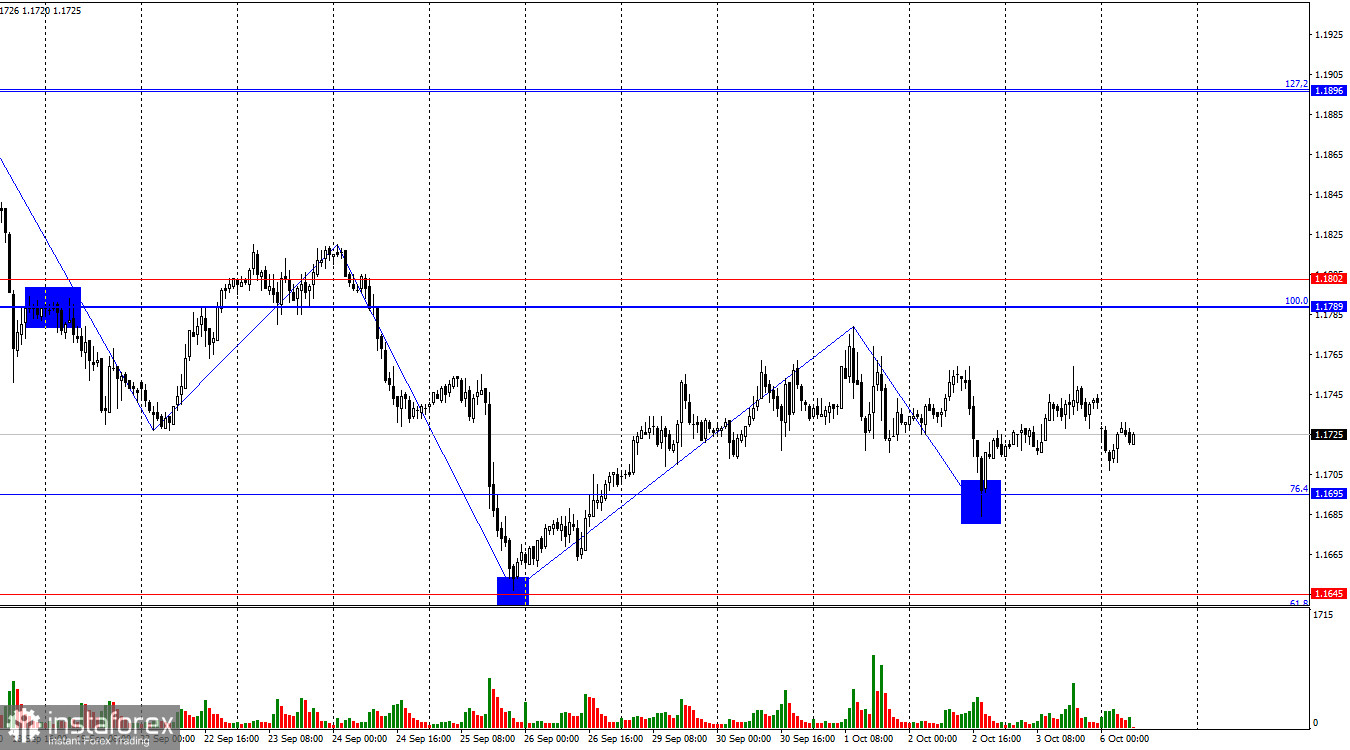

On Friday, the EUR/USD pair continued to rise after bouncing from the 76.4% retracement level at 1.1695. Thus, on Monday this process may continue toward the resistance zone of 1.1789–1.1802. A consolidation of quotes below 1.1695 would favor the U.S. dollar and a further decline toward the support level of 1.1637–1.1645.

The wave situation on the hourly chart remains simple and clear. The last completed downward wave broke the previous wave's low, while the last upward wave did not break the previous peak. Thus, the trend currently remains "bearish." The latest labor market data and the changed outlook for the Fed's monetary policy support bullish traders, so I expect a shift of the trend to "bullish." For the "bearish" trend to end, the price needs to consolidate above the last peak – 1.1779.

On Friday, there were few notable events, but the main one remains the American "shutdown." The U.S. Senate, where the budget bill for the next fiscal year is stuck, has already gathered several times for new votes, but the result is the same – Republicans lack the necessary 60 votes to pass the budget and restart the government and all federal agencies. Traders have chosen the least obvious tactic in reacting to this event. They are ignoring the flow of disappointing U.S. statistics and have decided to pause until the "shutdown" ends. When and how it will end – no one knows. Thus, traders have likely decided not to make any important decisions until the situation clears up. The budget impasse lies not in the stance of Democrats or Republicans, but in the intransigence of both parties. Donald Trump has publicly stated that he will not yield to Democrats' demands to restore social and healthcare programs. How he intends to win over at least seven Democratic senators remains unclear.

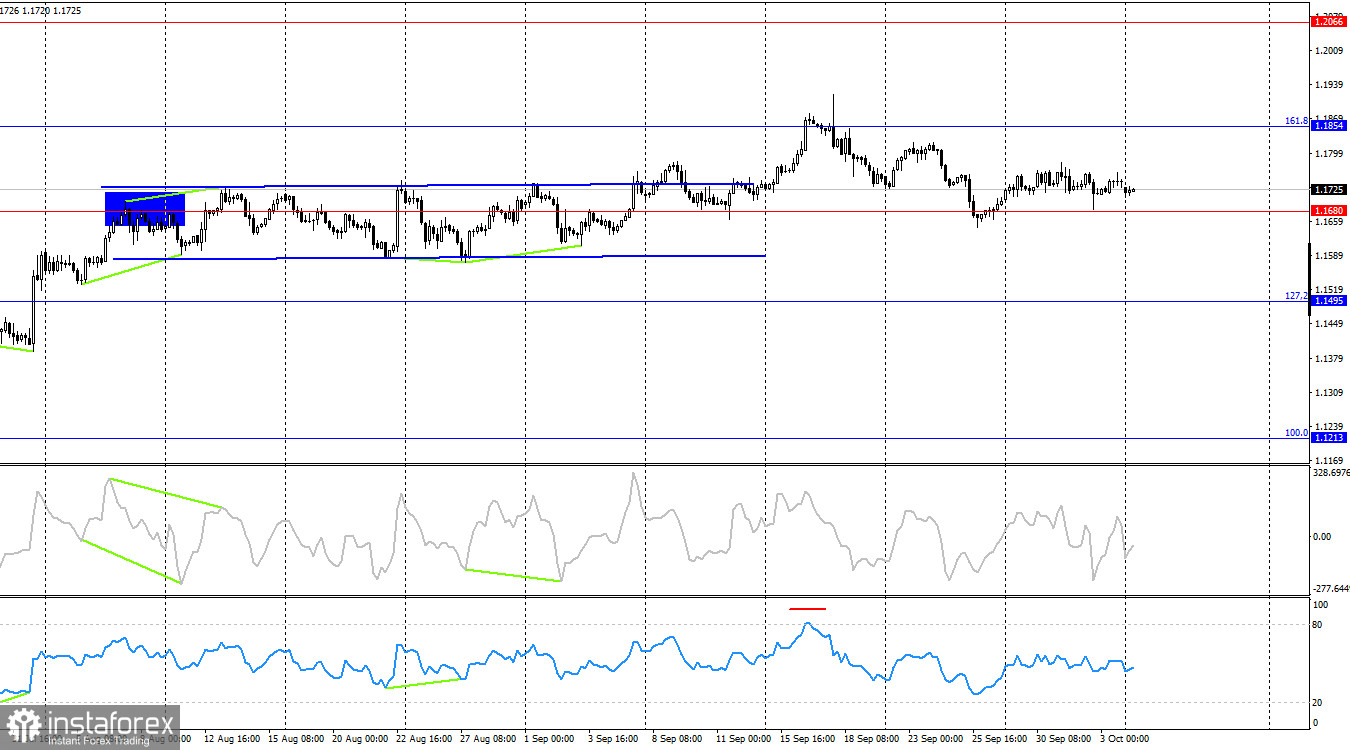

On the 4-hour chart, the pair turned in favor of the euro around the 1.1680 level, but in recent months movements have become more sideways. Growth may resume toward the 161.8% retracement level at 1.1854. A consolidation below 1.1680 would favor the U.S. dollar and open the way for a further decline toward the 127.2% Fibonacci level at 1.1495. No emerging divergences are observed today.

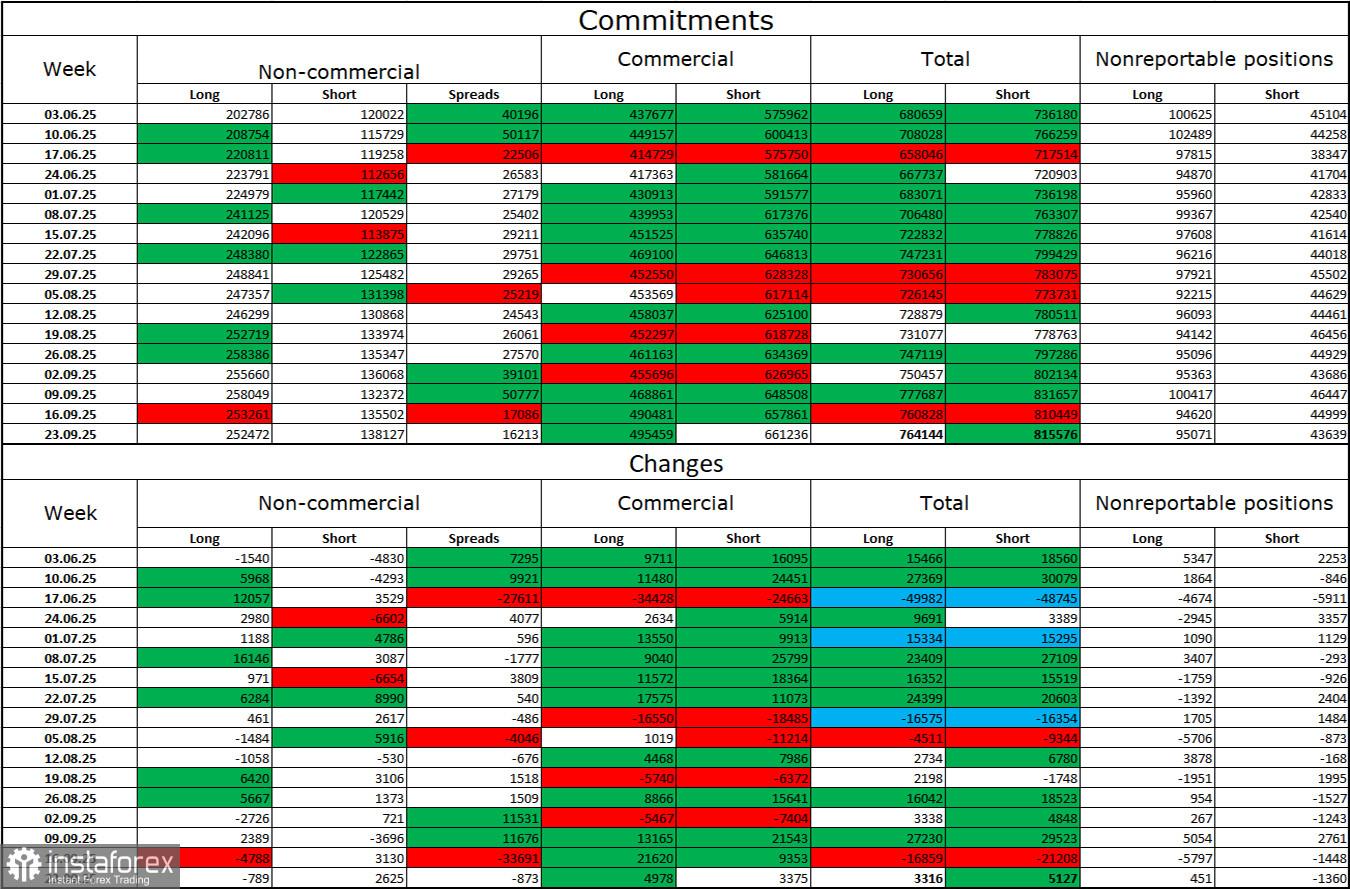

Commitments of Traders (COT) Report:

During the last reporting week, professional players closed 789 long positions and opened 2,625 short positions. The sentiment of the "Non-commercial" group remains "bullish" thanks to Donald Trump – and is strengthening over time. The total number of long positions held by speculators is now 252,000, compared with 138,000 short positions. The gap is essentially twofold. Also note the number of green cells in the table above – they reflect strong increases in euro positions. In most cases, interest in the euro is only growing, while interest in the dollar is declining.

For thirty-three consecutive weeks, large players have been shedding short positions and building longs. Donald Trump's policies remain the most significant factor for traders, as they could create many problems of a long-term and structural nature for America. Despite the signing of several important trade agreements, many key economic indicators continue to decline.

News Calendar for the U.S. and Eurozone:

- Eurozone – Retail sales change (09:00 UTC).

The October 6 economic calendar contains only one entry, which is not important. The influence of the news background on market sentiment on Monday will be very weak.

EUR/USD Forecast and Trader Advice:

Sales will be possible on a rebound from the 1.1789–1.1802 zone with a target at 1.1695. Purchases were possible on a rebound from the 1.1637–1.1645 zone, as well as on a rebound from 1.1695 with a target at 1.1789–1.1802. New purchases can be considered if similar signals form.

The Fibonacci grids are built between 1.1789–1.1392 on the hourly chart and between 1.1214–1.0179 on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română