Trade review and tips for trading the British pound

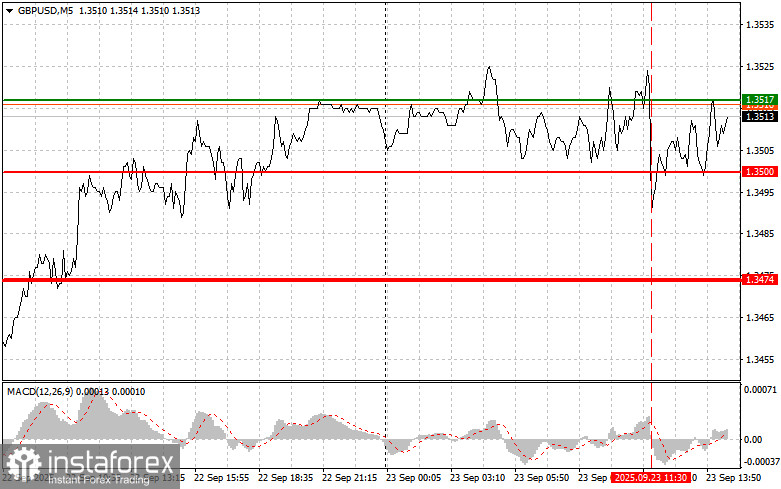

The test of 1.3517 occurred when the MACD indicator had already moved significantly above the zero mark, which limited the pair's bullish potential.

The pound reacted with a decline to weak UK PMI data for September. The composite PMI, reflecting overall economic activity, fell, signaling a slowdown in growth. Particularly worrying were the figures for the manufacturing sector, showing a contraction in output and reduced demand. This heightens concerns about a possible recession in the UK economy. Inflation, despite the Bank of England's efforts, remains elevated, pressuring consumer spending and restraining growth. In the near term, the pound's dynamics will be determined by upcoming macroeconomic data, Bank of England policy decisions, and developments in the global economy.

In the second half of the day, GBP/USD will be influenced by US manufacturing, services, and composite PMI data. These indicators, reflecting the state of the world's largest economy, traditionally have a strong impact on currency markets. Particularly important are services PMI results, as the services sector dominates the US economy. Today's speech by Federal Reserve Chair Jerome Powell will also be in focus. If his rhetoric is dovish, this could trigger a decline in the dollar, thereby supporting the pound.

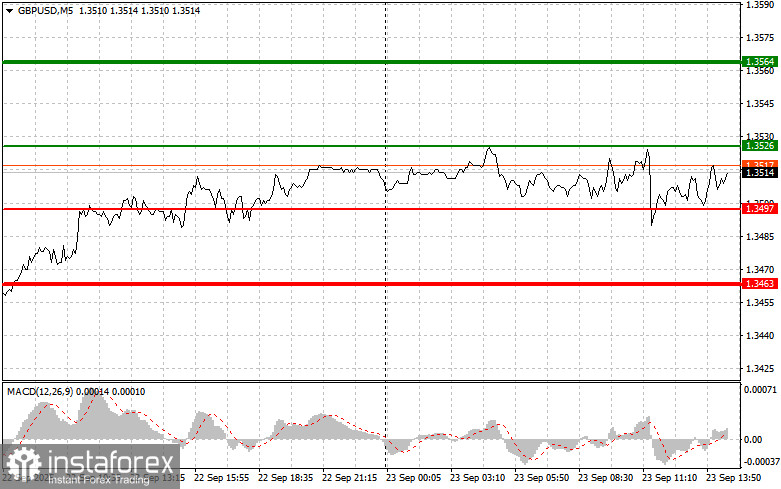

As for intraday strategy, I will focus mainly on scenarios #1 and #2.

Buy signal

Scenario #1: I plan to buy the pound today at the entry point around 1.3526 (green line on the chart) with a target at 1.3564 (thicker green line on the chart). Around 1.3564, I will exit long positions and open shorts in the opposite direction (expecting a 30–35-point move back from the level). A strong rise in the pound can be expected only after weak US data. Important! Before buying, make sure the MACD indicator is above the zero mark and just beginning to rise.

Scenario #2: I also plan to buy the pound in case of two consecutive tests of 1.3497, at a time when MACD is in oversold territory. This will limit the pair's downward potential and trigger an upward reversal. Growth toward 1.3526 and 1.3564 can then be expected.

Sell signal

Scenario #1: I plan to sell the pound after a break of 1.3497 (red line on the chart), which will lead to a rapid decline. The key target for sellers will be 1.3463, where I will exit shorts and immediately open longs in the opposite direction (expecting a 20–25-point bounce). The pound may drop sharply in the second half of the day. Important! Before selling, make sure the MACD indicator is below the zero mark and just beginning to decline.

Scenario #2: I also plan to sell the pound in case of two consecutive tests of 1.3526, at a time when MACD is in overbought territory. This will cap the pair's upward potential and trigger a downward reversal. A decline toward 1.3497 and 1.3463 can then be expected.

What's on the chart:

- Thin green line – entry price for buying the instrument;

- Thick green line – projected level for placing Take Profit or manually fixing profits, as further growth above this level is unlikely;

- Thin red line – entry price for selling the instrument;

- Thick red line – projected level for placing Take Profit or manually fixing profits, as further declines below this level are unlikely;

- MACD indicator – when entering the market, it is important to follow overbought and oversold zones.

Important. Beginner Forex traders should be extremely cautious when making entry decisions. Before major fundamental reports are released, it is best to stay out of the market to avoid sudden price swings. If you decide to trade during news releases, always set stop orders to minimize losses. Without stop orders, you may quickly lose your deposit, especially if you do not use money management and trade large volumes.

And remember: successful trading requires a clear trading plan, like the one presented above. Making spontaneous trading decisions based only on current market conditions is an inherently losing strategy for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română