The market is once again driven by headlines: gold has rewritten its all-time high, soaring to $3,812 per ounce; Brent crude slipped below $70 amid a supply glut; Oracle is entering TikTok US through a $14 billion deal; and Apple is preparing to give Siri a "second wind," accelerating the AI race. This article explores the reasons and consequences behind each story, offers fresh forecasts and key risks, and, in conclusion, presents practical strategies for traders looking to turn this volatility into real results.

Gold hits a historic peak: a new benchmark for traders

Gold has shattered its previous price records, breaking above the $3,812 per ounce mark and cementing its status as the standout asset of the fall season. On Monday, September 29, prices reached an all-time high, prompting analysts to revise their forecasts and the market to closely monitor the metal's momentum. This article delves into why gold is back at the center of the global financial stage, what's driving its price, and how traders can capitalize on the current trend.

On Monday, gold prices surged by 1.4% to a record $3,812 per ounce, later settling around $3,806. This marked the sixth consecutive week of gains – a clear signal of a strong uptrend.

The key driver behind gold's recent surge is the weakening of the US dollar, which is losing ground amid political uncertainty in Washington and the looming threat of a federal government shutdown.

A weaker dollar makes gold more accessible to global buyers, while doubts surrounding the Federal Reserve's future policy direction are further fueling interest in the asset.

Adding to the momentum is the risk of delayed publication of key macroeconomic data, including labor market reports. If the forecasted slowdown in employment is confirmed, expectations for a Fed rate cut as early as October will strengthen, giving gold another tailwind.

Over the past six weeks of uninterrupted growth, the metal has gained 45% year-to-date, continuing to set new records. Demand is being driven not only by retail investors but also by central banks, which are actively increasing their gold reserves.

Gold-backed exchange-traded funds (ETFs) are seeing their highest volumes since 2022, further reinforcing the bullish trend. For many market participants, gold has become a symbol of distrust in the US political and economic landscape, where even the Federal Reserve's independence is under scrutiny.

Top bank analysts agree that the rally still has room to run. Goldman Sachs and Deutsche Bank forecast continued growth, citing a combination of structural demand and escalating geopolitical uncertainty, which only enhances the asset's appeal.

Barclays notes that gold appears to be "an unexpectedly profitable hedge" against both the dollar and Treasury bonds. In other words, investors are increasingly viewing the metal not just as a defensive asset, but as a source of returns even amid instability.

For traders, the current situation presents a wide range of opportunities. Gold remains a key risk-hedging tool and is well-suited for long-term positions. In a highly volatile environment, the market offers flexibility to adapt: traders can lock in profits at high levels or increase exposure during short-term pullbacks. Gold is no longer just a "safe haven" – it's becoming a full-fledged source of income for those who know how to seize the moment.

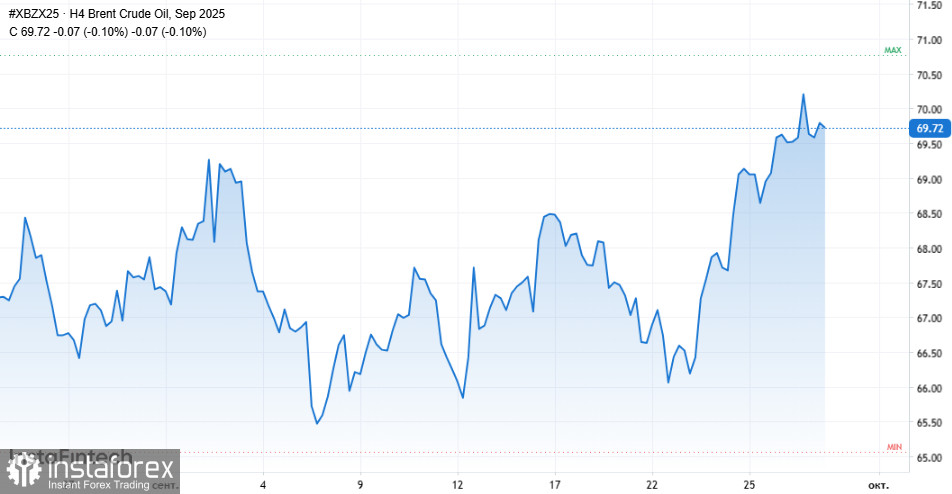

Oil under pressure again: oversupply pushes prices down

Oil prices began the week with a decline, as Brent dropped below $70 per barrel. In this article, we'll break down why crude is losing ground, which factors are shaping its movement, what banks and analysts are saying, and how traders can turn this turbulence into profit.

On Monday, Brent futures fell by 63 cents to $69.50. This came after Iraq resumed oil exports from its Kurdish region, halted for more than two and a half years. The Iraq–Turkey pipeline began pumping 180,000–190,000 barrels per day on Saturday morning, with potential to increase to 230,000. The agreement between Baghdad, the Kurdish regional government, and international oil companies—brokered with US support—came as a surprise to the market and added downward pressure on prices.

However, the main factor remains unchanged: OPEC+ policy. The alliance, led by Saudi Arabia, is set to increase output by at least another 137,000 barrels per day in November, continuing the pace already set for October. Since April, the cartel has added over 2.5 million barrels per day—about 2.4% of global demand. This move is not about stabilizing the market, but about regaining market share. In other words, OPEC+ is no longer trying to act as a "price manager"—instead, it's flooding the market with previously idled volumes.

While the headlines may make these increases sound significant, analysts caution that the actual production rise will likely be much smaller, as many member countries are already at or near capacity. As RBC notes, beyond Saudi Arabia, there's hardly anyone left who can realistically boost supply. Still, the mere expectation of more barrels entering the system undermines the recent rally in oil prices.

The International Energy Agency (IEA) adds fuel to the fire with a forecast: if current trends persist, the market will face a record surplus by 2026. According to their estimates, in the second half of 2025 alone, the oversupply could reach 2.5 million barrels per day. Goldman Sachs is even more blunt: the bank expects Brent to fall into the mid-$50 range as early as next year, despite China's ongoing stockpiling.

In other words, the oil market is increasingly looking like a battleground where sellers are fighting to maintain their share at any cost, while buyers simply shrug and go for the cheapest option. For traders, the key is not to get discouraged but to use the volatility as a tool.

Given the oversupply and pressure from OPEC+, short strategies on Brent—such as opening sell positions—look like a logical move. Conservative traders may look for entry points during upward corrections, aiming to take profits on subsequent declines. More aggressive traders can take advantage of intraday volatility for scalping opportunities.

The current oil market environment offers a unique opportunity to those ready to act now. Open a trading account with InstaForex and download the mobile app to quickly respond to price movements and seize every profit opportunity.

Oracle grabs a big piece of TikTok: $14 billion deal and new horizons

The deal over TikTok's US operations is finally moving forward: last week, Donald Trump signed an executive order valuing TikTok US at around $14 billion and setting a 120-day deadline to finalize all the details. Investors include Oracle, Silver Lake, and Abu Dhabi's MGX. In this article, we break down—in plain terms—what exactly Oracle is getting, how governance will be structured, where the risks lie, what the implications could be for the business, and finally, specific trading ideas.

Let's get to the point. According to US Vice President JD Vance, the $14 billion valuation is fixed by the order. Ownership is split as follows: the Oracle-Silver Lake-MGX consortium holds around 45–50% of TikTok US; ByteDance retains less than 20% (with a target of 19.9%); the remaining ~35% is held by US investors, including General Atlantic, Susquehanna, and KKR. The board of directors consists of seven members: six appointed by the US side and one by ByteDance.

The White House insists that the recommendation algorithm used in the US will be retrained and operate under the oversight of security partners within the new joint venture. According to sources, China's cybersecurity regulator has approved a licensing structure that permits the use of AI technologies in the US market. The concept is simple: TikTok continues to operate in the US, but the key "control levers" are transferred to the new American structure.

The $14 billion valuation appears conservative compared to market benchmarks. For reference, TikTok's rival Snap has 98 million daily active users in North America and a market cap of about $14 billion. TikTok US is significantly larger in scale. Analyst Dan Ives previously valued TikTok (excluding the algorithm) at $30–40 billion, and ByteDance itself was valued at over $330 billion in employee stock buyback programs.

Oracle's key advantage: strategic access to a massive audience at a discounted price

The main advantage for Oracle is clear: it's entering a high-value asset with a massive US user base at a price below market expectations, and it's gaining control over the most valuable part of the platform—the data and algorithm operations.

Oracle's outlook is quite tangible. The company is strengthening its relationship with the US government as a "trusted custodian" of sensitive data, enhancing its cloud platform with a high-load AI product, and gaining access to advertisers within the TikTok ecosystem.

Key growth catalysts include: successful deal closure within the 120-day window, a clear governance model for the algorithm, and the first revenue and monetization metrics from TikTok US. Risks involve regulatory delays, disputes over foreign investor stakes and influence, and potential degradation of content quality during the transition period.

Key takeaways for investors

$14 billion is a low price for access to one of the largest digital audiences in the US; Oracle gains a strategic asset and bolsters its position in AI and digital advertising.

Execution is everything – the outcome for investors depends on how swiftly and smoothly the algorithm and governance restructuring are completed.

What traders can do:

- Bullish Idea: Long positions in Oracle – a bet on successful deal closure and future monetization of TikTok US. Tactic: Buy on dips triggered by news volatility; add to positions as key milestones are confirmed.

- Volatility Strategy: Play price swings around key events – White House statements, updates from Chinese regulators, board composition announcements, and details on algorithm oversight.

- Risk Management: Partial profit-taking during optimism spikes. Cautious traders may prefer to wait for official deal approval and early operating metrics, using corrections as entry points.

- Simple rule of thumb: Watch the 120-day timeline, the algorithm control framework, and the first earnings signals from TikTok US. If all goes smoothly, Oracle may be on track to rewrite its growth story—and give the market a solid reason to reward patient investors.

Apple gives Siri a second wind: rejoining the AI race

Apple is making it clear that rumors of its AI "lag" have been greatly exaggerated. The company is developing an internal app, similar to ChatGPT, to speed up testing of the long-awaited Siri update, expected to launch in spring 2026.

Codenamed Veritas (Latin for "truth"), the project aims to assess whether Siri can truly compete with Google and OpenAI's offerings.

Veritas is an internal tool that allows Apple engineers to test new Siri features—from searching personal data like emails and music to editing photos directly within apps. The app mimics the interface of popular chatbots, supports contextual awareness, parallel conversations, and can even access historical queries.

While there's no public release planned yet, the very existence of this tool signals Apple's urgency in preparing a next-generation voice assistant.

The future Siri will be powered by a system called Linwood, built on large language models developed in-house by the Foundation Models team, with input from external technologies.

Apple is keeping things quiet. Company representatives are staying silent, and at a recent internal meeting, Tim Cook simply stated:

"AI is our transformation, and we will invest whatever it takes to win."

Behind the scenes, however, the company has already held talks with OpenAI and Anthropic, and is now reportedly discussing the use of a customized version of Google's Gemini platform.

The road to a new Siri has been bumpy

Apple had initially planned to unveil the Siri update in spring 2025, but engineering setbacks delayed the launch—about a third of the new features simply didn't work. This led to a full AI strategy review and internal shakeups:

- Former AI chief John Giannandrea has stepped back,

- Siri veteran Robbie Walker is leaving the company in October,

- The AKI team (Apple Knowledge Integration) is now leading the development of advanced search features.

- Veritas is expected to help test integration with online data and generate short, useful summaries.

Apple understands that this is not just a cosmetic update—it's a matter of survival in the AI competition. In 2026, the smartphone market is set for an all-out battle over AI features, and consumer choice will increasingly hinge on the intelligence of their pocket assistant.

What success looks like for Apple

If the new Siri can truly act on on-screen data, control devices without extra clicks, and complete tasks faster than its competitors, it could be a turning point. If not, Apple risks cementing its reputation as a follower, not a leader.

What this means for traders:

The news presents a mixed picture:

- On the upside: The development of Veritas and the anticipated Siri upgrade in spring 2026 are reigniting investor interest in Apple. The company is re-entering the AI conversation—now the biggest growth driver in tech.

- On the downside: Release delays, executive turnover, and strong competitors like Alphabet and Samsung could put pressure on Apple's stock.

Strategies to consider:

- Optimists may go long on Apple in anticipation of a successful Siri relaunch and stronger iPhone sales.

- Conservatives might wait for stable functionality and confirmed AI features, buying on dips.

- Aggressive traders can play off speculative moves, trading news leaks and announcements that will likely trigger sharp price swings.

To turn this volatility into opportunity, open an account with InstaForex and download our mobile app to act fast and capture profit as the AI race heats up.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română