Trade Analysis and Tips for Trading the Euro

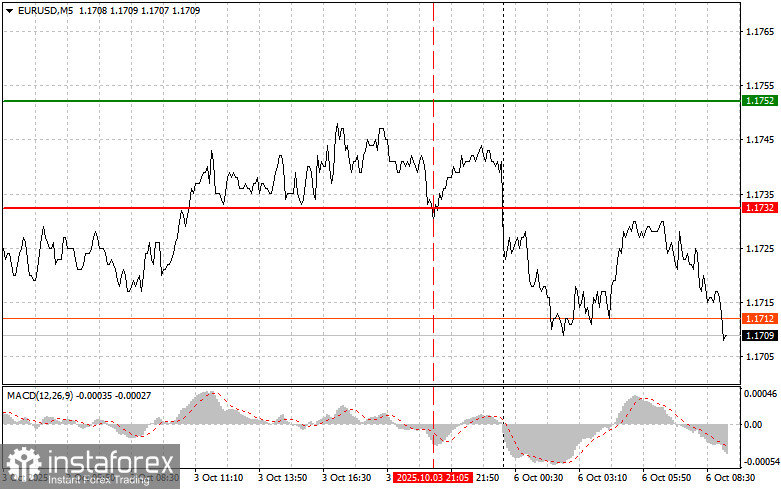

The test of the 1.1732 level occurred at a time when the MACD indicator had moved significantly below the zero line, which limited the downside potential of the pair. For this reason, I did not sell the euro.

The release of ISM data showing a decline in U.S. services sector activity to the borderline level of 50 raised concerns among market participants but did not trigger a large-scale drop in the dollar. Most likely, the market was already prepared for such a development. The ISM index nearing such a critical level reflects the general trend of slowing economic growth in the U.S., so an interest rate cut in October now appears to be the most likely scenario from the Federal Reserve.

Today will be packed with key events that could have a significant impact on the euro. The spotlight will be on the release of the Eurozone Sentix Investor Confidence Index, retail sales data, and a speech by European Central Bank President Christine Lagarde. The Sentix index offers insight into the current state and future outlook of the Eurozone economy from the perspective of investors. A reading above zero reflects optimism, while a reading below zero indicates a pessimistic sentiment.

Retail sales data help assess the strength of consumer spending, one of the main drivers of economic growth. A decline in retail sales may signal a slowdown in economic expansion and potentially lead to a revision of the ECB's monetary policy stance. However, keep in mind these figures come with a two-month delay, so they are unlikely to have a substantial effect on traders' plans.

The main event of the day will be Lagarde's speech. Her comments will shape market expectations for the ECB's future actions. Traders will be paying close attention to clues about possible interest rate changes. However, based on her recent interviews, significant new policy revelations are unlikely in the near term.

Today, I plan to rely mainly on the execution of Scenarios 1 and 2.

Buy Scenarios

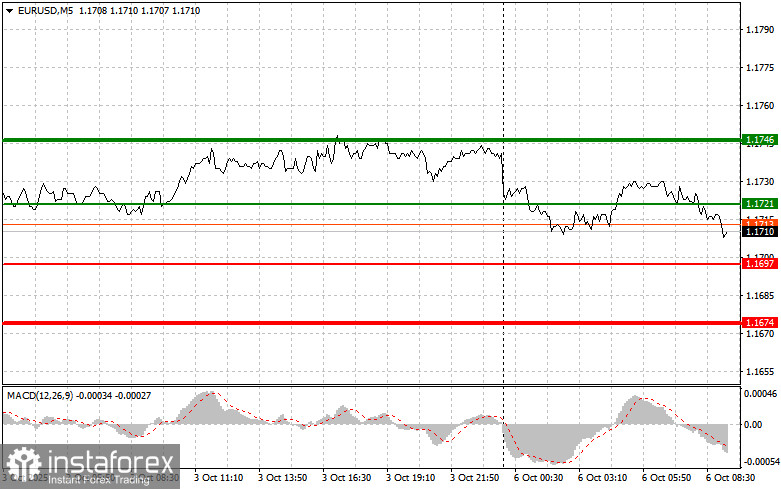

Scenario 1: Buying the euro is possible if the price reaches the 1.1721 level (indicated by the green line on the chart), with the goal of a rise toward 1.1746. Around 1.1746, I plan to exit the trade and also consider selling the euro in the opposite direction, anticipating a 30- to 35-pip retracement. Buying should only be considered after the release of strong economic data.

Important: Before entering a buy trade, ensure that the MACD indicator is above the zero level and starting to rise.

Scenario 2: Another buying opportunity may arise if the price tests the 1.1697 level twice while MACD is in oversold territory. This will limit the pair's downward momentum and may signal an upside reversal. A rise toward the opposite levels of 1.1721 and 1.1746 can be expected.

Sell Scenarios

Scenario 1: I plan to sell the euro after the price reaches the 1.1697 level (red line on the chart). The target will be 1.1674, where I'll exit the position and open a long trade in the opposite direction with a potential move of 20 to 25 pips. A return of bearish pressure can be expected with weak data.

Important: Before entering a sell trade, ensure that the MACD is below the zero line and is starting to decline.

Scenario 2: I will also consider selling the euro if two consecutive tests of the 1.1721 level occur while MACD is in overbought territory. This will limit the pair's upside potential and likely lead to a reversal to the downside. A decline to the opposite levels of 1.1697 and 1.1674 can be expected.

What's on the Chart:

- Thin green line – entry price where the instrument can be bought

- Thick green line – target price where Take Profit can be placed or profits secured, since further growth is unlikely above this level

- Thin red line – entry price where the instrument can be sold

- Thick red line – target price where Take Profit can be placed or profits secured, since further decline is unlikely below this level

- MACD Indicator – use overbought and oversold zones when entering the market

Important for Beginner Traders

Beginner Forex traders should exercise extreme caution when entering the market. It is best to stay out of trades just before the release of major economic reports to avoid sudden volatility. If you do decide to trade during economic news releases, always use stop-loss orders to limit potential losses. Failing to use stop losses can result in a complete loss of the trading account, especially if money management is not applied and trades are made in large volumes.

Remember that successful trading requires a clear and well-defined plan—just like the one outlined above. Making impulsive decisions based on the current market behavior is a losing strategy for any intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română