Gold is an asset that people buy in anticipation of doomsday, and a bipolar world is bringing that event closer. The threat of a third world war and the Fed's unwillingness to fight inflation amid serious cooling in the US labor market create the perfect external environment for XAU/USD. The precious metal has already surged 44% year-to-date, and judging by geopolitical and other risks, this is only the beginning. Goldman Sachs' forecast of $5,000 per ounce no longer looks unrealistic.

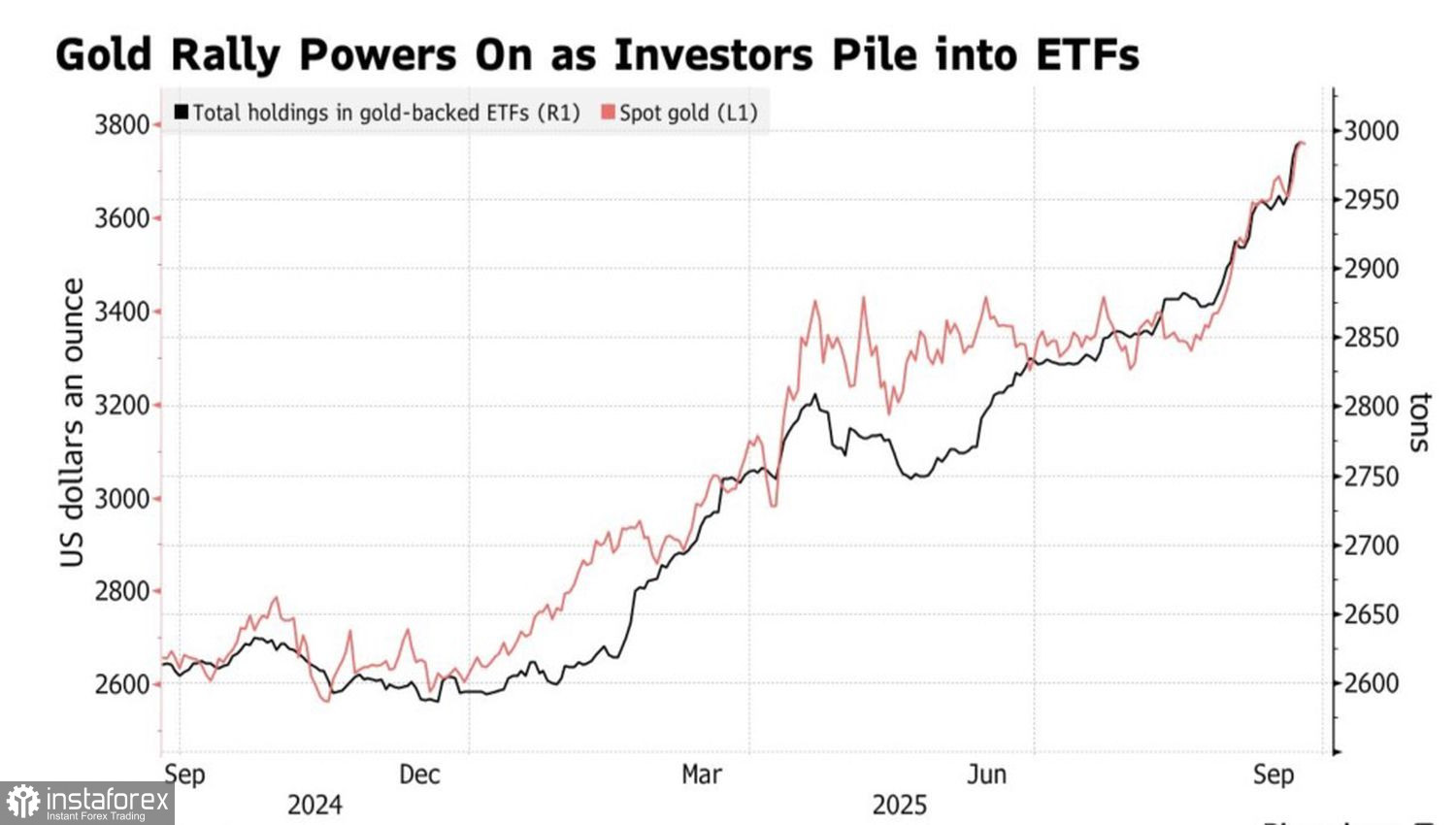

Gold-oriented ETF holdings are growing at their fastest pace in three years, up 400 tons since January, according to Bloomberg calculations. Investors are hedging not only against high inflation but also geopolitical risks, resulting in a slew of new XAU/USD records this year.

Gold and ETF Holdings Dynamics

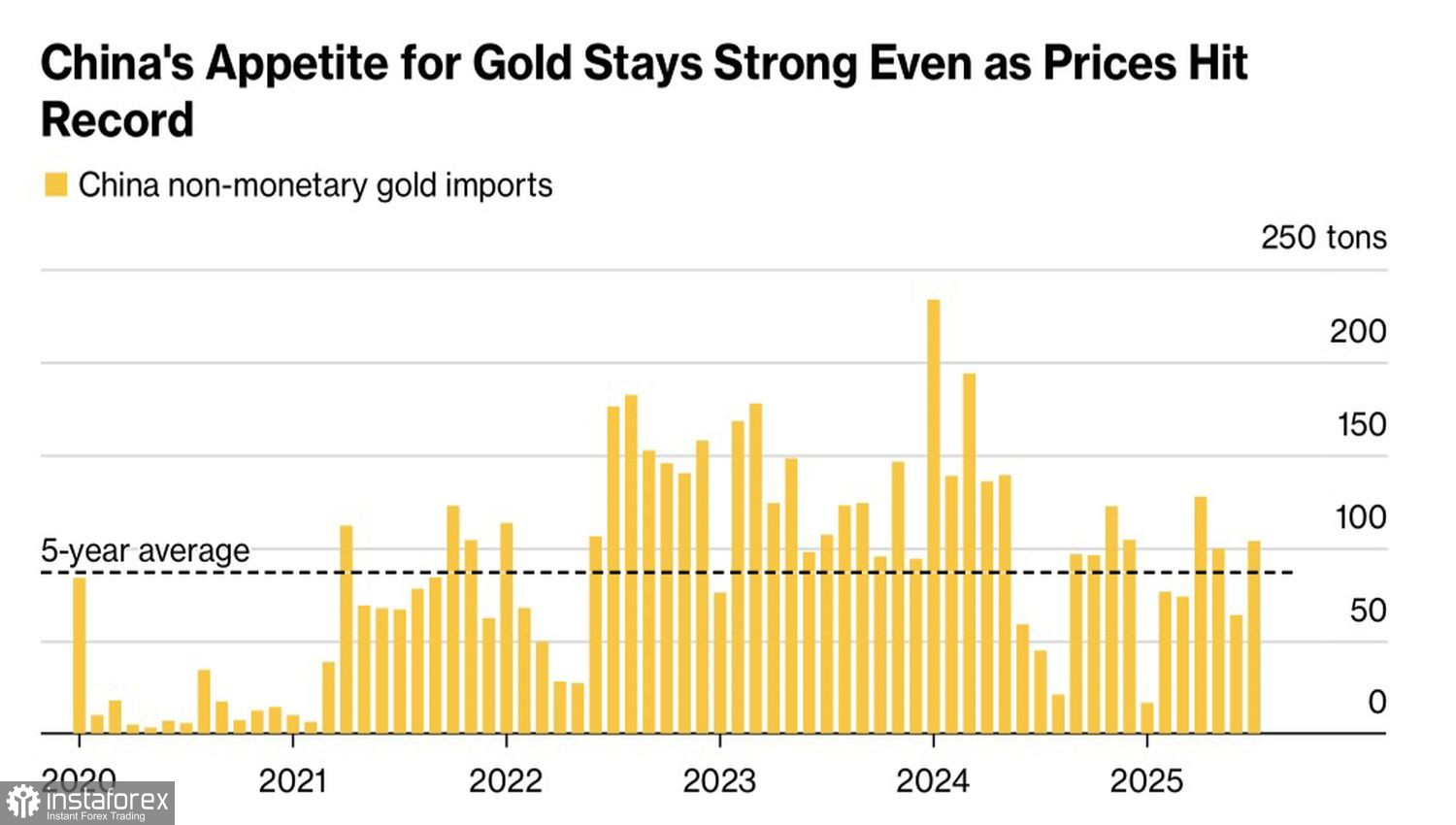

The division of the world into East and West brings new energy to the gold rally. China aims to replicate the same functions in its friendly region that London performs globally. Beijing is luring its partners with attractive bullion storage terms at the Shanghai Exchange, indicating gold's growing role in international politics and economics.

Of course, overtaking Britain won't be easy—the Bank of England's vaults hold about 5,000 tons of gold valued at almost $600 billion. Nevertheless, China is the world's largest gold consumer, with consistently high import levels.

Chinese Gold Imports

Yet, competition with London is not the main issue for XAU/USD. Far more important are the accompanying processes of dedollarization and diversification of foreign exchange reserves.

Gold has also been supported by "dovish" rhetoric from FOMC officials. Michelle Bowman highlighted weakness in the US labor market and said September's rate cut should be the first of several. Jerome Powell asserts that a return to monetary easing is the right call, arguing that job growth has slowed substantially and that the surge in inflation is temporary.

The Fed is clearly prioritizing unemployment over consumer prices. In such conditions, gold thrives. Stagflation—characterized by slower economic growth combined with accelerating inflation—is approaching. Rather than raising rates, the central bank is opting for cuts.

Investors no longer find protection in the Fed and are seeking it elsewhere. With its natural scarcity and massive demand, gold is the ideal choice. Small wonder, then, that XAU/USD has set more than three dozen records in 2025 alone.

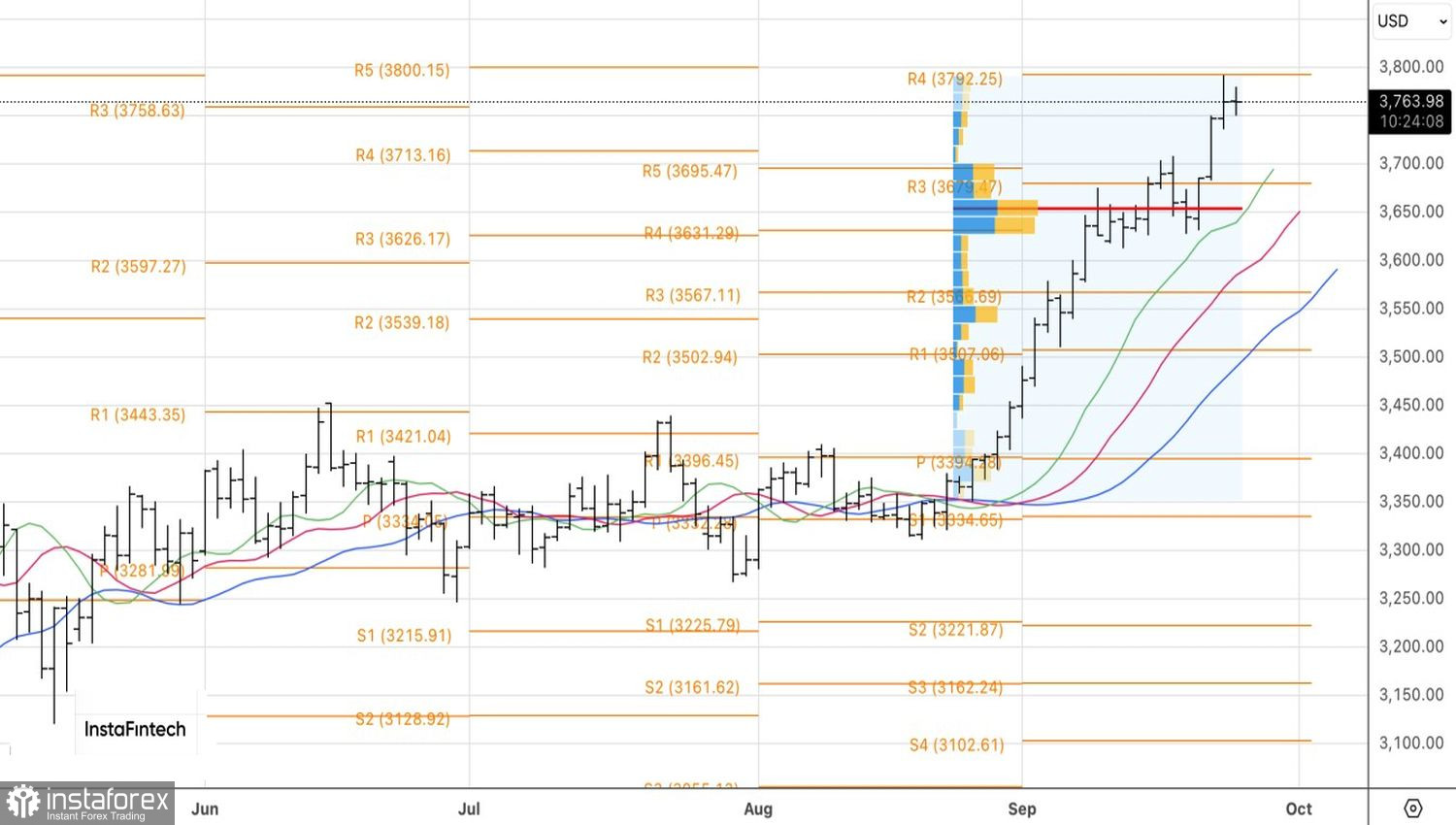

Technically, the daily chart shows an inside bar forming. It makes sense to place a pending buy order at $3,780 and a sell order at $3,750 per ounce. Meanwhile, with such a strong bull market, it's unwise to overdo short positions. The best approach is to reverse along with the exhaustion of each pullback.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română