1.20 per euro is the minimum projected exchange rate for EUR/USD by year-end. Most banks and economists agree with this forecast. The news background for the dollar in 2025 is not just poor—it keeps worsening. Just a couple of weeks ago, the market was still digesting Donald Trump's new import tariffs (covering all medicines, trucks, and furniture) and the FOMC rate cut, when a government shutdown had already begun in the U.S., while the labor market continued to cool. Currently, demand for the U.S. currency has not declined significantly, but I believe the market will factor these considerations in later.

The Federal Reserve has not just carried out one round of monetary easing. Most likely, the central bank will be forced to continue easing in the coming months, since the labor market shows no signs of recovery. It remains unclear on which reports one can even base an analysis of labor market conditions, given that the U.S. Bureau of Labor Statistics has temporarily halted operations. It is also questionable how accurate the October data will be, considering the shutdown. In short, there are now far more questions than answers concerning the U.S. economy and the dollar.

Economists note that investors are increasingly hedging risks associated with the dollar, with the euro (and other currencies) being the main beneficiaries of such hedging flows. Many analysts also believe that the dollar's sell-off is far from over. For example, Peter Schaffrik, a macro strategist at RBC Capital Markets, argues that what we have seen so far is just the tip of the iceberg—the worst is yet to come for the dollar.

Goldman Sachs expects the euro to rise to 1.25 over the next 12 months. JPMorgan forecasts EUR/USD at 1.22 as early as March of next year. Investment bank UBS projects 1.23 by the beginning of 2026. One way or another, everyone is betting on a stronger euro and a weaker dollar. It is worth remembering, however, that the euro and the dollar are both global currencies, and they cannot stage rallies of 10% per month.

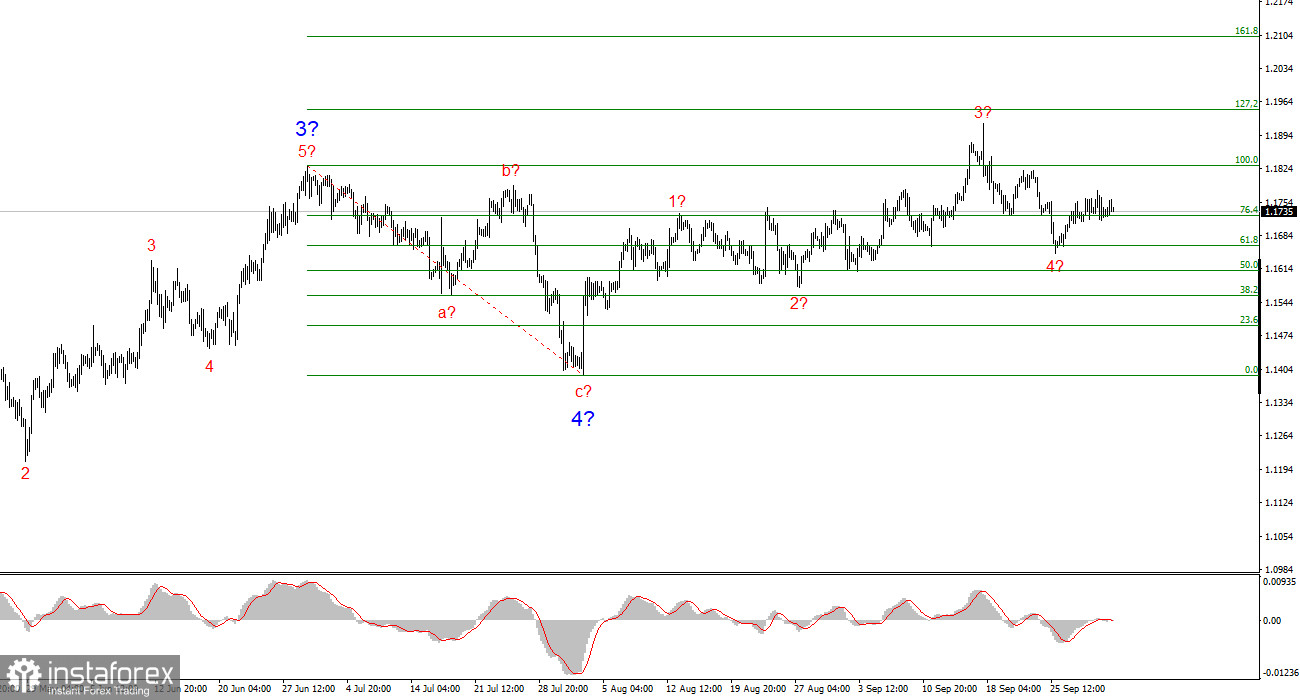

Wave Pattern for EUR/USD:

Based on the analysis of EUR/USD, the instrument continues building an upward segment of the trend. The wave layout still entirely depends on the news background related to Trump's decisions and the foreign and domestic policies of the new U.S. Administration. Targets of the current trend segment may extend as far as the 1.25 area. Currently, a corrective wave 4 is being formed, which may already be complete. The upward wave structure remains intact. Therefore, in the near term, I only consider buying opportunities. By year-end, I expect the euro to rise to the 1.2245 level, which corresponds to the 200.0% Fibonacci.

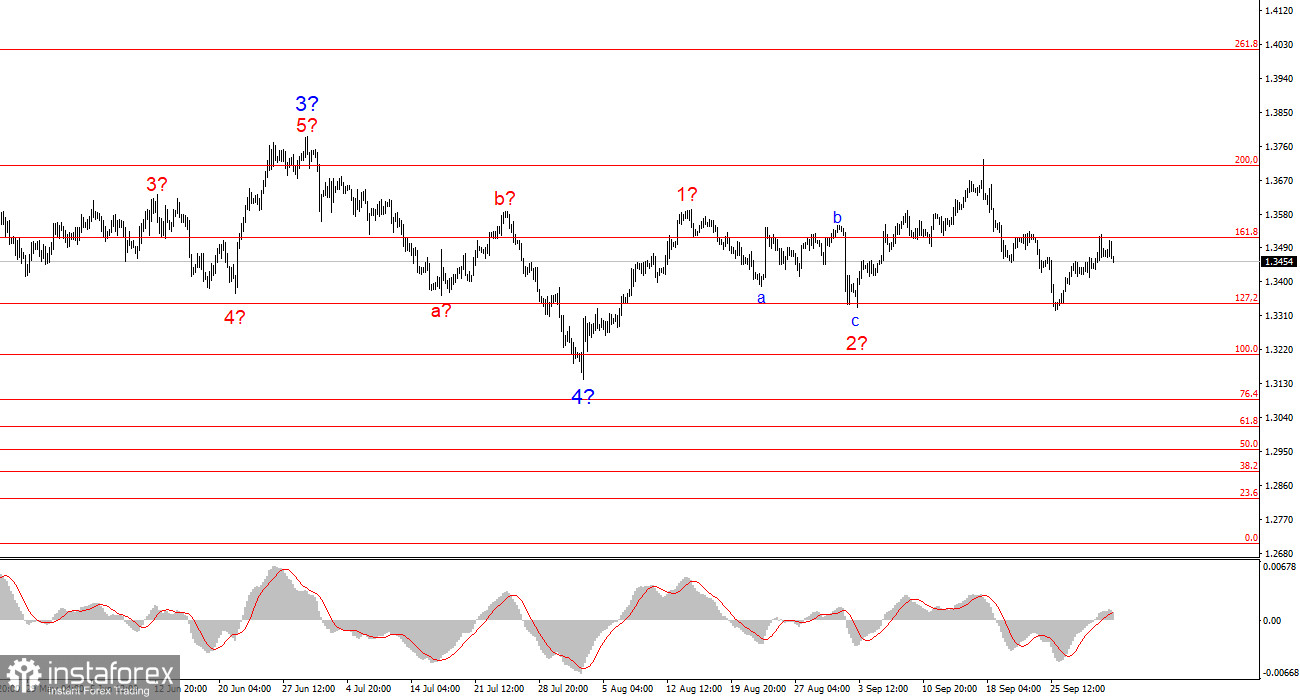

Wave Pattern for GBP/USD:

The wave structure of GBP/USD has shifted. We are still dealing with a bullish impulse segment of the trend, but its internal structure has become less clear. If wave 4 develops into a complex three-wave pattern, the structure will normalize; however, even in this case, wave 4 will turn out to be much more complex and longer than wave 2. In my view, the best approach right now is to lean on the 1.3341 level, which corresponds to the 127.2% Fibonacci. Two failed attempts to break this level may indicate the market's readiness for new purchases.

Key Principles of My Analysis:

1. Wave structures should be simple and clear. Complex structures are challenging to trade and frequently undergo changes.

2. If there is no confidence in what is happening in the market, it is better to stay out.

3. One can never have 100% certainty about the market's direction. Always remember to use protective stop-loss orders.

4. Wave analysis can be combined with other types of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română