Perhaps the most interesting aspect for us as traders is the statistical picture. Since the U.S. Bureau of Labor Statistics is also a government agency, all upcoming labor market reports will not be published during the shutdown. As I've mentioned before, I personally doubt this is inevitable, but no one knows for sure at this point. If the Nonfarm Payrolls (NFP) report doesn't come out this Friday, the market will find it extremely difficult to assess the condition of the U.S. labor market — especially after five consecutive months of weak numbers. Even more complicated will be the situation for the Federal Reserve, because on what basis will it set monetary policy if it lacks reliable economic data?

Fortunately, the next FOMC meeting isn't scheduled until the end of October. By that time, the shutdown could already be over. However, this still raises real concerns about the quality and reliability of the data that will eventually be released once the government reopens. Economists are already warning that the upcoming labor market and inflation reports may not reflect the actual economic situation. Let's not forget that during the last data misalignment, Donald Trump fired the director of the Bureau of Labor Statistics, Erica McEntarfer, after job figures were substantially revised downward for the previous three months.

Today, the U.S. released a report that the market may use as a strategic reference for trading the dollar throughout the next month — the ADP employment report. To say the numbers were disappointing is a major understatement. According to ADP, the U.S. economy lost 32,000 private-sector jobs in September. Meanwhile, the previous month's figure (August) was revised sharply lower — from +54,000 to -3,000. In my opinion, the U.S. labor market continues to "cool off," and so far, the Fed's interest rate cuts haven't had any meaningful impact.

This "cooling" may well continue in the coming months, since a single round of rate cuts is unlikely to be enough to jumpstart the jobs market. As a result, we may not see an improvement until the holiday season, around Christmas and New Year. During this time, the U.S. dollar could remain under pressure in financial markets, although it hasn't really managed to break free from that pressure in all of 2025. Economists continue to point to the growing number of net short positions on the dollar, and the U.S. Dollar Index remains in a downward trend.

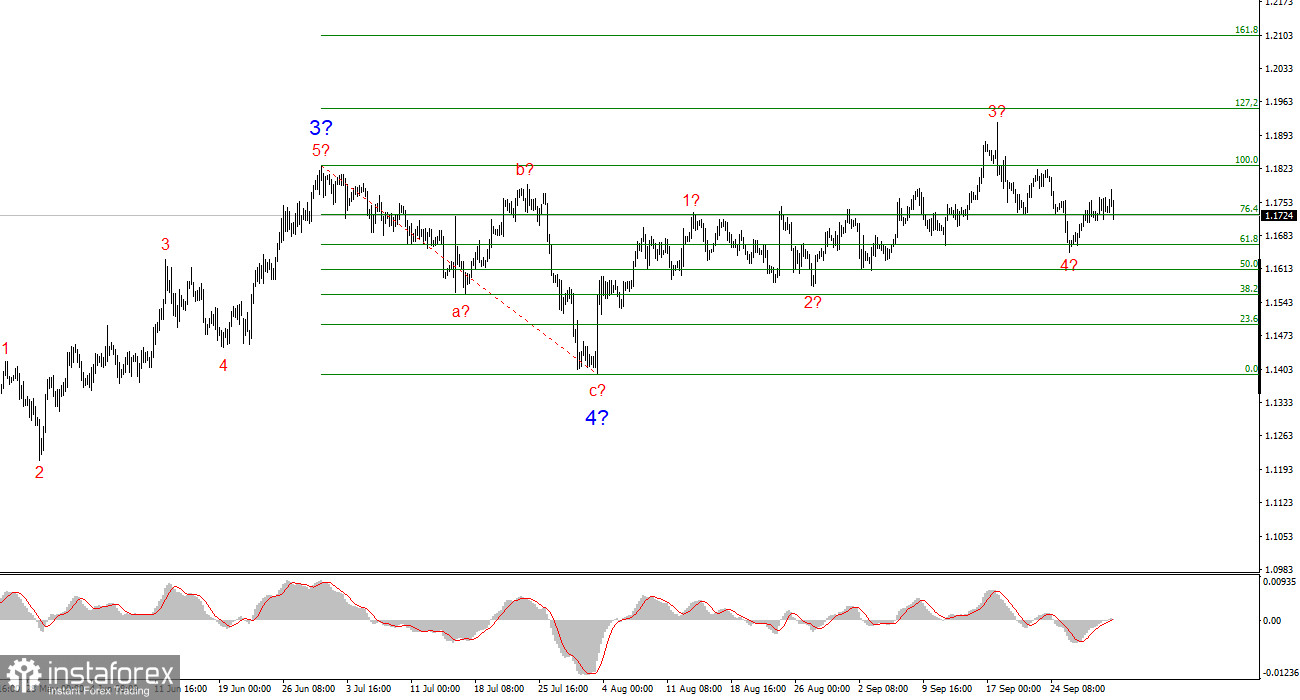

Wave Pattern for EUR/USD:

Based on my analysis of the EUR/USD pair, it continues to build an upward segment of the trend. The wave pattern still largely depends on the news background surrounding Trump's decisions and the domestic and foreign policies of the new U.S. administration. The targets for the current uptrend could extend as far as the 1.25 area. At present, a corrective wave 4 is taking shape, which may already be complete. The bullish wave structure remains valid. Therefore, I am still considering only long positions. By the end of the year, I expect the euro to rise to the 1.2245 mark, which corresponds to the 200.0% Fibonacci.

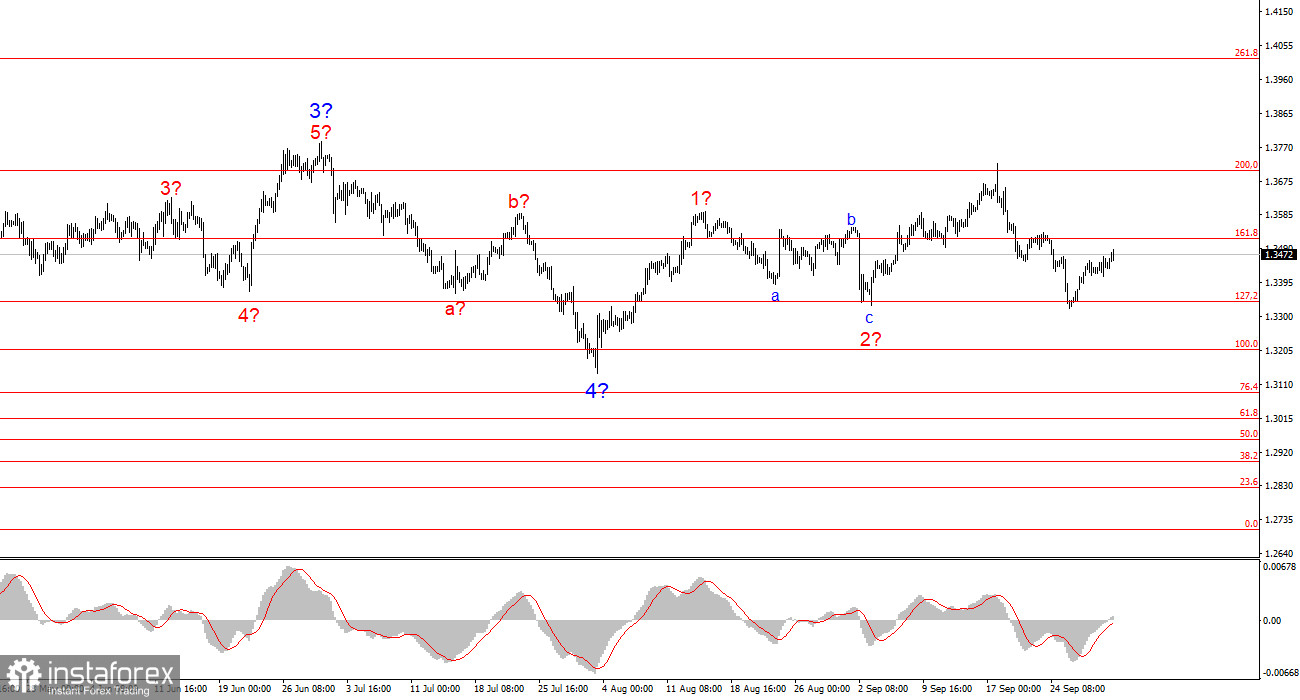

Wave Pattern for GBP/USD:

The wave structure for GBP/USD has undergone a change. We are still in an upward, impulsive segment of the trend, but its internal waves are currently difficult to read. If wave 4 unfolds as a complex three-wave pattern, the structure could normalize. Even so, Wave 4 will be significantly more complex and drawn out than Wave 2. In my opinion, the best benchmark right now is the 1.3341 level, which corresponds to the 127.2% Fibonacci. Two failed breakout attempts at this level could indicate the market is preparing for a fresh buying phase.

Key Principles of My Analysis:

- Wave structures should be simple and easy to interpret. Complex structures are hard to trade and often indicate a change in trend.

- If you're uncertain about what's happening in the market, it's better to stay out.

- There is no such thing as 100% certainty in market direction. Always use protective Stop Loss orders.

- Wave analysis can be effectively combined with other types of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română