The US dollar quickly regained the upper hand, indicating the presence of major buyers in the market even though the Federal Reserve cut interest rates the previous day.

Apparently, without a good correction in risk assets, another move to the upside will be hard to achieve. Strong Philadelphia Manufacturing Index numbers gave the dollar a boost. Traders, encouraged by the unexpectedly high readings, rushed to buy the US currency, viewing it as a sign of strengthening in the US economy. The euro, on the other hand, came under heavy selling pressure.

Today, German Producer Price Index (PPI) data is due. If the figure comes in below economists' forecasts, it could trigger another euro sell-off. Traders will be closely watching the German economy—the locomotive of Europe—in hopes of getting signals about the state of inflation. Weak PPI data would be interpreted as a sign of slowing inflation, easing pressure on the ECB. A sustained slowdown in German inflation, confirmed by several consecutive reports, will be a significant factor shaping the euro's medium-term trajectory.

As for the pound, this morning brings key data on UK retail sales and net public sector borrowing. These two indicators, like the two sides of a scale, could sway market sentiment in either direction and significantly affect the GBP exchange rate and broader prospects for economic growth.

Retail sales data, which reflect changes in fuel prices, will provide valuable information about consumer demand—a key driver of the economy. If the report shows growth in sales volumes, it will be seen as a positive signal indicating resilient consumer spending, despite inflationary pressures. The pound could see support, strengthening against other currencies.

On the other hand, the net public sector borrowing report reflects the state of government finances. Rising borrowings may raise concerns about the debt burden and fiscal sustainability, putting pressure on the pound.

If the data matches economists' expectations, it's better to lean on a Mean Reversion strategy. If the data comes in much higher or lower than expected, the best approach is to use a Momentum strategy.

Momentum Strategy (Breakout):

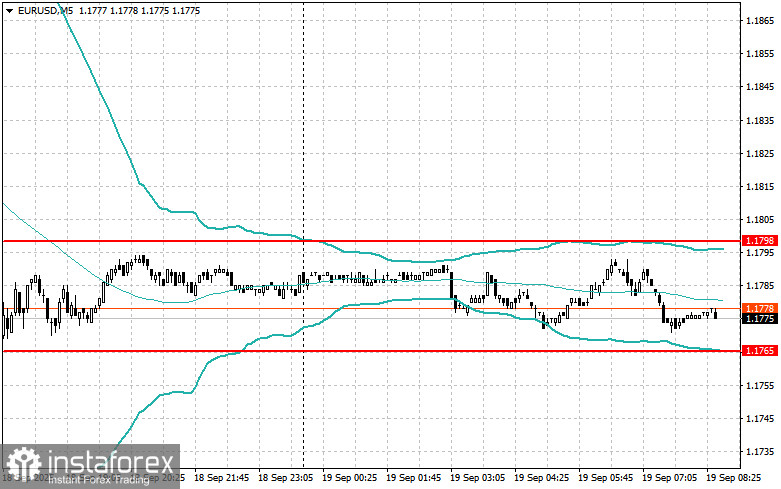

EUR/USD

Buying on a breakout of 1.1805 could push the euro up to the 1.1830 and 1.1870 areas.

Selling on a breakout below 1.1760 could lead to a fall toward 1.1703 and 1.1665.

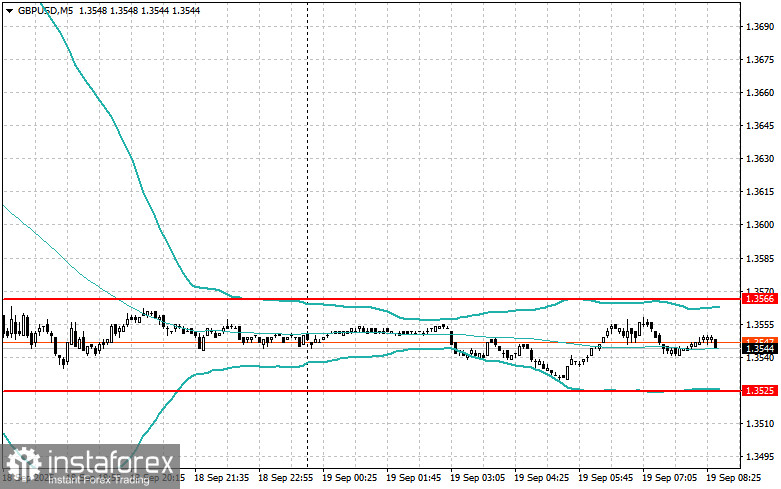

GBP/USD

Buying on a breakout of 1.3665 could push the pound up to 1.3685 and 1.3699;

Selling on a breakout below 1.3525 could lead to a drop towards 1.3490 and 1.3455.

USD/JPY

Buying on a breakout of 147.72 could push the dollar up to 147.99 and 148.23;

Selling on a breakout below 147.40 could spark a decline toward 147.00 and 146.70.

Mean Reversion Strategy (Pullbacks):

EUR/USD

I'll look for short trades after a failed move above 1.1798 and a return below this level.

I'll look for long trades after a failed move below 1.1765 and a return above this level.

GBP/USD

I'll look for short trades after a failed move above 1.3566 and a return below this level.

I'll look for long trades after a failed move below 1.3525 and a return above this level.

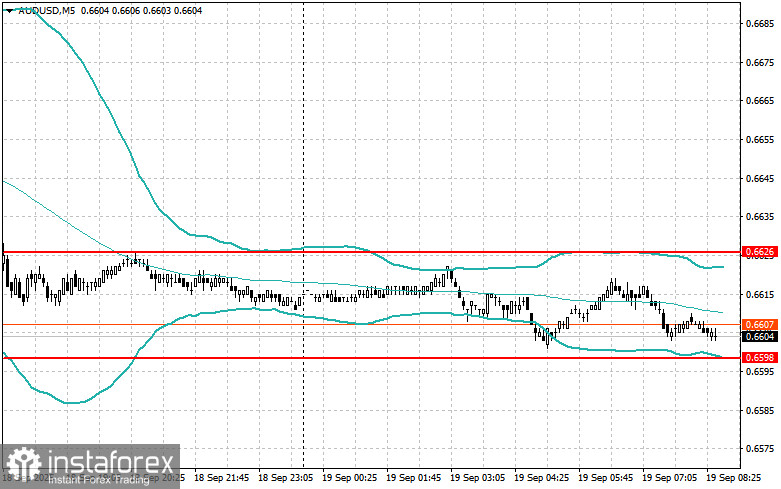

AUD/USD

I'll look for short trades after a failed move above 0.6626 and a return below this level.

I'll look for long trades after a failed move below 0.6598 and a return above this level.

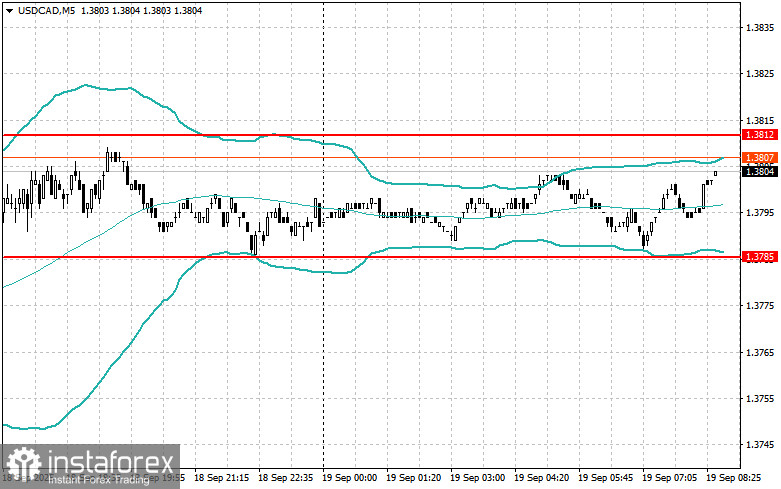

USD/CAD

I'll look for short trades after a failed move above 1.3812 and a return below this level.

I'll look for long trades after a failed move below 1.3785 and a return above this level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română