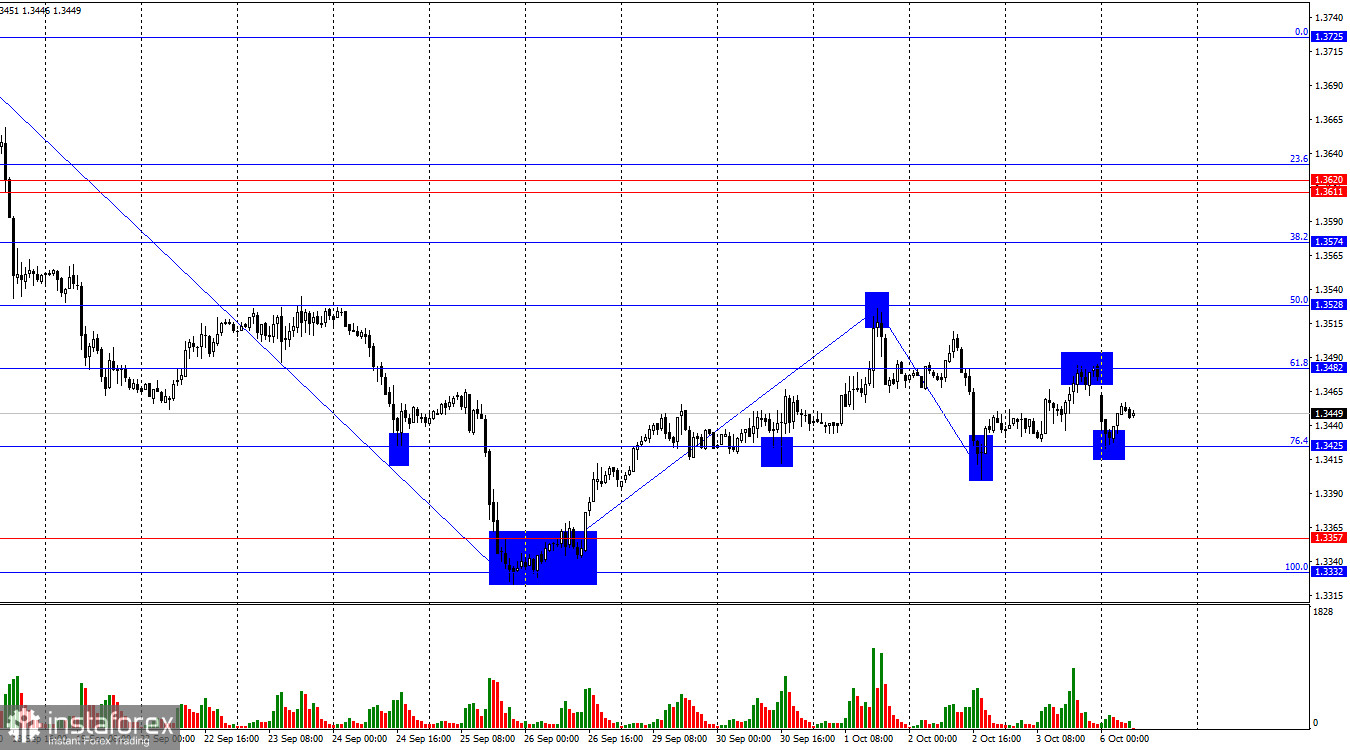

On the hourly chart, the GBP/USD pair on Friday rose to the 61.8% retracement level at 1.3482, bounced off it, turned in favor of the dollar, fell to the 76.4% Fibonacci level at 1.3425, and rebounded from it. Thus, today the growth process may resume toward the 1.3482 level. A consolidation of the pair below 1.3425 would allow us to expect a further decline toward the support level at 1.3332–1.3357, from where the bulls' last ascent began.

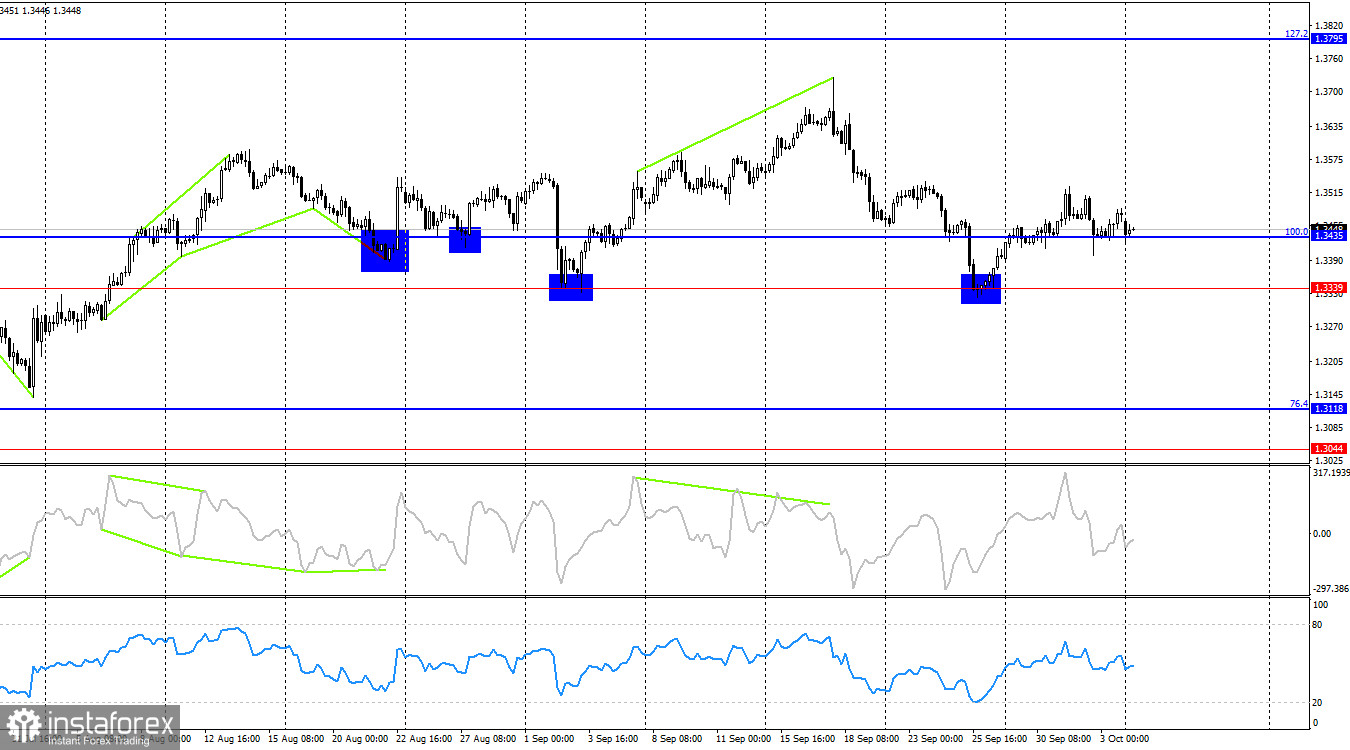

The wave structure remains "bearish." The last completed downward wave did not break the previous low, and the last upward wave did not break the previous high. The news background over the past week was negative for the U.S. dollar, but the bulls have not yet taken advantage of the opportunities to launch an offensive. To cancel the "bearish" trend, the pair needs to rise above 1.3528.

On Friday, there was a fair amount of economic data, but almost all reports were insignificant—except ISM. In Germany and the Eurozone, the final estimates of the September services and manufacturing PMIs were released, which drew no interest from traders. Quite another matter was the ISM Services PMI, which was published only once. Business activity in the services sector fell by a full 2 points and barely managed to stay above 50.0. Traders had expected a slowdown of just 0.3 points. Thus, on Friday the dollar was walking a fine line, at risk of collapsing at any moment. Recall that not only were PMIs disappointed last week. The ADP report was also discouraging, failing even to show a positive figure (above 0). I won't even mention the government shutdown—traders understand this is yet another risk factor for the dollar. Thus, I fully support the process of the pound rising and the dollar falling. However, bulls are still in no hurry to attack.

On the 4-hour chart, the pair rebounded from the 1.3339 level and turned in favor of the pound sterling. A consolidation above the 100.0% Fibonacci level at 1.3435 increases the likelihood of continued growth toward the 127.2% retracement level at 1.3795. No emerging divergences are seen in any indicator today. A new decline in the pound can be expected only after consolidation below 1.3339.

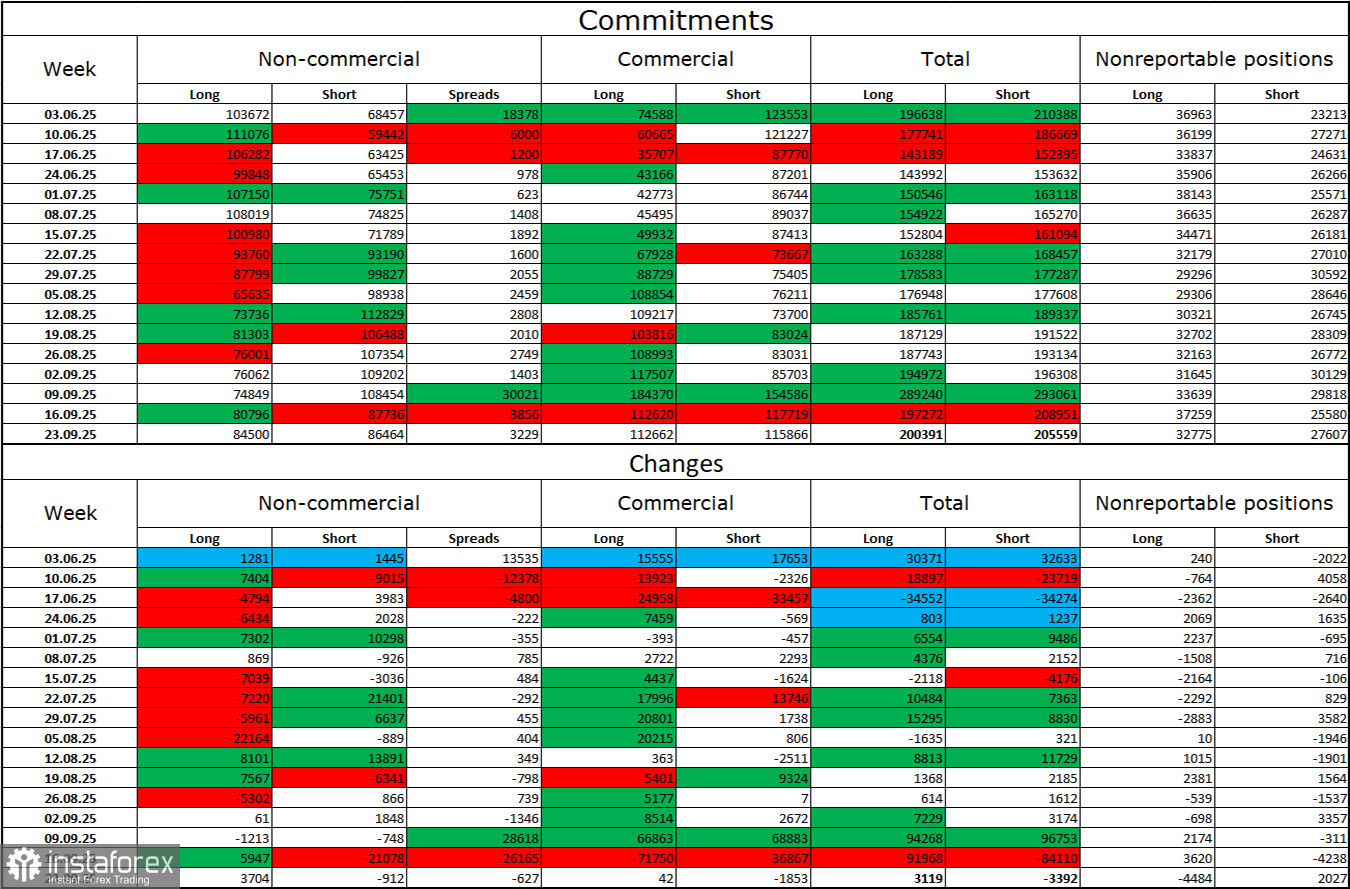

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category became more "bullish" over the last reporting week. The number of long positions held by speculators increased by 3,704, while the number of short positions decreased by 912. The current gap between long and short positions is roughly 85,000 vs. 86,000. Bullish traders are once again tilting the scales in their favor.

In my view, the pound still retains downward potential, but with each passing month the U.S. dollar looks weaker and weaker. Whereas earlier traders worried about Donald Trump's protectionist policies without fully understanding their consequences, now they may be worrying about the aftereffects: a possible recession, the constant introduction of new tariffs, Trump's battles with the Fed, which could ultimately make the regulator "politically controlled" by the White House. Thus, the pound already looks far less dangerous than the U.S. currency.

News Calendar for the U.S. and the U.K.:

- U.K. – Speech by Bank of England Governor Andrew Bailey (17:30 UTC).

The October 6 economic calendar contains only one entry, but it is quite important. The influence of the news background on market sentiment on Monday may be moderate in strength—if Bailey says anything significant regarding monetary policy.

GBP/USD Forecast and Trader Advice:

Sales of the pair were possible after a bounce from the 1.3482 level with targets at 1.3425 and 1.3357 on the hourly chart. The first target has already been met. New sales are possible if the pair closes below 1.3425, targeting 1.3332–1.3357. Purchases could be considered after a rebound from 1.3425 with targets at 1.3482 and 1.3528. These long positions can currently remain open.

The Fibonacci grids are built between 1.3332–1.3725 on the hourly chart and between 1.3431–1.2104 on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română