Donald Trump wanted to achieve high rates of economic growth through a sharp reduction in the Federal Reserve's interest rate. However, Jerome Powell did not agree to the deal, and the FOMC Committee openly refused to make politically driven decisions. Trump was unable to convince the central bank of the need to lower the interest rate to 1-2%. Treasury Secretary Scott Bessent also wonders why Powell did not promise a rate cut at the upcoming meetings. But Bessent and Trump are in the same boat, while Powell and the Fed's governors are in another. Therefore, the similarity in views on monetary policy between Trump and Bessent is not surprising.

Since he failed to overpower the Fed, and he still needs appealing numbers, Trump could have taken another route — namely, influencing the Bureau of Statistics, which is much easier. I am almost certain that statistics are much like U.S. legislation: you can find a number of loopholes that allow you to avoid violating the law or established rules directly, while still permitting some inaccuracies or double interpretations. For example, in the same 1974 Emergency Act, which Trump used as justification for imposing global import tariffs, nothing is actually said about the tariffs themselves—there is no direct ban on tariffs. Trump did not violate the law directly, since it doesn't actually prohibit anything. But at the same time, the act says nothing about the president's specific powers during a state of emergency, nor does it list the reasons for which a state of emergency can be declared. Trump simply took advantage of the imperfections in this law, and now the courts must determine whether the president had the right to do so.

And I'm not sure that the U.S. Supreme Court will make a definitive decision, as the two previous courts—the Trade and Appeals Courts—did. Six of the nine Supreme Court justices were appointed by Republican presidents, and the law can be interpreted in various ways. The same goes for statistical information: some data can be "forgotten," some data can "go unnoticed," and for an error or deception to be revealed, an official investigation would be required. But who will conduct such an investigation, and who will even file a complaint against the Bureau of Statistics?

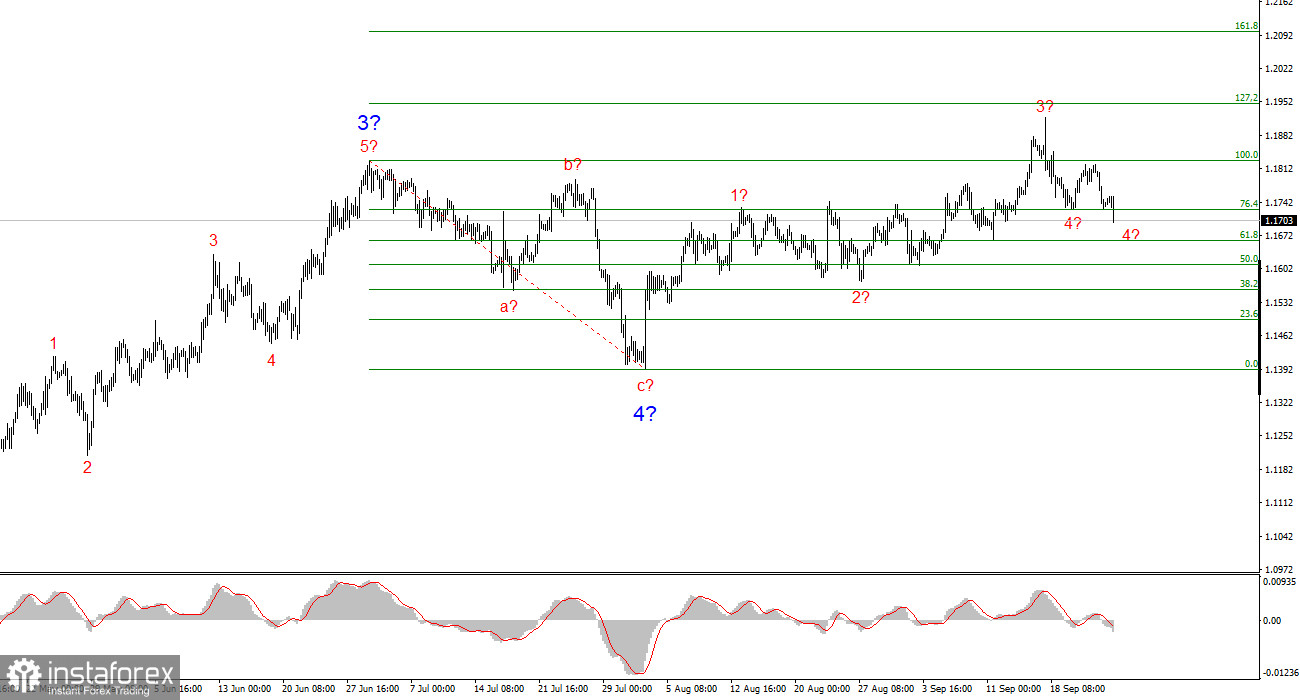

Wave Pattern for EUR/USD:

Based on the analysis of EUR/USD, I conclude that the instrument is continuing to build an upward trend segment. The wave structure still entirely depends on the news background connected to Trump's decisions, as well as the foreign and domestic policies of the new White House administration. The targets of the current trend segment may reach up to the 1.25 area. Currently, the instrument is declining within a corrective wave, but the upward wave structure remains intact. Therefore, in the near term, I'm still interested in buying. By the end of the year, I expect the euro to rise to the 1.2245 mark, which corresponds to the 200.0% Fibonacci level.

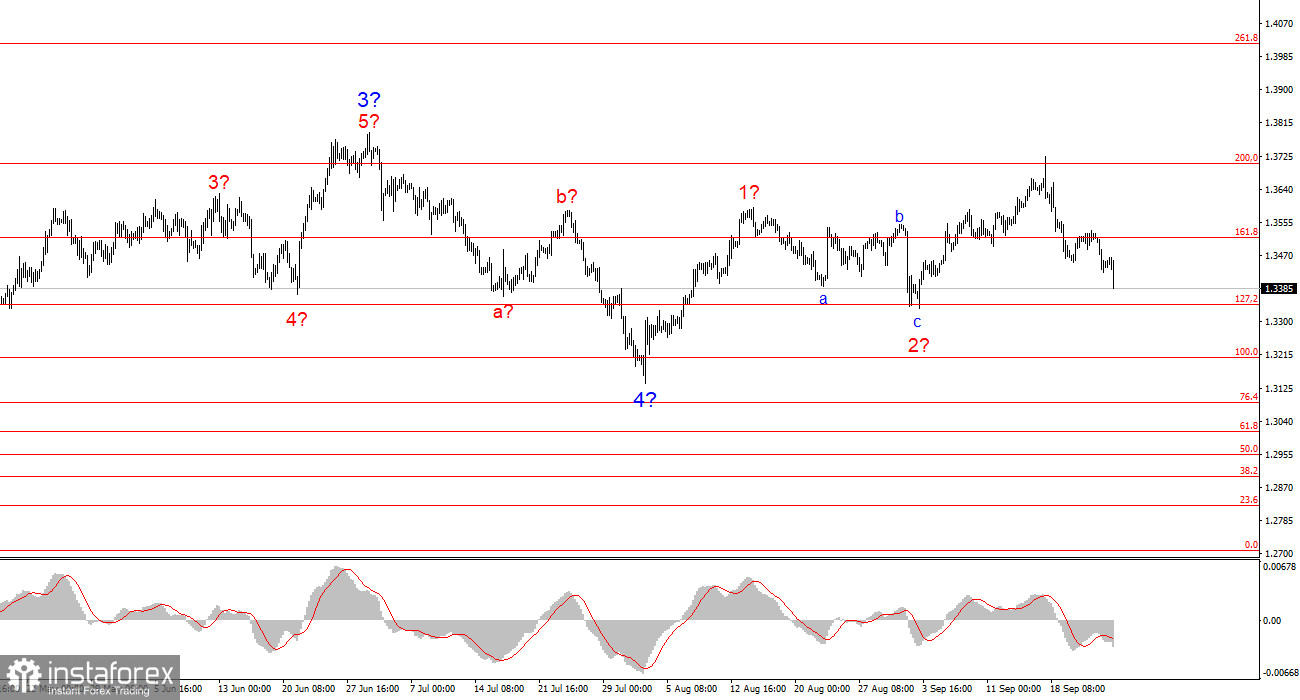

Wave Pattern for GBP/USD:

The wave pattern for GBP/USD is starting to change due to the recent decline. We are still dealing with an upward, impulsive segment of the trend. However, the internal structure of this segment is becoming increasingly complex. There is no talk of building a downward trend segment yet, but the pound now looks less attractive for trading than the euro. The targets for the upward trend segment are located around the 1.4017 mark, which corresponds to the 261.8% Fibonacci level. However, it is now necessary to determine where the current downward wave will end and how the wave structure will transform.

Main Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are challenging to trade and often require adjustments.

- If you're not confident in what's happening in the market, it's better not to enter it.

- There is and can never be 100% certainty about the direction of movement. Don't forget about protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română