Although this week has already brought a number of important events and economic data, the amplitude of price movements remains extremely low, and trader activity is subdued. If we had seen a four-day strengthening of the euro by now, I would not have considered such a move unusual. However, instead of a logical rise in the euro, we are witnessing sideways choppiness in a very narrow range. The market is in no hurry to trade, despite all the conditions for active trading being present.

In fact, this week has delivered just one report that outweighs all others – the ADP employment data. Inflation in the eurozone or the U.S. manufacturing PMI are important releases, but they are not what drives the market at the moment. In most cases, participants wait for the unemployment and Nonfarm Payrolls reports to make final judgments. However, this week, there is nothing to wait for, and the labor market can only be assessed based on the ADP report.

As I have already mentioned, this report came out extremely weak. The number of new jobs amounted to -32,000 against much higher expectations. And if the Nonfarm Payrolls report does not get published, as is now expected, neither the Fed nor the market will have any choice but to conclude solely from ADP. I don't think it's necessary to spell out how the market should react to such a "positive" number.

And, in fact, markets have already reacted—unfortunately, all except the currency market. Futures markets are now pricing in a 99% probability of another round of monetary policy easing in October and an 87% probability of a further rate cut in December. In other words, the market is almost 100% certain that two additional rounds of easing will occur in 2025.

If that is indeed the case, why isn't the demand for the U.S. currency declining? In such situations, one must think outside the box and recall that manipulation often occurs in the market. In other words, I believe the market could very well decline somewhat to confuse everyone and then sharply rise upward. Moreover, it won't even need fresh data or new economic statistics for that. The reasons to sell the U.S. dollar are already more than sufficient.

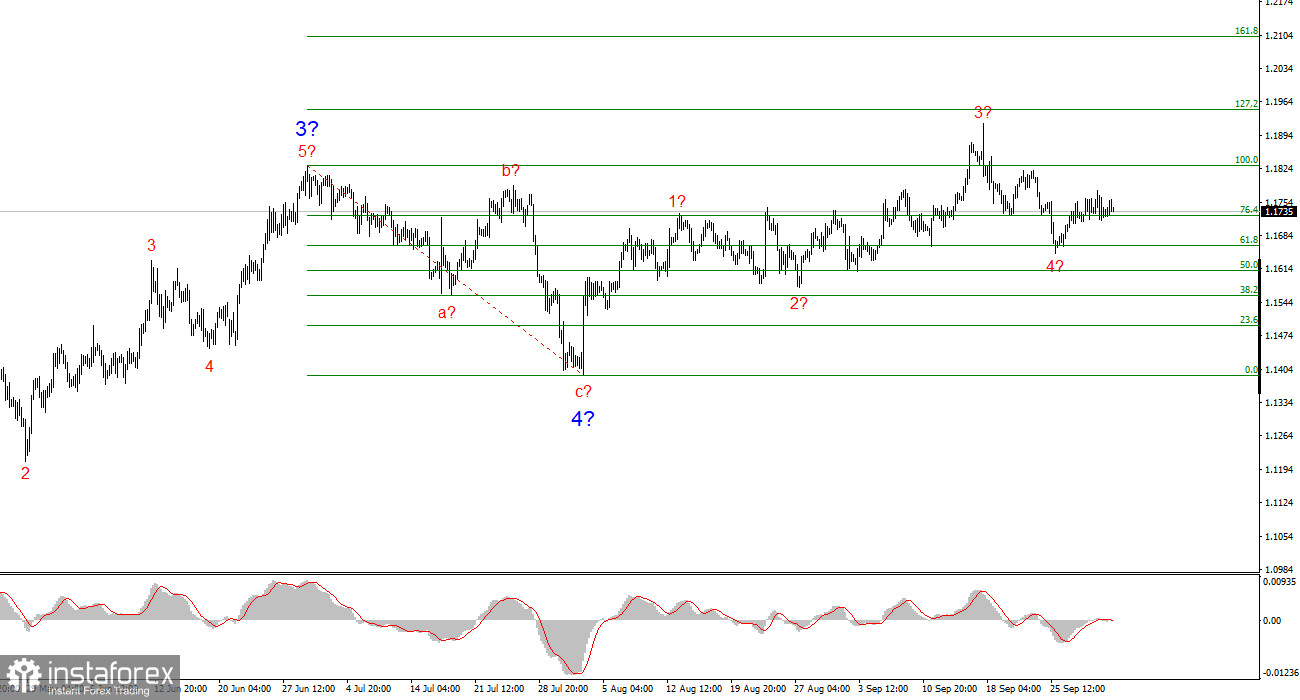

Wave Pattern for EUR/USD:

Based on the analysis of EUR/USD, the instrument continues building an upward segment of the trend. The wave layout still entirely depends on the news background related to Trump's decisions and the foreign and domestic policies of the new U.S. Administration. Targets of the current trend segment may extend as far as the 1.25 area. Currently, a corrective wave 4 is being formed, which may already be complete. The upward wave structure remains intact. Therefore, in the near term, I only consider buying opportunities. By year-end, I expect the euro to rise to the 1.2245 level, which corresponds to the 200.0% Fibonacci.

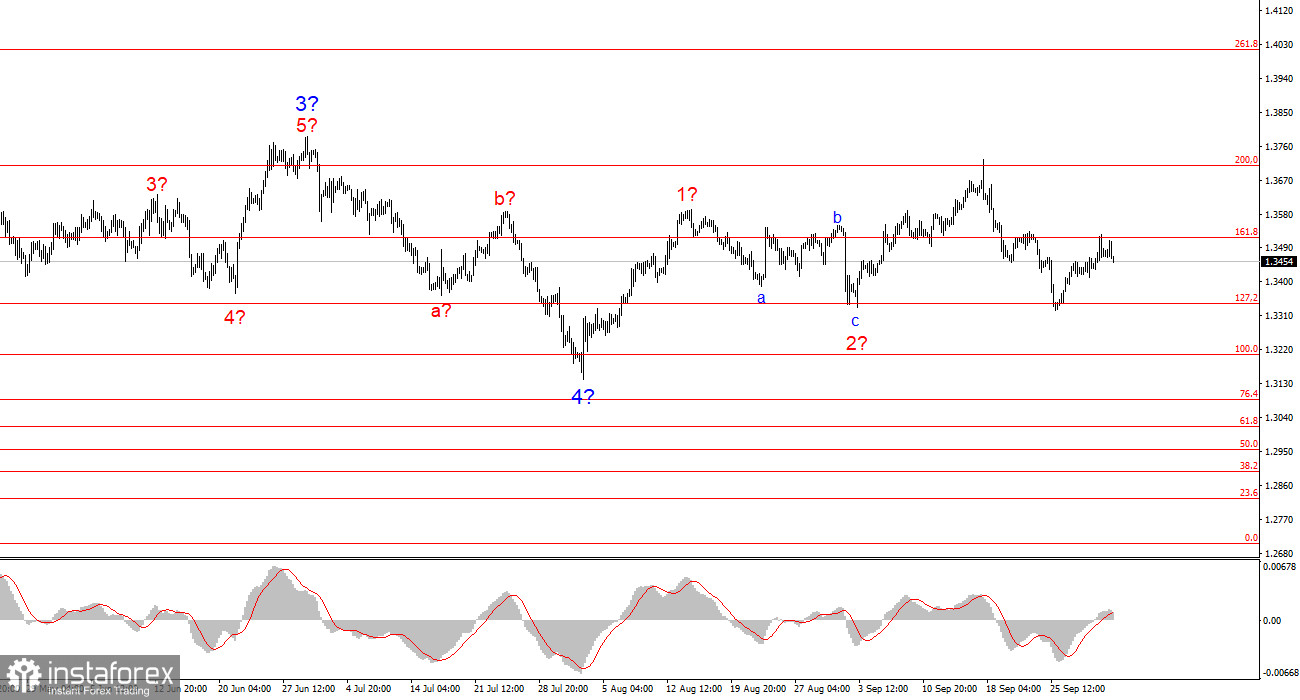

Wave Pattern for GBP/USD:

The wave structure of GBP/USD has shifted. We are still dealing with a bullish impulse segment of the trend, but its internal structure has become less clear. If wave 4 develops into a complex three-wave pattern, the structure will normalize; however, even in this case, wave 4 will turn out to be much more complex and longer than wave 2. In my view, the best approach right now is to lean on the 1.3341 level, which corresponds to the 127.2% Fibonacci. Two failed attempts to break this level may indicate the market's readiness for new purchases.

Key Principles of My Analysis:

1. Wave structures should be simple and clear. Complex structures are challenging to trade and frequently undergo changes.

2. If there is no confidence in what is happening in the market, it is better to stay out.

3. One can never have 100% certainty about the market's direction. Always remember to use protective stop-loss orders.

4. Wave analysis can be combined with other types of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română