The GBP/USD currency pair continued its upward movement on Wednesday, which began a few days earlier. While the euro came under pressure following the release of eurozone inflation data, the British pound had no such releases and continued to climb without interruption. Overall, the pound is rising, while the dollar continues to fall — a trend that is clearly visible on the daily timeframe. The pair has essentially been in a state of consolidation for over two months, but during that time, the pound never lost more than 400 points. In fact, the downward correction could be considered completed as early as August 1. So while the pound may not be growing as firmly as in the first half of the year, it's certainly holding its ground.

(Of course, this is said half-jokingly — the pound sterling hasn't really done anything to deserve a 15-cent rally in 2025. It was the dollar that collapsed by 15 cents.) If not for the fundamentally disastrous backdrop in the U.S., we would never have seen such a sharp upward move in the pound, a currency that, along with the euro, has only been falling for the past 17 years. It's evident that the British economy is not fundamentally strong enough to justify the high demand for the pound. The UK's economic situation has remained poor since 2016.

The current U.S. government shutdown resembles an episode from a new "mini-series from HBO." It's unlikely that the shutdown will last for months, but this particular stoppage of government operations carries special weight. It doesn't even matter which exact policy issues are to blame for the deadlock between Democrats and Trump. What matters is that for the first time during Trump's second term, Democrats finally have a chance to push back.

Let's remember: Trump has passed most major decisions unilaterally, and the entire Republican party has been operating in lockstep under his direction. Because Republicans hold the majority in both chambers of Congress, they haven't needed Democratic approval for most legislation. Currently, however, the Senate must pass a budget for the upcoming fiscal year — and it requires more than a simple 50%+1 majority.

For a budget, 60 votes are needed. But there are only 53 Republicans in the Senate, which normally suffices for most legislation, but not for the budget. This gives Democrats a rare opportunity to play a decisive role in 2025 policymaking.

Adding to the political complexity, midterm congressional elections are scheduled for next year, and Republicans risk losing control of the House of Representatives. We believe that's quite likely, as many of Trump's decisions have objectively worsened the quality of life for everyday Americans. The "Great Future" Trump promised has yet to materialize. Now is the Democrats' moment to demonstrate their strength to the American public. They'll stand firm, prioritizing the rights of socially vulnerable groups — a key component of their platform heading into the 2026 election cycle.

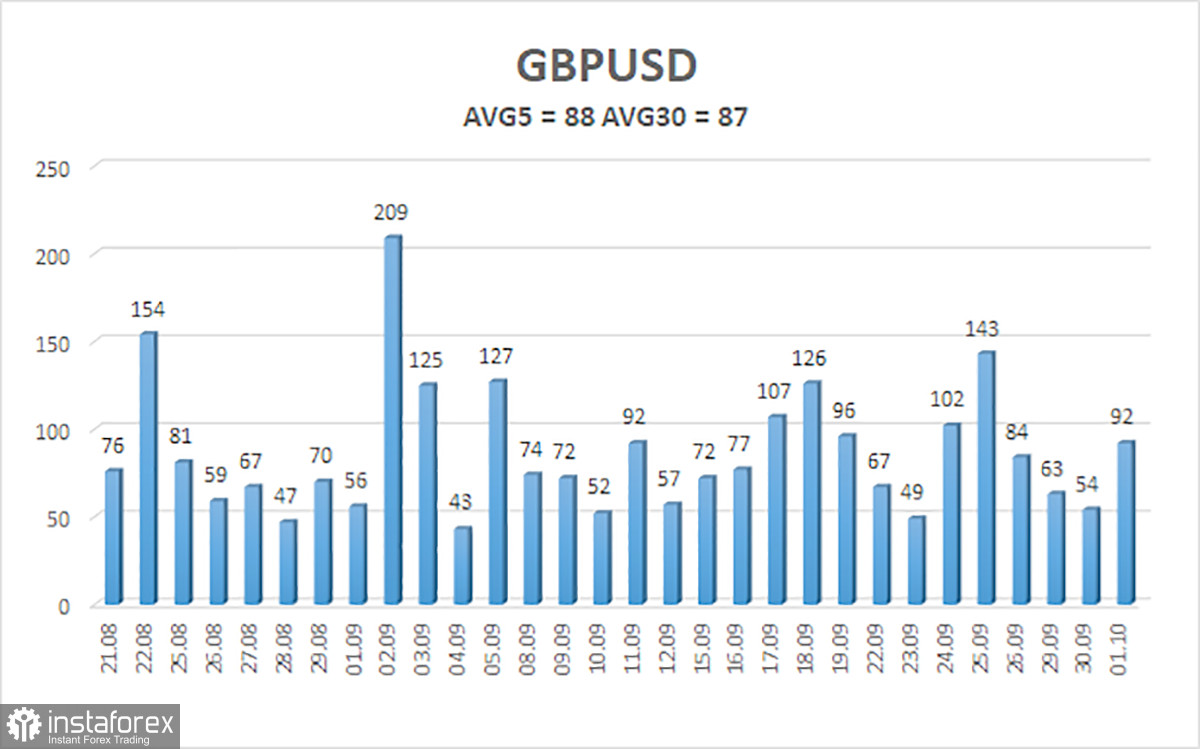

The average volatility of the GBP/USD pair over the last five trading days is 88 pips, considered average for this pair. On Thursday, October 2, we expect price movement within the range of 1.3392 to 1.3568. The longer-term linear regression channel points upward, confirming the continuation of a bullish trend. The CCI indicator recently dipped into oversold territory, signaling a potential resumption of the uptrend.

Nearest Support Levels:

- S1 – 1.3428

- S2 – 1.3367

- S3 – 1.3306

Nearest Resistance Levels:

- R1 – 1.3489

- R2 – 1.3550

- R3 – 1.3611

Trading Recommendations:

The GBP/USD pair is currently in a correction, but its long-term bullish outlook remains unchanged. Donald Trump's policies will continue to exert downward pressure on the dollar, so we don't expect any sustained recovery of the greenback. Long positions with targets at 1.3672 and 1.3733 become especially relevant if the pair trades above the moving average. If the price is below the moving average, short-term short positions may be considered with technical targets at 1.3367 and 1.3352. Occasionally, the dollar shows signs of correction (as it does now), but for a true trend reversal, it needs real progress — such as the end of the trade war or other major positive developments.

Chart Elements Explained:

- Linear regression channels help determine the current trend. If both channels point in the same direction, the trend is strong.

- The moving average line (settings 20,0, smoothed) indicates the short-term trend and trade direction.

- Murray levels serve as target levels for moves and corrections.

- Volatility levels (red lines) are the likely price channel for the next day, based on current volatility readings.

- The CCI indicator: dips below -250 (oversold) or rises above +250 (overbought) mean a trend reversal may be near.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română