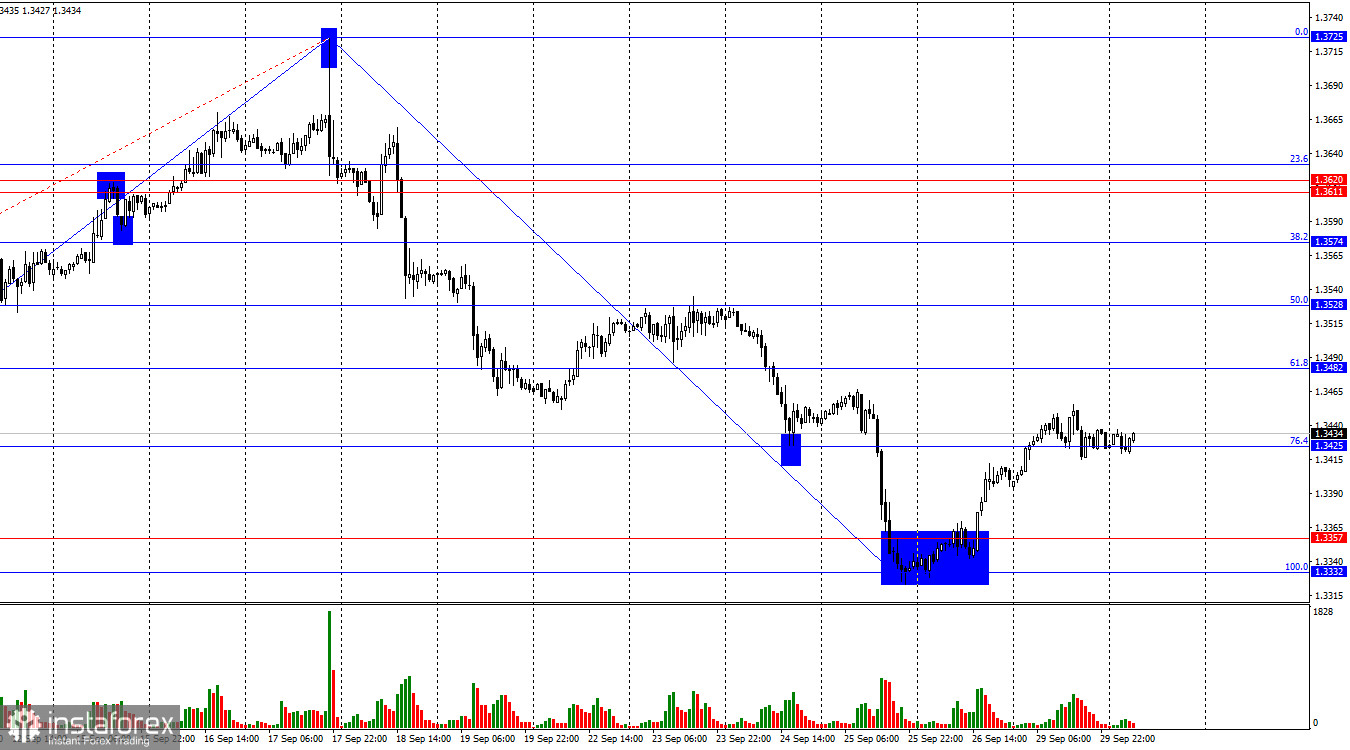

On the hourly chart, the GBP/USD pair on Monday consolidated above the 76.4% retracement level at 1.3425, where it continues to trade as of Tuesday morning. A rebound from the 1.3425 level would favor continued growth toward the levels of 1.3482 and 1.3528. A consolidation below the 1.3425 level would suggest a reversal in favor of the US dollar and a resumption of the decline toward the support zone of 1.3332–1.3357.

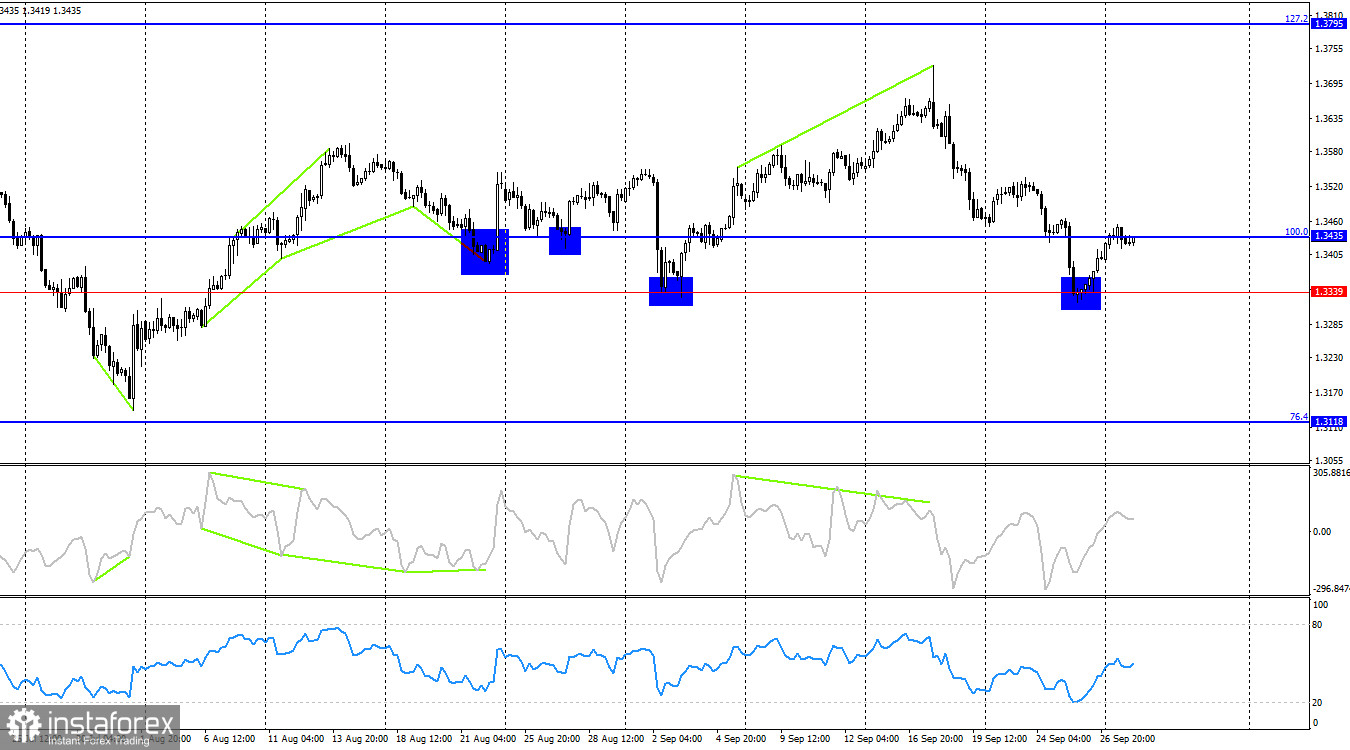

The wave pattern remains "bearish." The last completed downward wave broke the previous low, while the new upward wave has yet to surpass the previous high. The news background for the pound has been negative over the past two weeks, but I believe this has already been fully priced in by traders. This week, the news background could turn negative for the US dollar instead. A full trend reversal to "bullish" would require a rise of another 300 points, but I think we will see signs of a trend change earlier than that.

On Monday, there was no significant news from either the UK or the US (apart from the government shutdown situation). However, starting today, traders will begin to receive data on the US labor market. The JOLTS Job Openings report is not considered a major release, but it reflects labor market supply. If supply is decreasing, the labor market tends to contract — and we've been seeing this contraction over the past 4–5 months. Thus, even if the JOLTS report doesn't trigger a drop in the dollar on Tuesday, it would still support the ongoing negative labor market trend. Also, today the UK will release its Q2 GDP report. The British economy may show only 0.3% growth — which, under current conditions, is actually quite decent. At the very least, traders are already accustomed to low growth rates, and a figure slightly above 0.3% could help bulls push further upward.

On the 4-hour chart, the pair rebounded from the 1.3339 level and turned in favor of the British pound. A consolidation above the 100.0% Fibonacci level at 1.3435 would increase the likelihood of further growth toward the 127.2% retracement level at 1.3795. As of today, no forming divergences are observed on any indicators. A new decline in the pound may be expected only after the pair consolidates below the 1.3339 level.

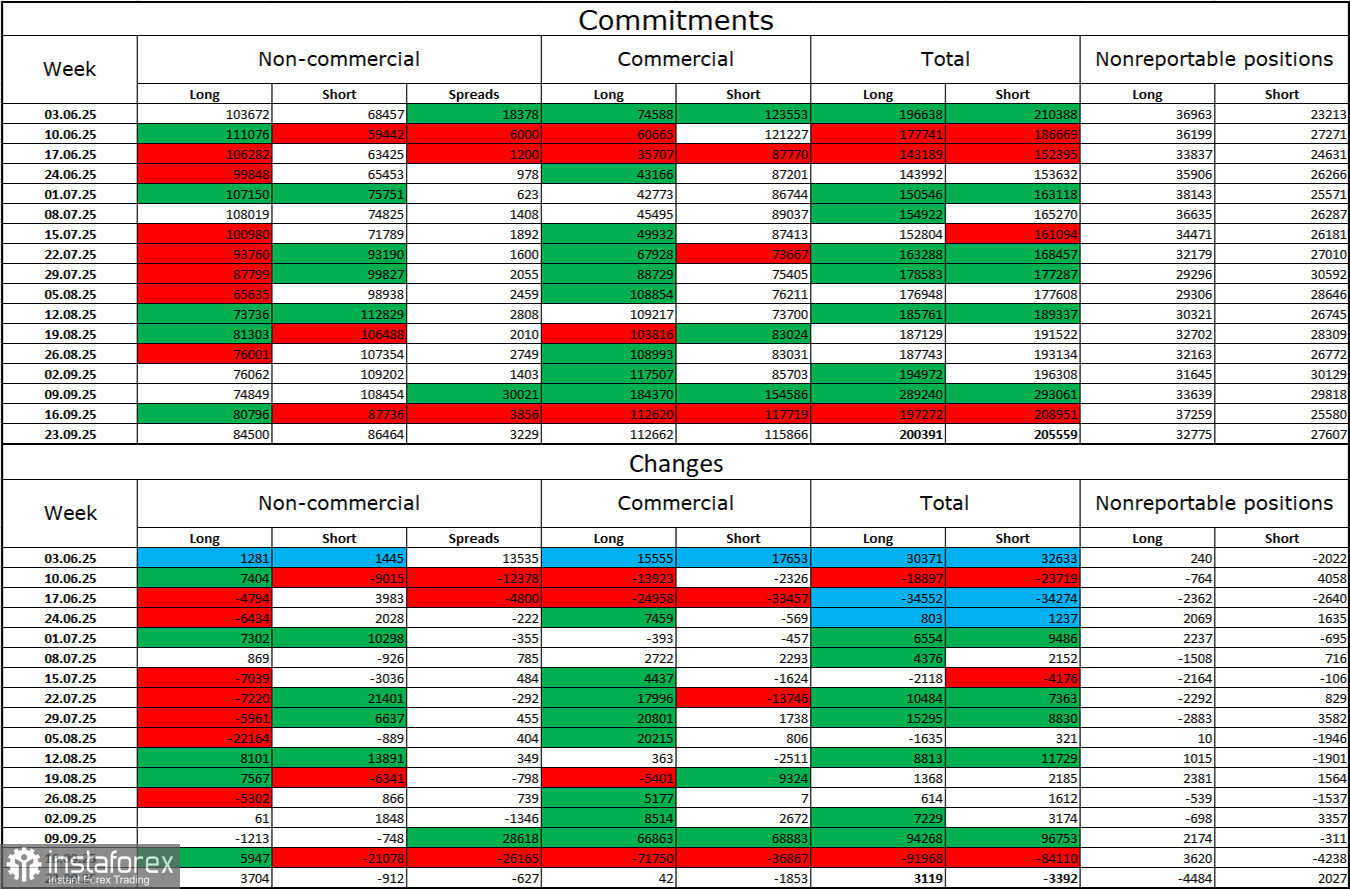

Commitments of Traders (COT) Report:

The sentiment among the "Non-commercial" trader category became more bullish in the latest reporting week. The number of Long positions held by speculators increased by 3,704 positions, while Short positions decreased by 912. The current gap between Long and Short positions is practically even: 85,000 vs. 86,000. Bullish traders are once again tipping the scales in their favor.

In my view, the pound still faces downward pressure, but with each passing month, the US dollar looks increasingly weak. Previously, traders were concerned about Donald Trump's protectionist policies, uncertain of their outcomes. Now, they may be worried about the consequences of those policies: a possible recession, continual introduction of new tariffs, and Trump's pressure on the Fed, which could lead to the regulator becoming politically influenced by the White House. As a result, the pound now seems far less risky compared to the US dollar.

News Calendar for the US and UK:

- UK – Q2 GDP Growth (06:00 UTC)

- US – JOLTS Job Openings (14:00 UTC)

The economic calendar for September 30 includes two events, both of medium importance. Market sentiment on Tuesday may be affected by news, but only slightly.

GBP/USD Forecast and Trading Recommendations:

Sell positions are possible today if the pair closes below the 1.3425 level on the hourly chart, with targets at 1.3332–1.3357.

Buy positions could have been considered after a rebound from the 1.3332–1.3357 level, with targets at 1.3425, 1.3482, and 1.3528. These positions can still be held today, with Stop Loss set to breakeven.

Fibonacci levels are based on:

- 1.3332–1.3725 on the hourly chart

- 1.3431–1.2104 on the 4-hour chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română