Trade review and tips for trading the Japanese yen

The test of 148.74 in the first half of the day occurred when the MACD indicator had already moved significantly down from the zero line, which limited the downward potential of the pair. For this reason, I did not sell the dollar.

In the second half of the day, U.S. pending home sales data will be released. However, a much greater impact on USD/JPY will come from the speeches of Fed officials Christopher Waller and John Williams. The market is waiting in suspense, trying to anticipate the direction of monetary policy. Investors listen closely to every word, searching for hints about the future of interest rates. Pending home sales act as a barometer reflecting the health of the housing sector, a key indicator of the U.S. economy. A decline in this metric could be a troubling sign, pointing to slowing growth. Nevertheless, the day's main event will undoubtedly be the speeches from Waller and Williams. Their views on the current economic situation and the outlook for monetary policy are critical. Particular attention will be paid to their assessment of inflation risks. If their rhetoric proves softer than expected, the dollar may come under pressure, inevitably leading to a decline in USD/JPY. Conversely, hawkish statements would boost demand for the U.S. currency and push the pair higher.

As for intraday strategy, I will focus mainly on implementing Scenarios #1 and #2.

Buy Signal

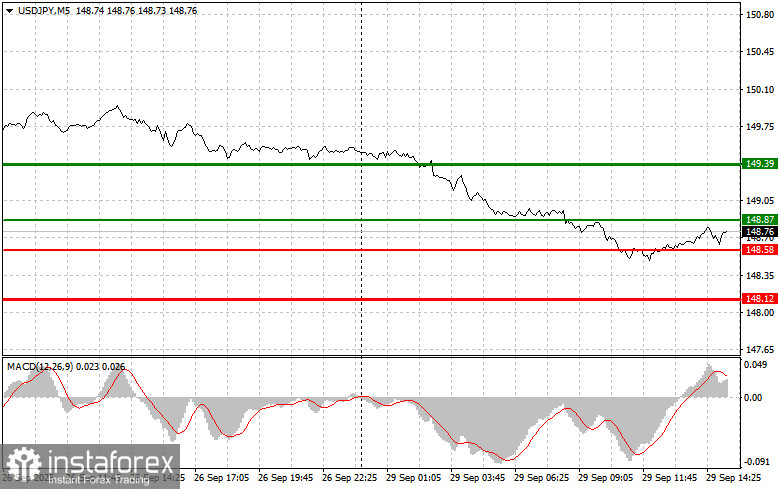

Scenario #1: I plan to buy USD/JPY today at the entry point around 148.87 (green line on the chart), targeting growth toward 149.39 (thicker green line on the chart). Around 149.39, I will exit long positions and open short positions in the opposite direction (expecting a 30–35 point pullback from that level). A continuation of the bullish market can support this growth. Important! Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy USD/JPY today in case of two consecutive tests of 148.58, when the MACD indicator is in oversold territory. This will limit the downward potential of the pair and lead to a reversal upward. Growth toward the opposite levels of 148.87 and 149.39 can be expected.

Sell Signal

Scenario #1: I plan to sell USD/JPY today after breaking below 148.58 (red line on the chart), which would lead to a quick decline in the pair. The key target for sellers will be 148.12, where I will exit short positions and immediately open long positions in the opposite direction (expecting a 20–25 point rebound from that level). Pressure on the pair may persist if the data is weak. Important! Before selling, make sure the MACD indicator is below the zero line and just starting to decline from it.

Scenario #2: I also plan to sell USD/JPY today in case of two consecutive tests of 148.87, when the MACD indicator is in overbought territory. This will limit the upward potential of the pair and lead to a reversal downward. A decline toward 148.58 and 148.12 can be expected.

Chart Notes:

- Thin green line – entry price for buying the instrument;

- Thick green line – suggested level for setting Take Profit or fixing profit manually, since growth above this level is unlikely;

- Thin red line – entry price for selling the instrument;

- Thick red line – suggested level for setting Take Profit or fixing profit manually, since decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to use overbought and oversold zones.

Important: Beginner Forex traders must make entry decisions with extreme caution. Before the release of major fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you neglect money management and trade with large volumes.

And remember, successful trading requires having a clear trading plan, like the one outlined above. Spontaneous decisions based on the current market situation are inherently a losing strategy for intraday traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română