Yesterday's latest failed attempt by Bitcoin to break above $118,000 could present significant challenges for its near-term growth prospects. The third consecutive failure to push beyond this range signals that bullish sentiment for a run to all-time highs in the near-term is quickly dwindling.

Meanwhile, the crypto market continues to evolve. Yesterday, trading began in the US for the first spot XRP ETF and Dogecoin ETF from REX-Osprey. This step marks an important milestone in the legitimization of cryptocurrencies as an asset class, expanding access for a broader range of investors and traders. The launch of the XRP ETF and Dogecoin ETF triggered mixed reactions in the market. On one hand, this development indicates growing institutional investor interest in cryptocurrencies, which could lead to increased trading volumes and improved market liquidity. On the other hand, concerns remain about the volatility of XRP and Dogecoin, as well as the overall regulatory environment for crypto markets.

Despite this, the introduction of spot ETFs is a significant step forward for the crypto industry. ETFs allow investors to gain exposure to XRP and Dogecoin without having to buy and hold the actual cryptocurrencies, simplifying the investment process and reducing the risks associated with securing digital assets.

It should be noted that the success of these ETFs will depend on several factors, including trading volumes, spreads, and regulatory compliance. Nonetheless, the launch of the XRP ETF and Dogecoin ETF is an important precedent that may pave the way for new crypto ETFs in the future, further transforming the financial landscape.

For intraday strategies, I will continue to focus on major pullbacks in Bitcoin and Ethereum, looking for opportunities to capitalize on what I expect to remain a medium-term bull market.

As for short-term trading, the specific strategies and setups are outlined below.

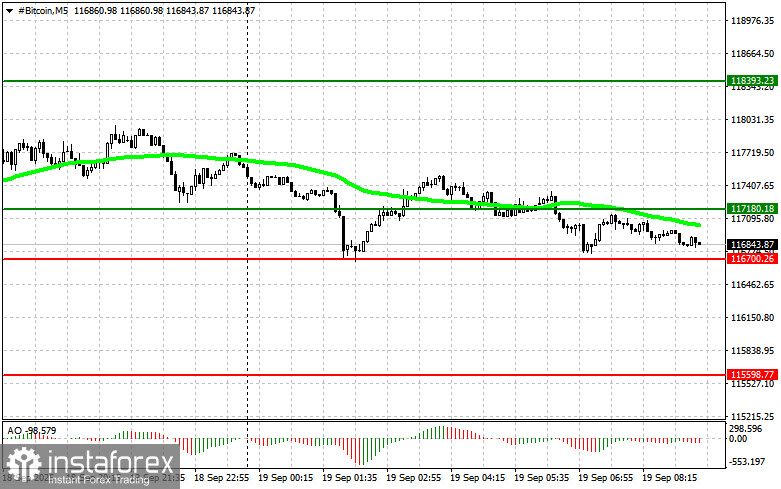

Bitcoin

Buy Scenario

- Scenario #1: I plan to buy Bitcoin today at the entry point around $117,100, targeting an upward move to $118,400. Around $118,400, I will exit longs and immediately switch to selling on the pullback. Before entering a breakout buy, make sure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

- Scenario #2: Buying from the lower boundary at $116,700 is possible if there is no strong market reaction to a downside breakout, targeting moves back to $117,100 and $118,400.

Sell Scenario

- Scenario #1: I plan to sell Bitcoin today at the entry point around $116,700, targeting a decline to $115,600. Around $115,600, I will exit shorts and immediately switch to buying on the rebound. Before entering a breakout sell, ensure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

- Scenario #2: Selling from the upper boundary at $117,100 is possible if a breakout attempt fails, targeting $116,700 and $115,600 on the way down.

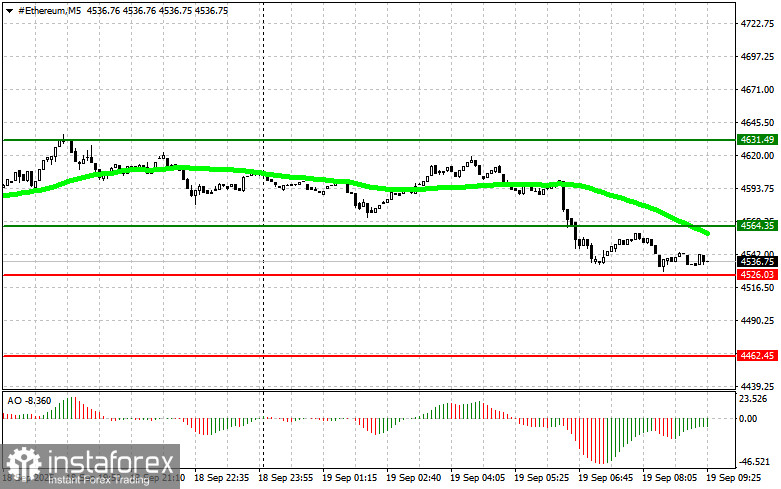

Ethereum

Buy Scenario

- Scenario #1: I plan to buy Ethereum today at the entry point around $4,564, targeting a rise to $4,631. Around $4,631, I'll exit longs and immediately switch to selling on the pullback. Before entering a breakout buy, check that the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

- Scenario #2: Buying from the lower boundary at $4,526 is possible if there is no notable downside follow-through, targeting a move back up to $4,564 and $4,631.

Sell Scenario

- Scenario #1: I plan to sell Ethereum today at the entry point around $4,526, targeting a decline to $4,462. Around $4,462, I will exit shorts and immediately switch to buying on the rebound. Before entering a breakout sell, make sure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

- Scenario #2: Selling from the upper boundary at $4,564 is possible if a breakout fails, targeting $4,526 and $4,462.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română