The final — and perhaps most important — point to consider is the economy. When government spending is slashed and up to 1 million federal employees are furloughed, economic and business activity drops abruptly. American consumers cut back on spending, and business revenues, along with personal incomes, decline.

Between 2018 and 2019, the U.S. economy contracted by 0.4%, and between 2012 and 2013, by 0.6%. However, economists noted that the 2018–2019 shutdown was only partial, while in 2012–2013, it was total. This means that in just two weeks of a total shutdown, the U.S. economy sustained one and a half times more damage than it did during five weeks of a partial shutdown. It's important to remember that this time, we are facing a total shutdown.

Therefore, the U.S. economy won't get away with a light scare. The losses will be significant. I still have strong doubts about the GDP growth reported in the second quarter. Many experts argue that this growth wasn't driven by industrial expansion or real economic development, but rather resulted from increased tariff revenues. In other words, the U.S. budget saw an increase in income because imports dropped significantly, directly due to the rise in tariffs. So the claimed 4% economic growth in the U.S. should be taken with a grain of caution.

Typically, once a shutdown ends, the economy recovers from the ground it has lost. But this time, the consequences may be more long-term. We must also not forget the lasting effects of the ongoing trade war. I believe those analysts who suggest that a recession is more likely now than ever before are absolutely right.

Will the Federal Reserve be able to help? Maybe — but not quickly or easily. It would take at least a few more rounds of rate cuts to revive the labor market. As for what inflation would look like after such easing, I don't even want to think about it. But the Fed doesn't really have a choice. One or two additional rate cuts are likely to be necessary. Indeed, Fed Chair Jerome Powell continues to insist that everything depends on the incoming data. But what if that economic data doesn't get published?

In my view, the U.S. dollar is poised to weaken further in the coming weeks, driven by market uncertainty — a sentiment fully reflected in the current wave pattern.

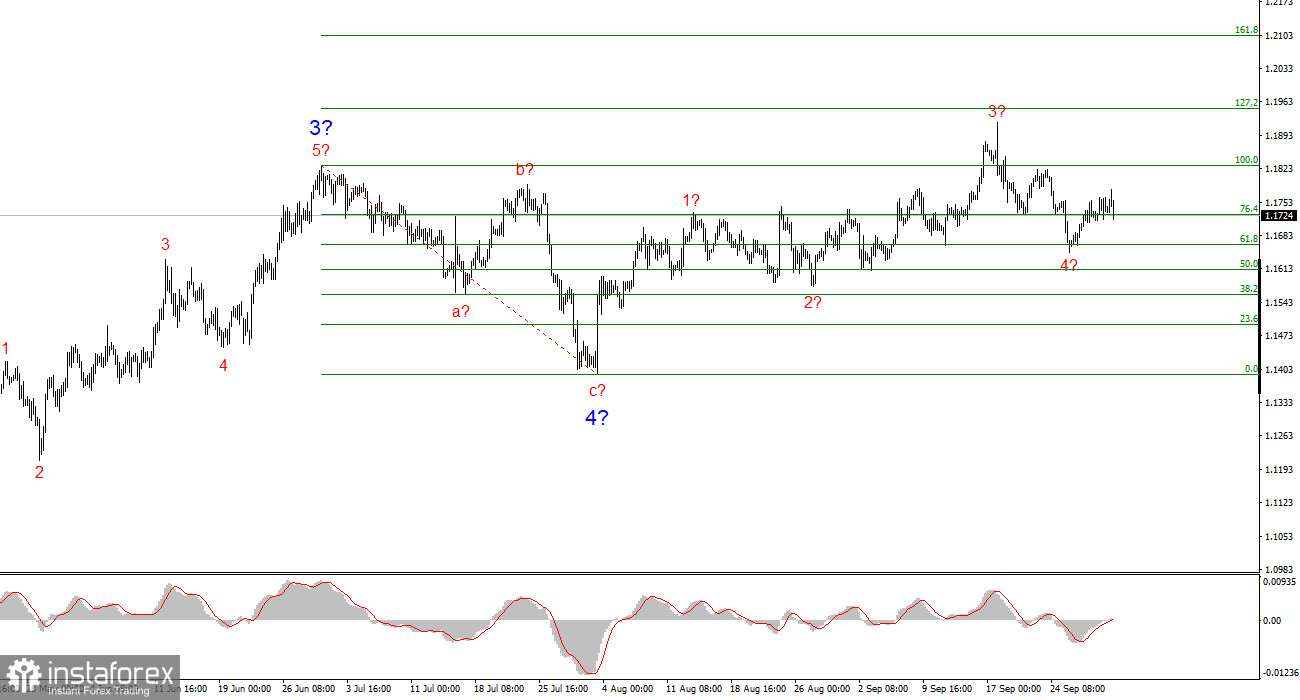

Wave Pattern for EUR/USD:

Based on my analysis of the EUR/USD pair, it continues to build an upward segment of the trend. The wave pattern still largely depends on the news background surrounding Trump's decisions and the domestic and foreign policies of the new U.S. administration. The targets for the current uptrend could extend as far as the 1.25 area. At present, a corrective wave 4 is taking shape, which may already be complete. The bullish wave structure remains valid. Therefore, I am still considering only long positions. By the end of the year, I expect the euro to rise to the 1.2245 mark, which corresponds to the 200.0% Fibonacci.

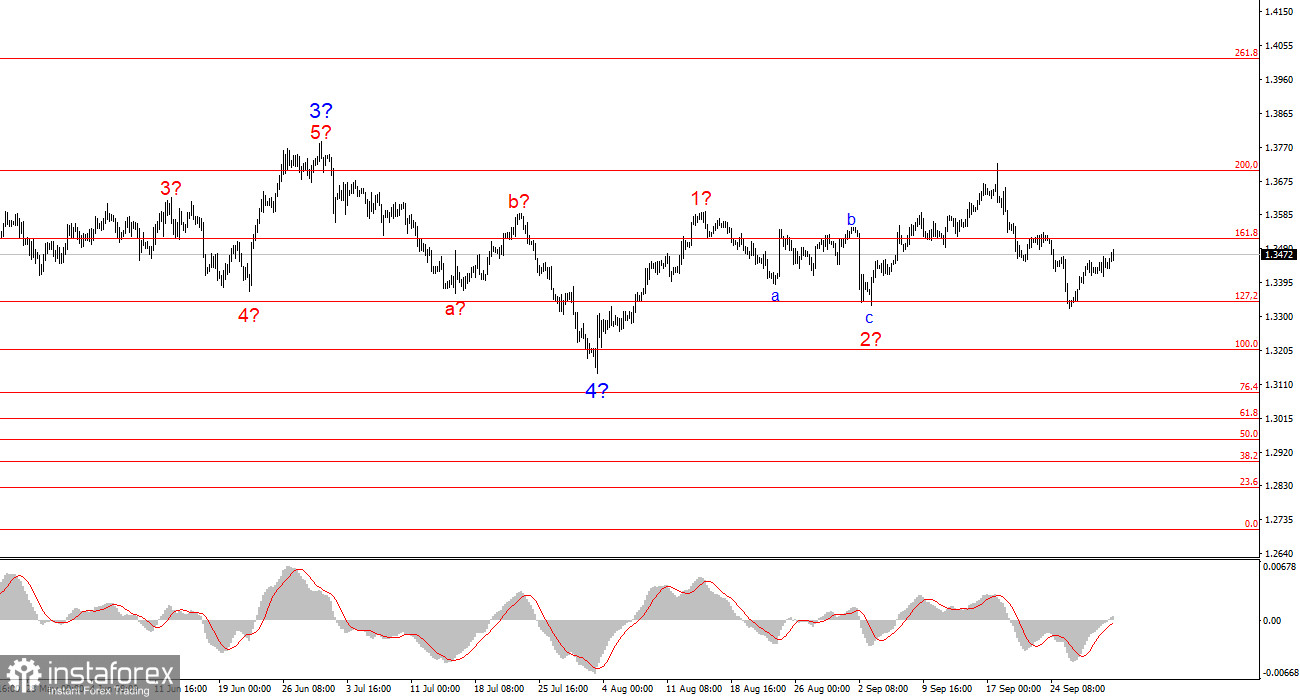

Wave Pattern for GBP/USD:

The wave structure for GBP/USD has undergone a change. We are still in an upward, impulsive segment of the trend, but its internal waves are currently difficult to read. If wave 4 unfolds as a complex three-wave pattern, the structure could normalize. Even so, Wave 4 will be significantly more complex and drawn out than Wave 2. In my opinion, the best benchmark right now is the 1.3341 level, which corresponds to the 127.2% Fibonacci. Two failed breakout attempts at this level could indicate the market is preparing for a fresh buying phase.

Key Principles of My Analysis:

- Wave structures should be simple and easy to interpret. Complex structures are hard to trade and often indicate a change in trend.

- If you're uncertain about what's happening in the market, it's better to stay out.

- There is no such thing as 100% certainty in market direction. Always use protective Stop Loss orders.

- Wave analysis can be effectively combined with other types of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română