharp volatility. If you choose to trade during news releases, always set stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember: to trade successfully, you need a clear trading plan, like the one outlined above. Spontaneous decisions based on the current market situation are a losing strategy for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română