Investors are awaiting the release of the PCE indices. If the PCE figures come in weaker than forecast (and especially weaker than the previous readings), signaling a slowdown in inflation, the dollar will almost certainly resume its decline. On the other hand, a stream of positive macroeconomic data from the US and lingering risks of further inflation growth are contributing to dollar strength. Therefore, both a renewed decline and a continuation of the upward correction are possible.

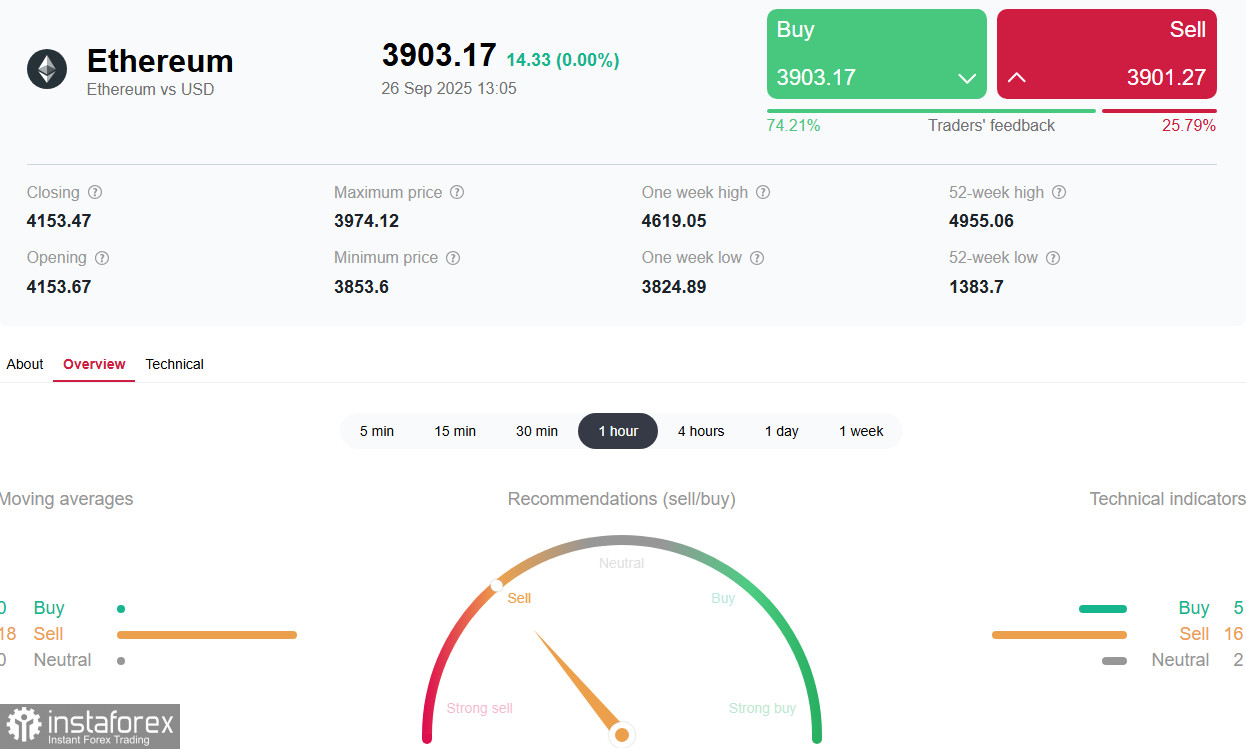

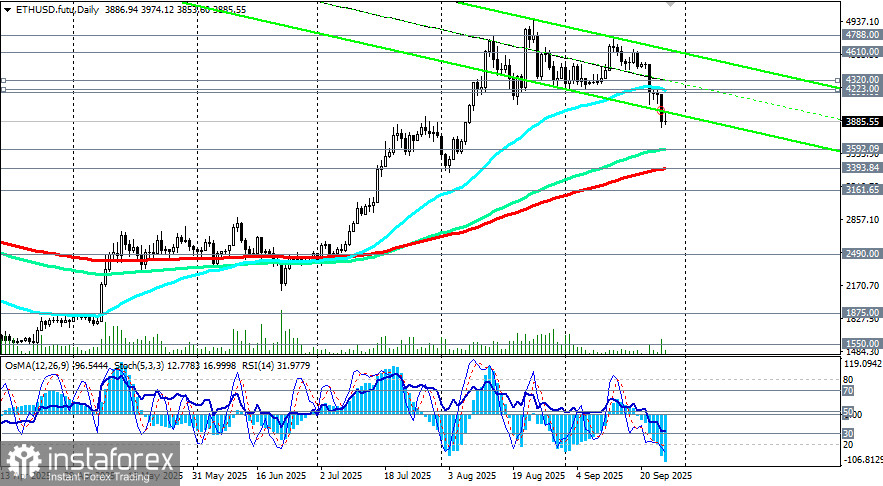

Meanwhile, a downward correction continues on the crypto market, partly due to the strengthening of the dollar. For instance, Ethereum (ETH) yesterday dropped below 3,900.00 for the first time since early August, and bitcoin fell below 109,000.00, its lowest level since September 3.

Among the reasons for the decline, analysts point to the current uncertainty regarding the Fed's next steps on interest rates and cascading margin position liquidations, which have exacerbated the drop.

The crypto market again lost billions in capitalization, despite a slight recovery earlier in the week.

Nevertheless, investors are trying to remain optimistic, expecting that ongoing market instability will continue to support cryptocurrencies as safe haven assets. The development of clear legal rules will also aid their adoption.

Among possible growth drivers, crypto market experts highlight:

- Government buying alongside major cryptocurrency holders—the ongoing trend of adding cryptocurrencies to countries' reserves.

- A weak dollar and low interest rates—the Fed could continue policy easing.

- Institutional demand.

- ICO and token regulation—creating a legal framework to attract new capital.

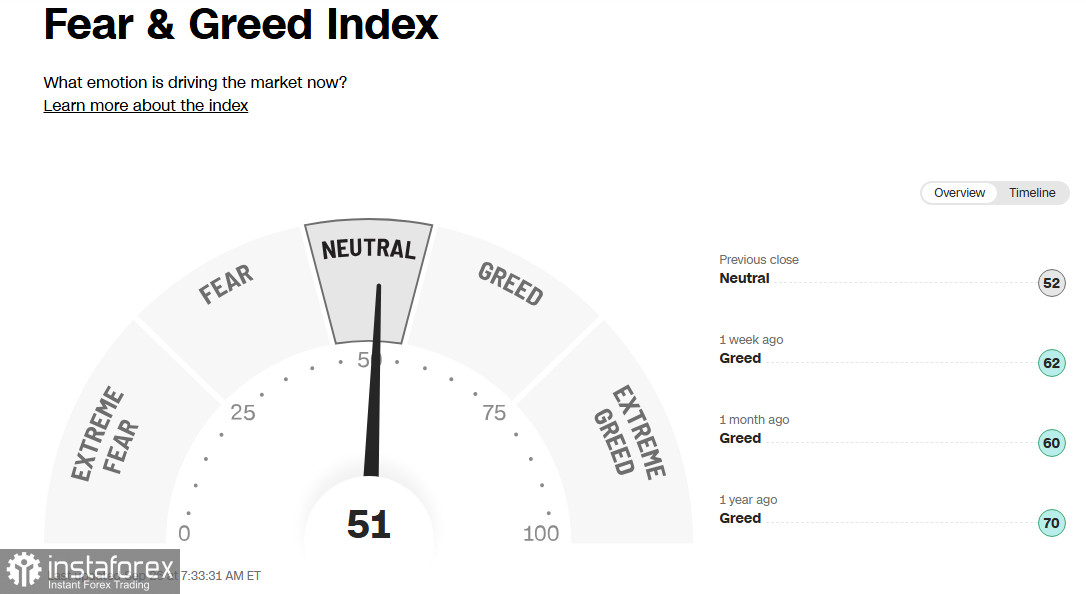

For the time being, the so-called "fear and greed" index stands today at 51 (out of 100), in neutral territory: investors are taking a wait-and-see approach ahead of the PCE report.

However, optimism still prevails among crypto market experts. In their opinion, Ethereum could reach $7,500 and Bitcoin $200,000 by the end of the first quarter next year. But we would note that this outlook holds only if the Fed continues to cut interest rates. It is Ethereum that is stimulating the growth of the non-bitcoin segment of the market, as reflected in the increased interest in the asset from investment companies.

Conclusion

So, the key event of today's trading session and economic calendar is the release (at 12:30 GMT) of the US PCE indices and the University of Michigan report (at 14:00 GMT) with the final estimate of consumer sentiment and inflation expectations, which could confirm the resilience of consumer spending and set the tone for markets for the coming week.

After that, investors will turn their attention to the upcoming US Department of Labor report (next Friday at 12:30 GMT) with September's employment data, which may determine the dollar's trend—and thus key crypto pairs—until mid-October and the release of new US inflation data.

As is well known, inflation figures, together with labor market and GDP dynamics, are the key indicators the Fed considers when making monetary policy decisions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română