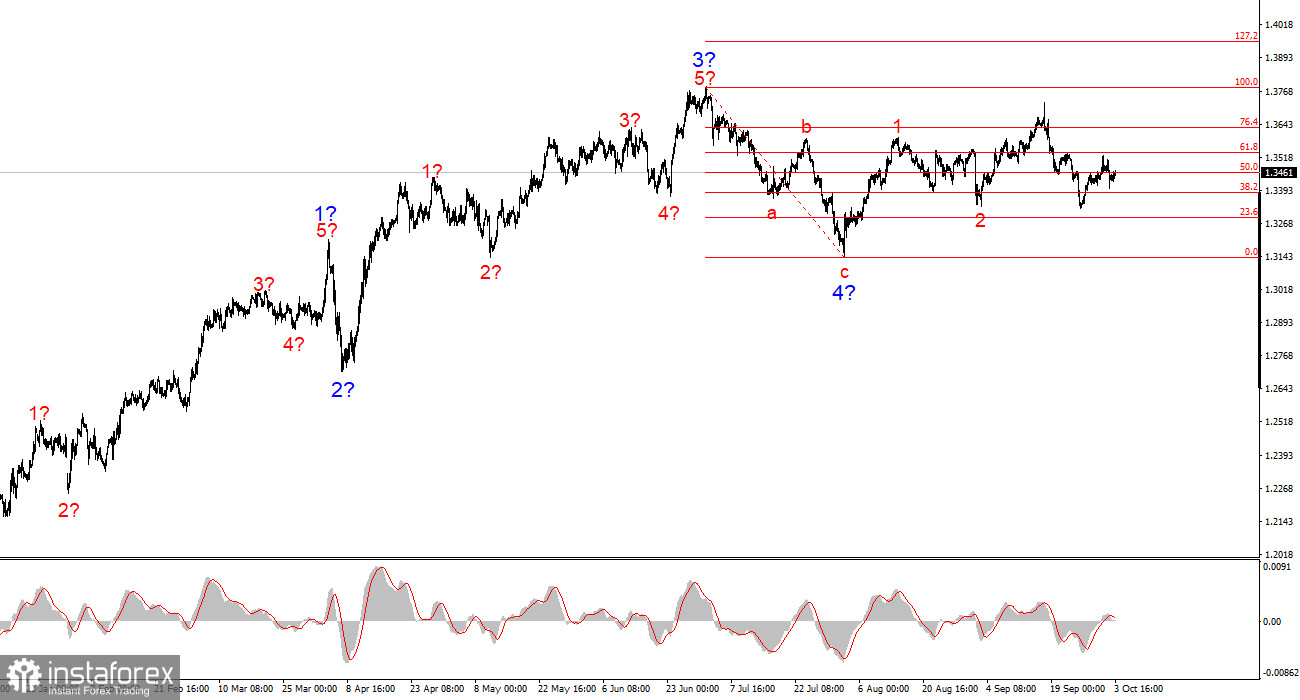

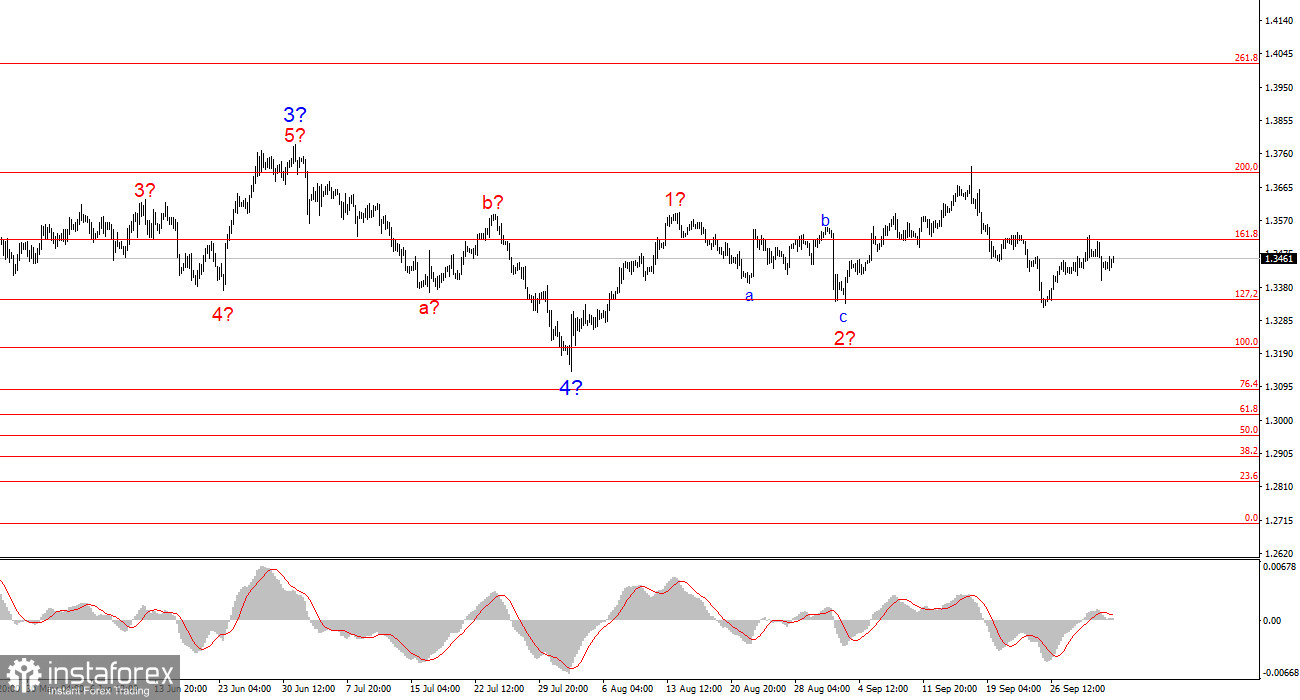

For GBP/USD, the wave structure continues to indicate the building of an upward wave pattern, and it has not changed over the past week. The pound has fallen too much recently, so the trend segment that began on August 1 now looks ambiguous. The first idea that comes to mind is a complication of the assumed wave 4, which could take the form of a three-wave structure, with each of its subwaves also made up of three smaller waves. In this case, a decline toward the 1.31 and 1.30 levels should be expected. However, if this assumption is correct, then the euro would also decline, and consequently its wave structure would undergo certain changes as well. At this time, I do not see any alternative scenarios with a clear structure. The news backdrop has significantly interfered with the realization of the most straightforward scenario.

It should be remembered that at the moment much in the currency market depends on Donald Trump's policies. The market fears Fed policy easing due to pressure from the U.S. president, while Trump himself has introduced a new package of tariffs, pointing to the continuation of the trade war. Therefore, the news backdrop remains unfavorable for the dollar.

The GBP/USD exchange rate rose by 30 basis points on Friday, and at this point one may ask: is that all? Recall that everything this week went against the British currency. The ISM Manufacturing PMI came in above market expectations, but still below the 50.0 threshold. The ADP employment report showed a negative figure. The Nonfarm Payrolls and unemployment rate reports did not come out on Friday, but they almost certainly would not have shown strong results. On Tuesday, the U.S. entered a government shutdown, and on Friday the Services PMI dropped from 52.0 points to 50.0. Was there even one report that could have boosted the U.S. dollar?

And yet, for example, yesterday demand for the dollar grew for most of the day. During the rest of the week, dollar demand rarely fell, and for the most part, the market moved sideways. Consequently, almost all of this week's reports and events were not priced in by the market. In my view, this indicates that the market is currently guided not by economic statistics but by something else.

Let me remind you that even if we abstract from this week's events, the Fed is still likely to cut rates twice more before the end of the year, although earlier the market expected a total of two rounds of easing only in 2025. The U.S. labor market shows no signs of recovery. Other economic indicators also continue to decline. And the most important reports — Nonfarm Payrolls, unemployment rate, and CPI — will not be released at all this month. I believe the GBP/USD exchange rate should already be a couple of figures higher than current levels.

General conclusions.

The GBP/USD wave structure has shifted. We are still dealing with an upward, impulsive trend segment, but its internal wave structure is becoming unreadable. If wave 4 develops into a complex three-wave pattern, the structure will normalize, but even then wave 4 will be far more complex and extended than wave 2. In my view, the best point of reference now is 1.3341, which corresponds to 127.2% on the Fibonacci scale. Two failed attempts to break this level indicate the market's readiness for new buying. Targets for the pair remain no lower than the 1.38 level.

The larger-scale wave structure looks almost perfect, even though wave 4 went beyond the high of wave 1. However, I remind you that perfect wave structures exist only in textbooks. In practice, everything is much more complicated. At the moment, I see no reason to consider alternative scenarios to the upward trend segment.

The main principles of my analysis:

- Wave structures should be simple and clear. Complex structures are hard to trade and often lead to changes.

- If you are not confident about what is happening in the market, it is better to stay out.

- One can never have 100% certainty about market direction. Do not forget about protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română