Trade Analysis and Tips for Trading the Japanese Yen

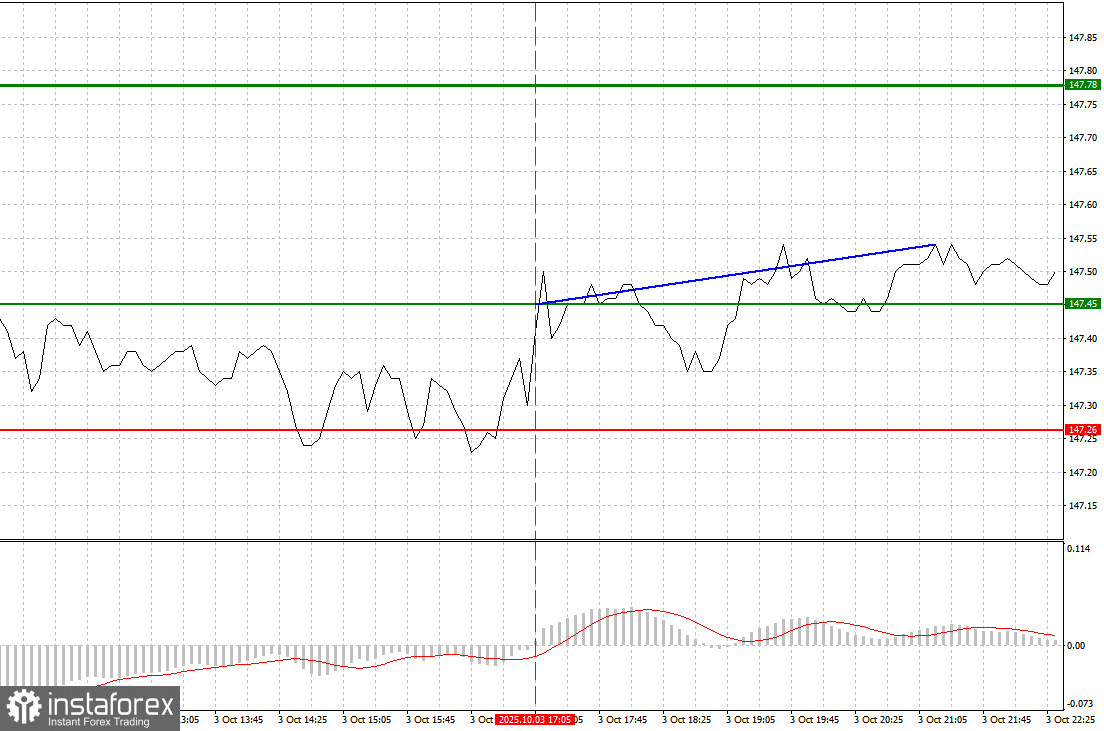

The test of the 147.45 price level occurred just as the MACD indicator began rising from the zero line, confirming a valid entry point for buying the dollar. This resulted in a minor rise of the pair by about 10 pips.

The yen fell by 300 pips against the U.S. dollar on the news that Sanae Takaichi would become the new Prime Minister of Japan. Her plans for economic stimulus and her commitment to accommodative monetary policy triggered a sharp sell-off in the yen on the currency markets. The market appears to view her election as a signal that Abenomics—the policy of aggressive fiscal stimulus and low interest rates—will continue.

Investors are concerned that while such policies may support short-term growth, they could lead to rising inflation and further long-term weakening of the yen. It is clear that in the near term, the yen's performance will largely depend on the new government's concrete actions and the tone of the Bank of Japan. If Takaichi confirms her commitment to large-scale stimulus and the BoJ continues to downplay rising inflation, downward pressure on the yen is expected to persist.

Today, I will primarily rely on executing Scenarios 1 and 2.

Buy Scenarios

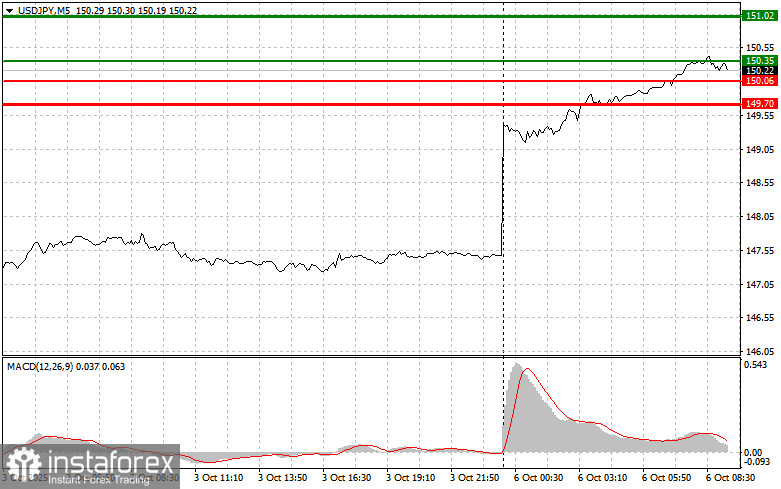

Scenario 1: I plan to buy USD/JPY today at the entry point near 150.35 (indicated by the green line on the chart), targeting a rise toward 151.02 (represented by the thicker green line). Around 151.02, I plan to close long positions and consider selling in the opposite direction, expecting a correction of 30 to 35 pips. The best time to return to buying the pair is after pullbacks or deeper dips in USD/JPY.

Important: Before buying, ensure the MACD indicator is above the zero line and is just beginning to rise.

Scenario 2: I also plan to buy USD/JPY today if the price tests the 150.06 level twice while the MACD indicator is in the oversold zone. This setup will limit the downside potential and lead to an upward market reversal. A rally to the opposite levels of 150.35 and 151.02 can be expected.

Sell Scenarios

Scenario 1: I plan to sell USD/JPY today only after a confirmed break below the 150.06 level (red line on the chart), which may spark a sharp decline. The primary target for sellers will be the 149.70 level, where I plan to exit the trade and immediately consider opening a long position in the opposite direction, targeting a rebound of 20 to 25 pips. It is preferable to sell from higher levels.

Important: Before selling, ensure the MACD indicator is below the zero line and is just beginning to decline.

Scenario 2: I will also consider selling USD/JPY if two consecutive tests of the 150.35 level occur while MACD is in the overbought zone. This would limit the upside potential and trigger a reversal to the downside. A drop toward 150.06 and 149.70 may be expected.

What's on the Chart:

- Thin green line – entry price where the instrument can be bought

- Thick green line – target price where Take Profit can be placed or profits secured, since further growth is unlikely above this level

- Thin red line – entry price where the instrument can be sold

- Thick red line – target price where Take Profit can be placed or profits secured, since further decline is unlikely below this level

- MACD Indicator – use overbought and oversold zones when entering the market

Important for Beginner Traders

Beginner Forex traders should exercise extreme caution when entering the market. It is best to stay out of trades just before the release of major economic reports to avoid sudden volatility. If you do decide to trade during economic news releases, always use stop-loss orders to limit potential losses. Failing to use stop losses can result in a complete loss of the trading account, especially if money management is not applied and trades are made in large volumes.

Remember that successful trading requires a clear and well-defined plan—just like the one outlined above. Making impulsive decisions based on the current market behavior is a losing strategy for any intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română