Trade Review and Advice on Trading the British Pound

The test of the 1.3631 price coincided with the moment when the MACD indicator had just started moving down from the zero line, confirming the validity of the sell entry on the pound and resulting in a drop of more than 60 pips for the pair.

The Bank of England's decision to keep rates unchanged did not help the pound; the market reacted with disappointment, viewing the lack of hawkish signals as a sign of caution and indecisiveness from the central bank in tackling inflation. On the one hand, the decision to hold rates at current levels can be seen as a balanced approach, accounting for the risks of slowing economic growth and inflation uncertainties. On the other hand, investors had expected more decisive action, as they see high inflation as a serious threat to the UK economy.

This decision from the BoE stands in stark contrast to the policies of other major central banks, such as the US Federal Reserve, which have shown a much softer approach.

Today, key data on UK retail sales and net public sector borrowing will be released. These two reports could significantly influence market sentiment. Retail sales figures, which account for fuel costs, will help gauge consumer activity—a key stimulus for the economy. Strong sales growth will point to stable consumer spending, which may support the pound and strengthen its position relative to other currencies. Meanwhile, the net borrowing report shows the state of national finances; an increase in borrowing may raise concerns about the debt load and fiscal stability, negatively impacting the pound.

As for the intraday strategy, I will focus more on implementing scenarios #1 and #2.

Buy Scenario

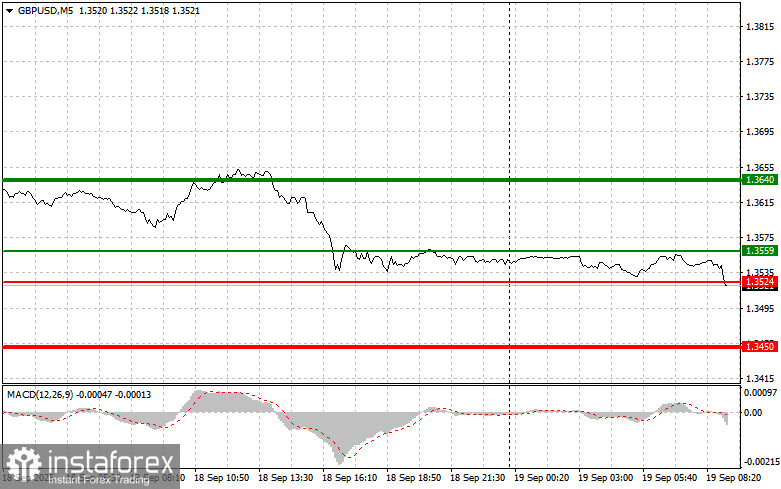

Scenario #1: Today, I plan to buy the pound at an entry point around 1.3559 (green line on the chart), targeting a move up to 1.3640 (thicker green line on the chart). Around 1.3640, I'll close the long and immediately open a short position, aiming for a 30–35 pip reversal from the level. A strong rally in the pound can be expected only if the report is positive. Important! Before buying, ensure the MACD indicator is above the zero line and is just starting to rise from it.

Scenario #2: I'll also look to buy the pound if there are two consecutive tests of the 1.3524 price while the MACD is in oversold territory. This will limit the pair's downside potential and prompt a reversal to the upside. An upward move to 1.3559 and 1.3640 can be expected.

Sell Scenario

Scenario #1: Today, I plan to sell the pound after it breaks below 1.3524 (red line on the chart), which should lead to a quick drop in the pair. The key target for sellers will be 1.3450, where I plan to close the short and immediately open a long position (looking for a 20–25 pip rebound from this level). Sellers will become active if the data disappoints. Important! Before selling, ensure the MACD indicator is below the zero line and is just starting to move down from it.

Scenario #2: I'll also plan to sell the pound if there are two consecutive tests of the 1.3559 price while the MACD is in the overbought zone. This will limit the pair's upward potential and lead to a bearish reversal. A decline to 1.3524 and 1.3450 can then be expected.

What's on the Chart:

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română