Trade Review for Thursday:

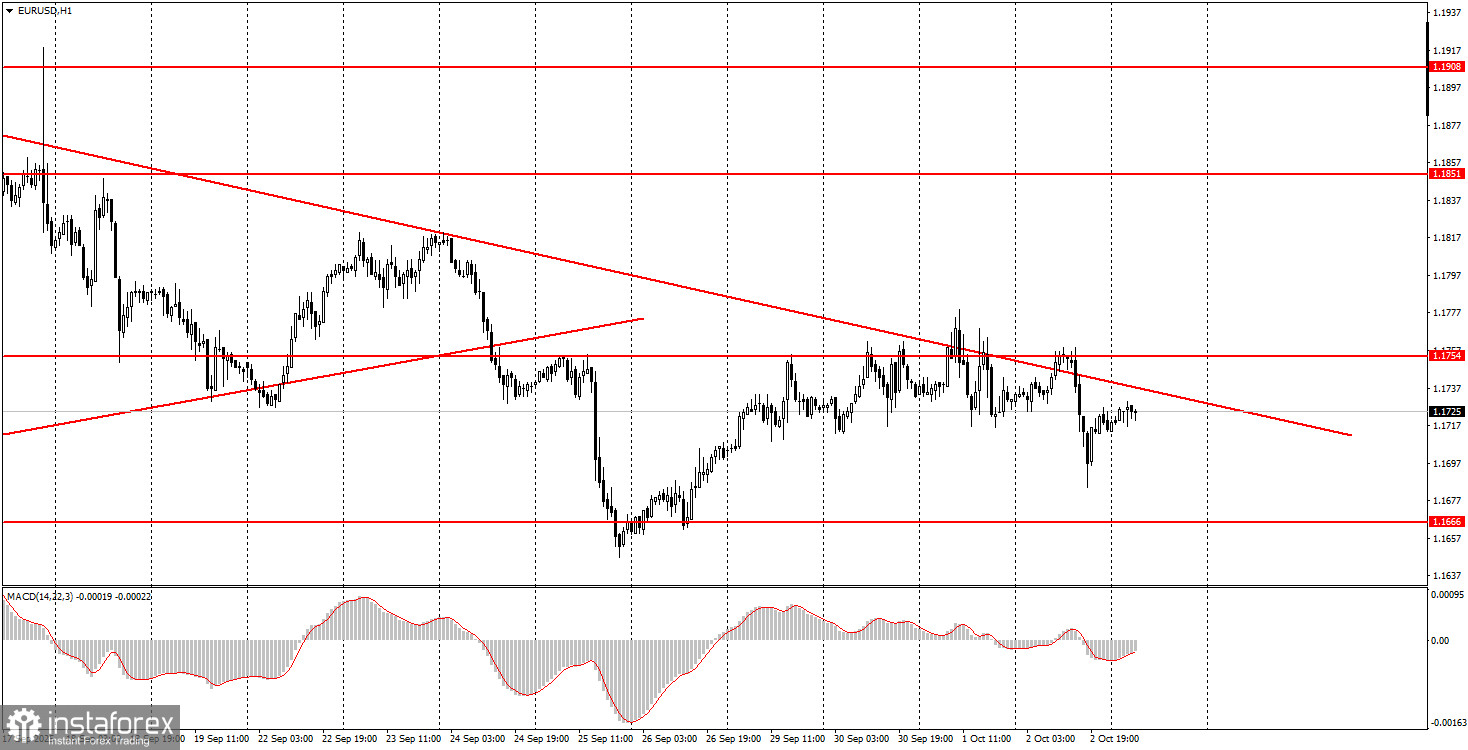

1H Chart of EUR/USD

On Thursday, the EUR/USD pair unexpectedly collapsed. This does not mean the dollar strengthened enough to start a new local "dollar trend." However, this week's movements have been very mixed and illogical, with the market ignoring many factors unfavorable for the U.S. currency. As noted, the dollar had formal reasons to fall yesterday. The eurozone unemployment rate unexpectedly rose to 6.3%, which could have triggered the euro's decline. Yet, in the U.S., a government shutdown has just begun, and the labor market once again showed weakness. In our view, these two factors are far more important than the EU unemployment rate. It is also worth noting that dovish expectations regarding the Federal Reserve's monetary policy continue to grow. The market is now nearly 100% certain that the Fed will cut rates twice before the end of the year. However, for now, all these factors are being ignored, which makes the movements appear illogical.

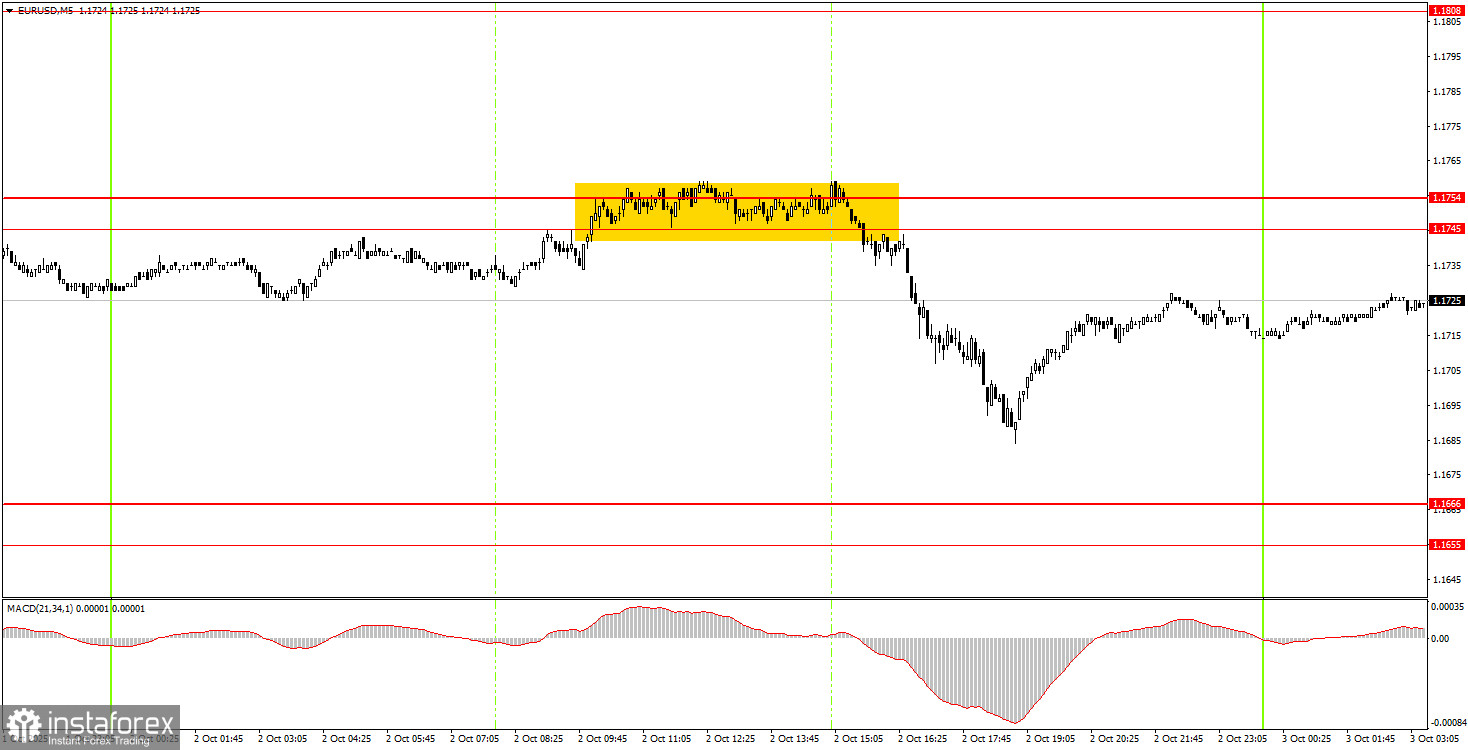

5M Chart of EUR/USD

On the 5-minute timeframe, only one trading signal formed on Thursday—but it was a strong one. For 5 hours, the pair consolidated around the 1.1745–1.1754 resistance zone. When the rebound finally occurred, the price moved about 50 pips in the right direction. Although the pair didn't reach the nearest target zone of 1.1655–1.1666, novice traders could still have closed the trade manually in profit.

How to Trade on Friday:

On the hourly chart, EUR/USD continues to display a downward trend and has yet to break above the trendline. Fundamentally, the backdrop for the dollar remains weak, so we do not expect sustained strength in the U.S. currency. As before, the dollar can only rely on technical corrections, one of which we are currently seeing.

On Friday, the EUR/USD pair will likely trade within the 1.1745–1.1754 zone again. A rebound from this zone is a new reason to open shorts targeting 1.1666. A breakout above this zone would allow for more logical longs targeting 1.1808.

On the 5M timeframe, key levels to watch: 1.1354–1.1363, 1.1413, 1.1455–1.1474, 1.1527, 1.1571–1.1584, 1.1655–1.1666, 1.1745–1.1754, 1.1808, 1.1851, 1.1908, 1.1970–1.1988. On Friday, Christine Lagarde will speak in the EU. In the U.S., Non-Farm Payrolls and unemployment data were initially scheduled but have been removed from event calendars due to the shutdown. Thus, the only report of interest in the U.S. today will be the ISM Services PMI.

Basic Rules of the Trading System:

- The strength of a signal depends on how quickly it forms (rebound or breakout). The less time needed, the stronger the signal.

- If two or more false signals form near a level, ignore subsequent signals from that level.

- In flat conditions, pairs may produce many false signals or none at all. At the first signs of flat, stop trading.

- Open trades between the start of the European session and the middle of the U.S. session; close all positions manually after that.

- On the 1H chart, trade MACD signals only when volatility is sufficient and the trend is confirmed by a trendline or channel.

- Levels close together (5–20 pips apart) should be considered a support or resistance zone.

- After the price moves 15 pips in the right direction, set the Stop Loss to breakeven.

What's on the Charts:

- Support/resistance levels – targets for buy/sell trades, and potential Take Profit levels.

- Red lines – trendlines or trend channels indicating the current trend and trading direction.

- MACD (14,22,3) – histogram and signal line, used as an additional source of signals.

- Support/resistance levels – targets for buy/sell trades, and potential Take Profit levels.

- Red lines – trendlines or trend channels indicating the current trend and trading direction.

- MACD (14,22,3) – histogram and signal line, used as an additional source of signals.

Important speeches and reports (always included in the news calendar) can have a significant impact on currency pair movements. Therefore, when they are released, it is recommended to trade with extreme caution or exit the market to avoid a sharp reversal of prices against the previous movement.

Beginners trading on the Forex market should remember that not every trade can be profitable. Developing a clear strategy and money management are the keys to success in trading over a long period of time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română