Gold has surged to another all-time high, extending Monday's rally as the looming prospect of a U.S. government shutdown has clouded the Federal Reserve's monetary policy outlook ahead of next month's interest rate decision.

Investors, seeking to protect their assets from geopolitical turbulence and potential economic instability, are increasingly turning to gold — traditionally viewed as a "safe haven." The rise in gold prices is also being fueled by the weakening of the U.S. dollar, making the precious metal more attractive to holders of other currencies. Economic uncertainty tied to a possible shutdown is forcing analysts to reconsider their forecasts regarding the Fed's next moves. If a government shutdown does occur, it could lead to a slowdown in economic growth. This scenario places further pressure on the dollar and boosts demand for gold.

Gold prices rose by 0.9%, hitting a new all-time high of $3867.25 per ounce, surpassing the previous session's peak when the metal rallied 2%. Yesterday's meeting between key congressional leaders and President Donald Trump ended without reaching an agreement on temporary government funding. This further intensified concerns over a potential economic halt, which could hinder the release of economic data, depriving investors of critical metrics needed to assess the health of the U.S. economy.

So far this year, gold has soared 47% — its highest annual gain since 1979 — and has set a series of records amid strong demand from central banks and the Fed's return to interest rate cuts. Major financial institutions such as Goldman Sachs Group Inc. and Deutsche Bank AG anticipate the rally to continue.

U.S. Treasury bonds also rose on Monday, while the dollar fell — partly due to fears of a potential economic shutdown. A decline in U.S. government bond yields typically benefits precious metals, which do not pay interest, while a weaker dollar makes dollar-priced bullion cheaper for most global buyers.

Among other precious metals, silver and platinum took a breather after hitting multi-year highs in the previous session. Since the beginning of the year, silver and platinum have gained approximately 63% and 76%, respectively. The rally is driven by sustained market tension, as supply deficits have reached peak levels over the past several years.

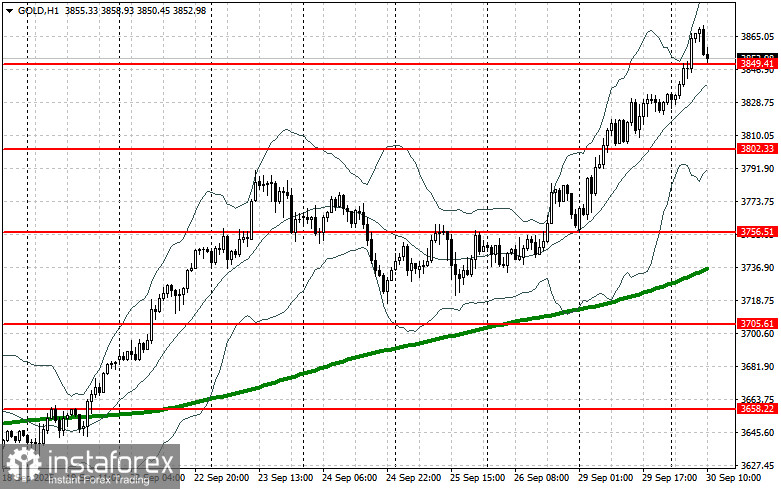

As for the current technical picture of gold, buyers need to break through the nearest resistance at $3906. That would allow targeting $3954, above which a breakout could prove difficult. The most distant upside target lies at $4008. In case of a decline, bears will try to regain control over the $3849 level. If successful, a break below this range would deal a significant blow to the bulls and drag gold down to $3802, with a possible extension to $3756.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română