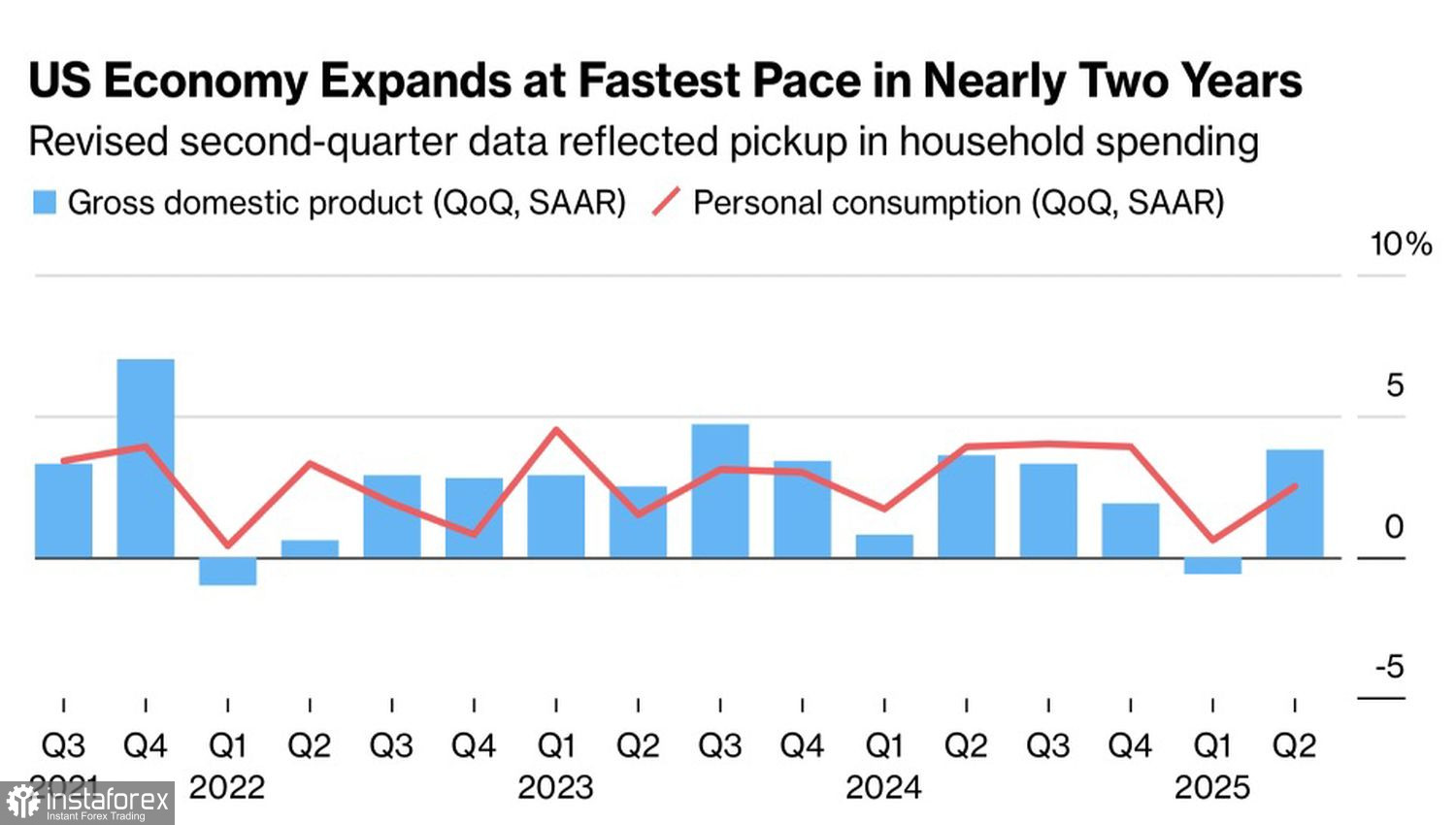

One wonders if Donald Trump is kicking himself or patting himself on the back while reviewing the latest US macroeconomic statistics. The US economy grew by an impressive 3.9% in the second quarter, marking the best performance in nearly two years. Jobless claims dropped to their lowest level since mid-July, highlighting the strength of the labor market. All good, Madame Marquise? Should the President have a statue built in his honor? But is a falling EUR/USD part of his plan?

Dynamics of the US Economy

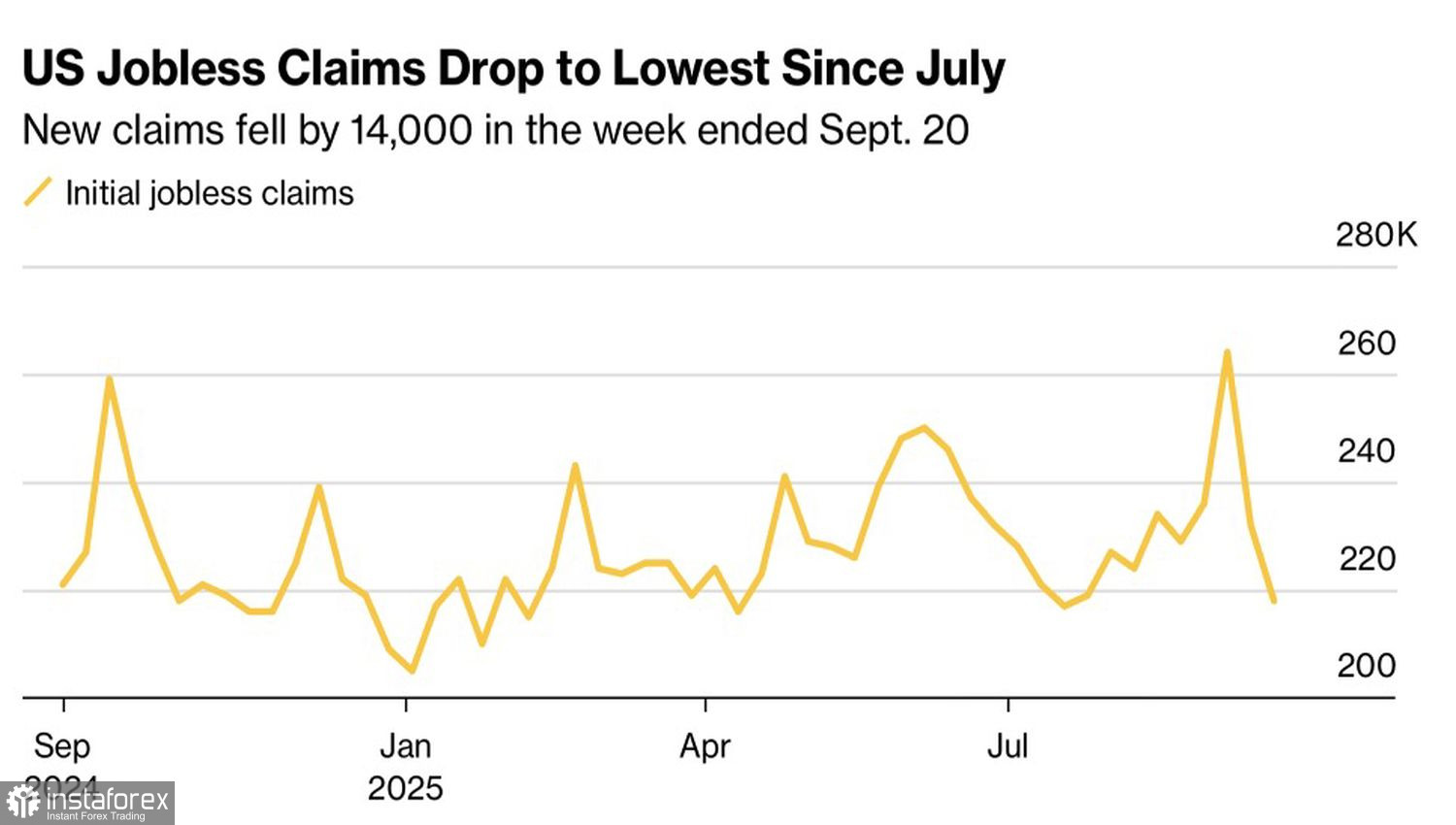

Did the labor market really deteriorate so much under the previous BLS leadership and turn upward so quickly with the new one? Bloomberg experts now forecast September nonfarm job growth of 70,000, well above August's +22,000. Maybe it's not about weakness or strength, but about the new BLS management? Still, their willingness to play along with the US President could become fatal. The Fed may stop cutting rates, no matter how loudly Trump demands the opposite.

Indeed, a chorus of FOMC representatives is voicing concern about inflation and is in no hurry to resume monetary expansion. For example, Kansas City Fed President Jeff Schmidt claims monetary policy is in the right place. It's slightly restrictive—just what the US economy needs right now. The September Fed funds rate cut was more of an insurance policy against a cooling labor market. If that risk doesn't materialize, why do anything more?

US Jobless Claims Dynamics

If the broader US economy and employment situation remain solid, EUR/USD could continue to correct lower, especially since conditions in the EU aren't as optimistic as some had hoped. Trump has washed his hands and said Ukraine can regain its territory with the help of the EU. This rhetoric isn't pressure on Russia—it's pressure on Europe. Europe needs to find a way out: stop buying energy from Moscow and cut ties with China. Meanwhile, the US will just sell more arms.

But where will those arms end up? Russian drones are appearing more and more frequently in NATO countries—even Denmark reported a second incident this week. If Europe starts stockpiling weapons for its own defense, what's left for Ukraine? The armed conflict risks dragging on for years. Combined with US tariffs and rising energy prices, this will continue to slow the eurozone economy. So why would you buy the euro?

Technically, on the daily EUR/USD chart, the 1-2-3 reversal pattern has played out clearly. A break of key support at 1.1725 signaled shorts. This level has now become resistance. As long as the main currency pair is trading below it, selling the euro against the US dollar is the preferred strategy.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română