The week saw another speech by Jerome Powell, during which the FOMC Chair stated that even one more rate cut is not guaranteed. Recall that at last week's Fed meeting, Powell indicated that two more rounds of monetary easing before year-end should not be ruled out. The market immediately raised its expectations for further cuts, but this week, Powell cooled the enthusiasm of the "dovish" camp.

I would like to draw my readers' attention to two key points. The first: since 2024, Jerome Powell has been regularly repeating the phrase, "rate decisions will be made solely based on economic data." Bearing in mind the Federal Reserve's dual mandate, we cannot be confident even in one more rate cut this year. What if the labor market begins to recover as early as September?

The second point is that inflation control is just as important for the Fed as supporting the labor market. Therefore, the Fed will balance between two fires, and there is no certainty that the choice will fall on labor market support. In my view, continued policy easing will only be possible if the labor market continues to "cool." If it does not, the FOMC may vote to keep current parameters unchanged.

I would also remind you that markets were pricing in 6–7 rounds of easing last year, and four rounds this year. Obviously, neither in the past year nor in the current one did these expectations materialize. Therefore, anyone who continues to believe in more easing is walking on thin ice. For the U.S. dollar, this situation is relatively favorable – but only because the market had initially priced in the most dovish scenario and is now realizing that, once again, things may not go according to plan.

Importantly, the Fed's policy is not the decisive factor behind the dollar's decline in 2025 – otherwise, the currency would have fallen much deeper. However, in the short term, the market may provide some support to the dollar. That said, given Donald Trump's new tariffs, any dollar strengthening is likely to be brief and fleeting.

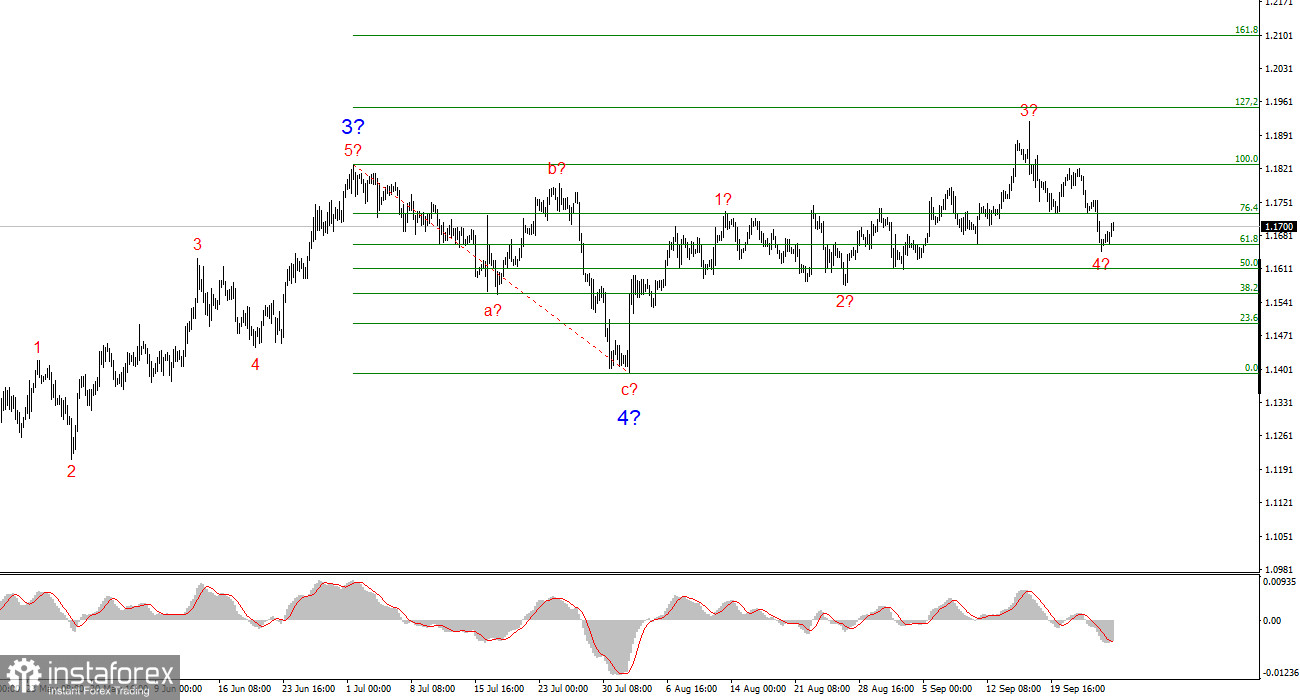

EUR/USD Wave Pattern:

Based on my analysis of EUR/USD, I conclude that the instrument continues to build an upward section of the trend. The wave pattern still depends entirely on the news background tied to Trump's decisions, as well as the domestic and foreign policy of the new White House administration. The targets of the current trend section may extend as far as the 1.25 area. At present, the instrument is declining within corrective wave 4, while the overall upward wave structure remains valid. Accordingly, I am considering only long positions in the near term. By year-end, I expect the euro to rise to 1.2245, which corresponds to 200.0% on the Fibonacci scale.

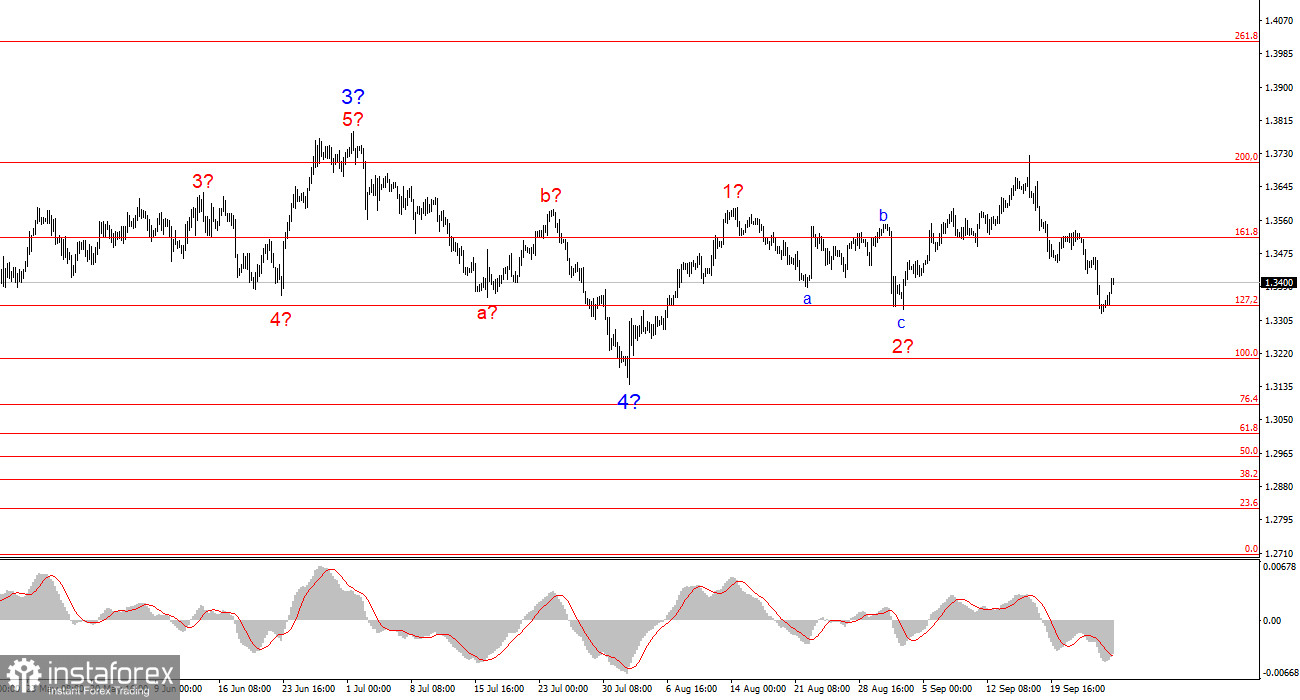

GBP/USD Wave Pattern:

The wave structure of GBP/USD has undergone a change in shape. We are still dealing with an upward impulsive section of the trend, but its internal wave pattern is becoming less readable. If wave 4 assumes a complex three-wave form, the structure will normalize; however, even in this case, wave four will be several times more complicated and extended than wave 2. In my opinion, it is best to work from the 1.3341 level, which corresponds to 127.2% of the Fibonacci. Two failed attempts to break this level may indicate the market's readiness for new buying.

My Core Principles of Analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often shift.

- If there is no confidence in market developments, it is better not to enter.

- One can never have 100% certainty about market direction. Always use protective Stop Loss orders.

- Elliott Wave analysis can be combined with other forms of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română