Trade Analysis and Advice on Trading the Euro

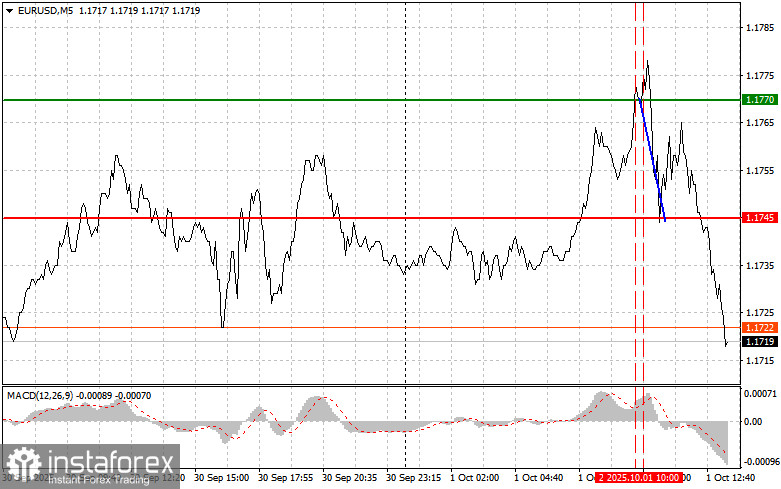

The test of 1.1770 coincided with the moment when the MACD indicator had already moved far above the zero line, which limited the pair's upward potential. For this reason, I did not buy the euro. The second test of 1.1770, with MACD in the overbought area, triggered scenario #2 for selling, resulting in a 30-point decline in the pair.

Revised upward data on the eurozone manufacturing PMI still showed a decline compared to the previous month, which negatively affected the euro in the first half of the trading day. Inflation figures fully matched economists' forecasts, which also failed to spark renewed demand for risk assets. Despite the revisions, the outlook for the eurozone's manufacturing sector remains uncertain. Declining activity indicates persistent logistical difficulties, which will weigh on eurozone economic growth for Q3.

Today, market participants will focus on the ADP employment data and the U.S. ISM Manufacturing Index. However, whether these reports will be released remains uncertain. The U.S. government shutdown may lead to a pause in statistical publications. If released, the ADP report will be closely examined by investors and analysts as a leading indicator for Friday's official employment statistics. Discrepancies between the two reports could trigger market volatility and force traders to adjust forecasts. The ISM index is an important indicator of U.S. economic health: values above 50 indicate growth in manufacturing, while values below 50 point to contraction. Market reaction to the ISM release is usually immediate: positive data tend to support the dollar, while negative data pressure it.

As for the intraday strategy, I will rely mainly on scenarios #1 and #2.

Buy Signal

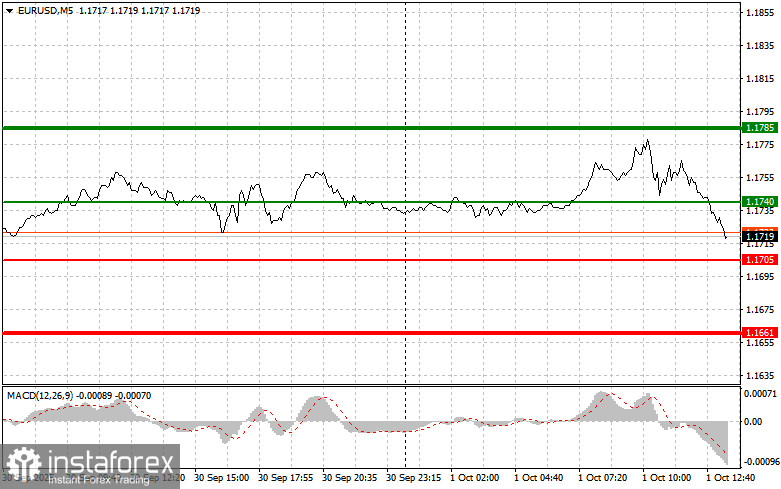

Scenario #1: Today, buying the euro is possible around 1.1740 (green line on the chart) with a target of 1.1785. At 1.1785, I plan to exit the market and also sell the euro in the opposite direction, expecting a 30–35-point pullback from the entry point. Euro growth today will depend on weak U.S. data.Important! Before buying, make sure the MACD indicator is above zero and just starting to rise from it.

Scenario #2: I also plan to buy the euro if the price makes two consecutive tests of 1.1705 while MACD is in the oversold area. This would limit the pair's downward potential and trigger a reversal upward. Growth toward 1.1740 and 1.1785 can then be expected.

Sell Signal

Scenario #1: I plan to sell the euro after the price reaches 1.1705 (red line on the chart). The target will be 1.1661, where I intend to exit and immediately buy in the opposite direction (expecting a 20–25-point move back from the level). Pressure on the pair will return if the U.S. statistics are strong.Important! Before selling, make sure the MACD indicator is below zero and just starting to decline from it.

Scenario #2: I also plan to sell the euro if the price makes two consecutive tests of 1.1740 while MACD is in the overbought area. This would limit the pair's upward potential and trigger a reversal downward. A decline toward 1.1705 and 1.1661 can then be expected.

What's on the chart:

- Thin green line – entry price for buying the instrument;

- Thick green line – suggested price for placing Take Profit or closing the trade, as further growth above this level is unlikely;

- Thin red line – entry price for selling the instrument;

- Thick red line – suggested price for placing Take Profit or closing the trade, as further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to rely on overbought and oversold zones.

Important: Beginner Forex traders must be extremely cautious when making market entry decisions. Before major fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you skip money management and trade large volumes.

And remember, successful trading requires a clear trading plan like the one presented above. Spontaneous decision-making based only on current market moves is an inherently losing intraday strategy.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română