The EUR/USD currency pair continued its upward movement on the first trading day of the week, which had begun on Friday. What is especially notable is the euro's rise during the Asian and European trading sessions, despite the absence of macroeconomic reports. By 2025 standards, the dollar's decline was minor—just a few dozen points. However, given the fundamental backdrop, we expect the U.S. currency to plunge at the same pace seen in the first half of this year soon.

As the saying goes, trouble comes quietly. Over the past one and a half to two weeks, the U.S. dollar has been resting on its laurels. The stock market was rising, the U.S. economy was growing, Donald Trump had not imposed new tariffs for over a month, and the president had lost his battle with the Federal Reserve outright. It seemed the moment had arrived for the dollar to reverse and stop its prolonged decline. But Trump sensed "something was wrong" and imposed new sectoral tariffs on trucks, pharmaceuticals, and even furniture. What is this? An escalation of the trade war. And why did the dollar fall in the first half of 2025? The question is rhetorical.

We should also mention the new "shutdown." Under Trump, shutdowns have become a routine occurrence. Each year, with the start of a new fiscal year, Democrats and Republicans cannot agree on the budget. And this happens only when Trump is president. Recall that during his first term, the U.S. recorded the longest shutdown in history—35 days. Of course, a shutdown does not mean that all government employees are fired or that all government agencies cease functioning. Or does it?

Trump has ordered the relevant agencies to prepare for mass layoffs. What is this? A new method of confronting the Democrats? Everyone understands perfectly well that after mass layoffs, total criticism will be directed at the Democratic Party, "which left Trump with no other choice." As usual in the U.S., the fate of people seems to matter to no one.

Let's also recall Trump's "One Big Beautiful Bill," adopted a couple of months ago, which provides not only for tax cuts but also for a sharp reduction in healthcare and social programs. The current sticking point lies in these very programs. Democrats want to preserve at least some support for the socially vulnerable, while Trump and his team insist on the opposite. If the ruling elites fail to reach an agreement by October 1, America will plunge into yet another display of the "Great Future."

Frankly, it is difficult to imagine under what circumstances the market will buy the dollar in the near future. Of course, the NonFarm Payrolls report could come out better than forecasts, but that's only because forecasts are now, so to speak, set at rock bottom. Previously, the Bureau of Labor Statistics projected 100,000 to 200,000 new jobs, but now it is just 39,000. It is much easier to beat 39 than 100,000. Thus, we would not be surprised by another dollar rebound. However, there are still no solid reasons for it. All that remains is to wait for the price to consolidate above the moving average so that both technical and fundamental signals point in the same direction.

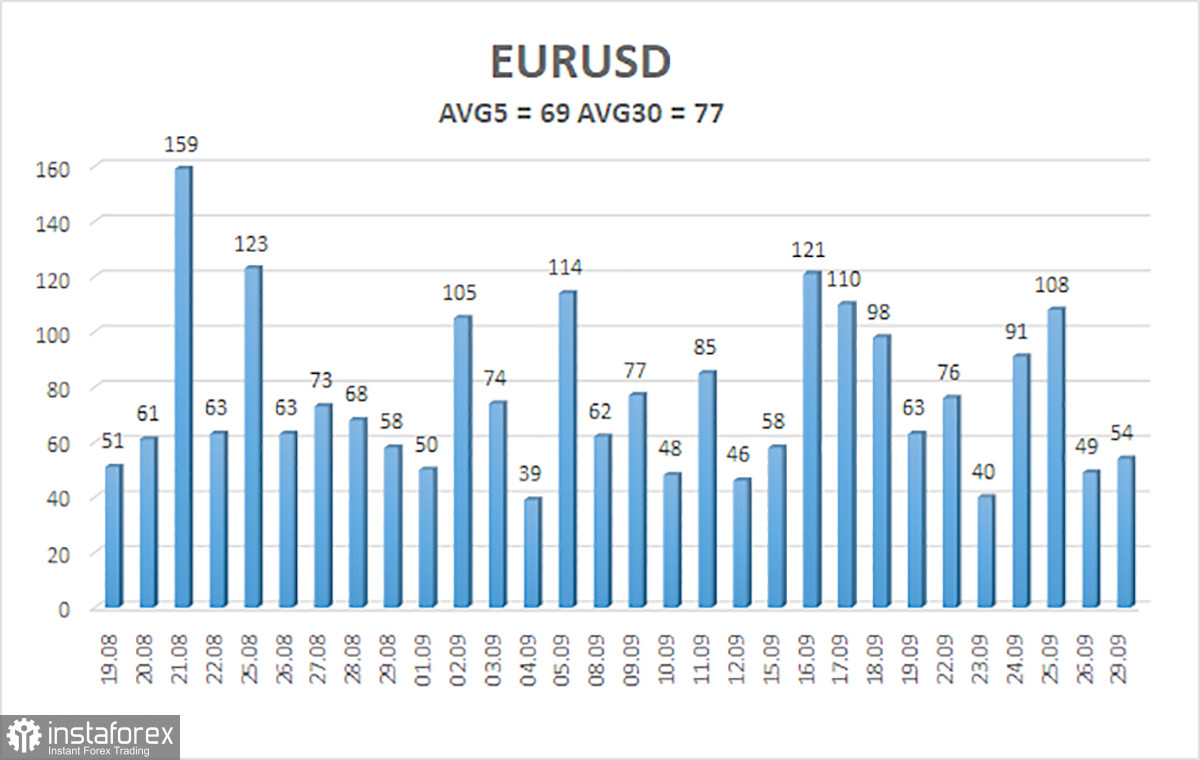

The average volatility of EUR/USD over the last five trading days as of September 30 is 69 pips, which is considered "average." We expect the pair to move between 1.1664 and 1.1802 on Tuesday. The longer-term linear regression channel remains upward, indicating a bullish trend. The CCI indicator entered the overbought zone, which triggered a new round of downward correction.

Nearest Support Levels:

- S1 – 1.1719

- S2 – 1.1597

- S3 – 1.1475

Nearest Resistance Levels:

- R1 – 1.1841

- R2 – 1.1963

Trading Recommendations:

The EUR/USD pair continues its correction, but the uptrend remains intact across all timeframes. The U.S. dollar is still heavily pressured by Trump's policies, and he clearly has no intention of "stopping where he is." The dollar rose as much as it could (for a whole month), but now it seems time for another round of prolonged decline. If the price is below the moving average, small shorts may be considered with targets at 1.1664 and 1.1597, purely on technical grounds. If the price is above the moving average, long positions remain relevant, with targets at 1.1841 and 1.1963, in line with the trend.

Chart Elements Explained:

- Linear regression channels help determine the current trend. If both channels point in the same direction, the trend is strong.

- The moving average line (settings 20,0, smoothed) indicates the short-term trend and trade direction.

- Murray levels serve as target levels for moves and corrections.

- Volatility levels (red lines) are the likely price channel for the next day, based on current volatility readings.

- The CCI indicator: dips below -250 (oversold) or rises above +250 (overbought) mean a trend reversal may be near.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română