Trade Analysis and Tips for Trading the British Pound

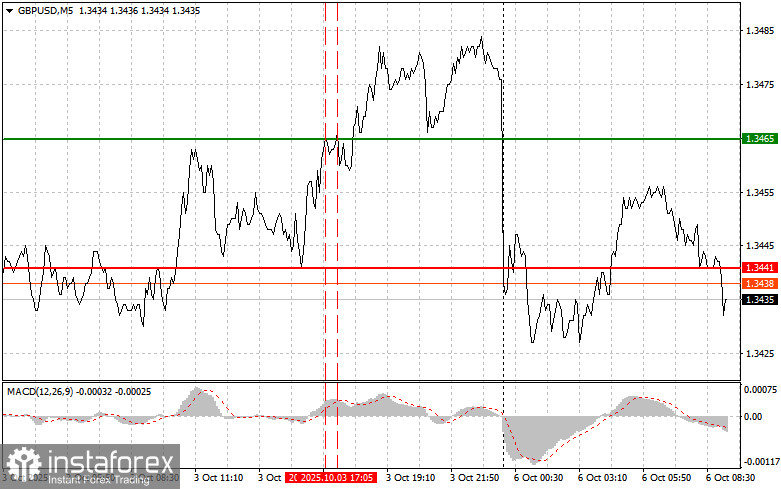

The test of the 1.3465 price level occurred when the MACD indicator had risen significantly above the zero line, which limited the pair's upside potential. A second test of 1.3465, while the MACD was in overbought territory, provided an entry point for a sell trade according to Scenario 2; however, no major decline in the pair occurred afterward.

The British pound responded with solid growth to the news that the U.S. ISM Services PMI had returned to the 50-point area. This morning, expectations for the UK Construction PMI are not optimistic, which may limit the upside potential of the pair. Additionally, a public speech by Bank of England Governor Andrew Bailey is scheduled. These factors could apply moderate downward pressure on the pound amid remaining uncertainty surrounding the UK's economic outlook.

Weak construction PMI data would highlight challenges in the industry related to supply shortages, rising costs, and sluggish demand. This could deepen fears of a looming recession and prompt the Bank of England to adopt a more dovish monetary policy stance. Bailey's speech will be closely monitored for hints on upcoming central bank decisions. A cautious tone and emphasis on economic risks could revise expectations regarding rate cuts and, in turn, weigh on the pound.

Today, I will focus on executing Scenario 1 and Scenario 2.

Buy Scenarios

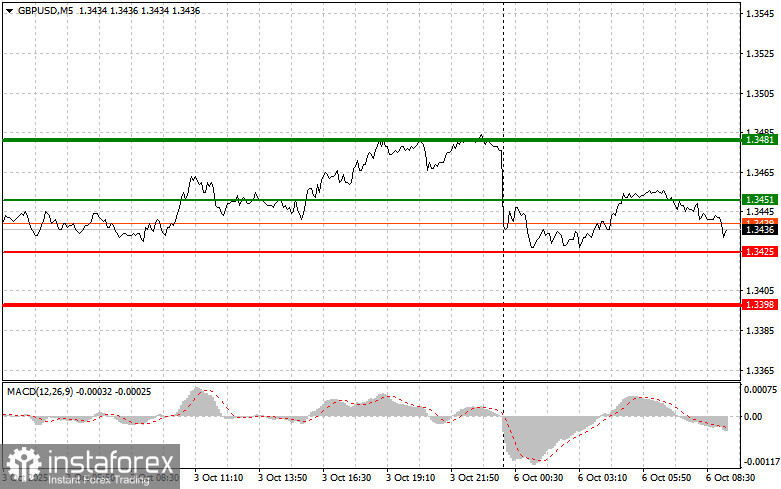

Scenario 1: I plan to buy the pound today upon reaching the entry point at 1.3451 (indicated by the green line on the chart), targeting growth toward 1.3481 (represented by the thicker green line). Around 1.3481, I plan to exit the long position and initiate a short position in the opposite direction, aiming for a 30–35 pip pullback. Buying can only be considered if strong fundamental data is released.

Important: Before entering a long trade, ensure the MACD indicator is above the zero line and starting to rise.

Scenario 2: I also plan to buy the pound today if two consecutive tests of the 1.3425 level occur while the MACD is in an oversold zone. This setup would limit downside potential and result in a reversal to the upside. A rise toward the 1.3451 and 1.3481 levels can be expected.

Sell Scenarios

Scenario 1: I plan to sell the pound today after a confirmed break below the 1.3425 level (red line on the chart), which could trigger a swift decline. My target is 1.3398, where I intend to exit the trade and open a long position in the opposite direction, looking for a 20–25 pip bounce. Pound sellers will look to build on any opportunity.

Important: Before entering a short trade, ensure the MACD indicator is below the zero line and is just starting to decline.

Scenario 2: I also plan to sell the pound today if two consecutive tests of the 1.3451 level occur while MACD is in overbought territory. This setup would limit further upside potential and trigger a reversal to the downside. A decline toward 1.3425 and 1.3398 can be expected.

What's on the Chart:

- Thin green line – entry price where the instrument can be bought

- Thick green line – target price where Take Profit can be placed or profits secured, since further growth is unlikely above this level

- Thin red line – entry price where the instrument can be sold

- Thick red line – target price where Take Profit can be placed or profits secured, since further decline is unlikely below this level

- MACD Indicator – use overbought and oversold zones when entering the market

Important for Beginner Traders

Beginner Forex traders should exercise extreme caution when entering the market. It is best to stay out of trades just before the release of major economic reports to avoid sudden volatility. If you do decide to trade during economic news releases, always use stop-loss orders to limit potential losses. Failing to use stop losses can result in a complete loss of the trading account, especially if money management is not applied and trades are made in large volumes.

Remember that successful trading requires a clear and well-defined plan—just like the one outlined above. Making impulsive decisions based on the current market behavior is a losing strategy for any intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română