Global markets are buzzing: gold is storming all-time highs, Bitcoin is once again proving it can rival the dollar, BlackRock is doubling down on AI infrastructure, and Tesla has released a mysterious announcement that could upend the electric vehicle market. In this review, we cover everything driving markets today: from the luster of gold and digital optimism to billion-dollar deals and Elon Musk's ambitions, along with practical ideas for those seeking to turn volatility into profit.

Gold storms records: factors behind historic rally and ways to capitalize

Against the backdrop of the prolonged US government shutdown, gold has once again claimed center stage in financial markets, moving confidently toward the $4,000 per ounce mark. Problems in Washington have not only deprived traders of official labor market data but have also added further uncertainty to the economic outlook, practically forcing investors to seek safety in safe-haven assets. In this article, we break down why gold is rising so rapidly, how the biggest players are reacting, and what traders should do in this exceptionally hot market.

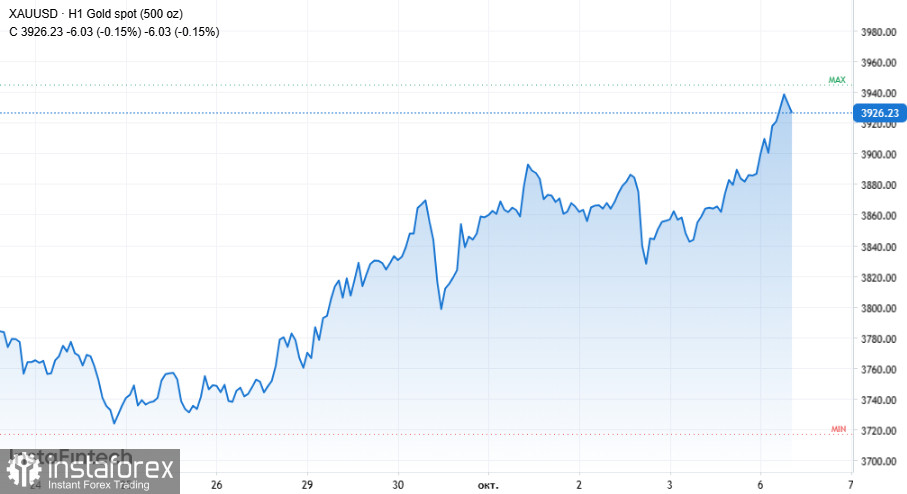

The week opened triumphantly for precious metal enthusiasts: on Monday morning, gold quotes jumped by 1.2% and reached $3,932.02 per ounce, hitting an all-time record and, apparently, only an interim milestone on the way to the coveted $4,000.The logic is simple: the more political and economic twists the Trump administration introduces, the sounder the sleep of precious metal holders.

In the past year, the gold bull has gathered tremendous pace, achieving nearly a 50% increase in value, driven by downbeat US labor market news, dollar weakness, and central banks' persistent desire to diversify away from the "once-glamorous" greenback.

And if you thought demand was being driven solely by the fears of major players, think again: retail investors are also fueling gold's rise. Gold-linked funds recorded their strongest monthly asset growth in the past three years just last month.

It seems that the habit of "buying the dip" is turning into a near-mass psychosis, with even skeptics leaning toward the idea that gold is not just a metal, but a gold storm at the center of restless markets. Analyst Priyanka Sachdeva aptly noted that the current rally is evidence of a deeply ingrained investor mantra of buying gold on any correction.

It is worth noting that silver, platinum, and palladium are also climbing, indicating a broad flight to safety among investors.

Leading analysts are unanimous: any slight cooling of the rally or even a short-term correction is likely to be seen as an opportunity for a fresh entry. Ahmad Assiri points out that a new Fed rate cut looms on the horizon, bringing with it yet another chance for gold to shine at the highs.

The main takeaway: the gold market is not just experiencing another growth wave, but a wholesale capital shift amid a weak dollar, shaky macro stats, and the US government shutdown.

The expectation of further Fed rate cuts only reinforces this scenario, making the "buy the dip" strategy a mantra for traders in the months ahead. Congratulations to those who caught the train, and for those still considering, it may be worth gradually increasing positions on corrections, as this cycle appears far from over. Tensions in the markets and a wavering US economy are becoming the very fuel upon which gold is soaring to new historic heights.

Bitcoin at new peak: digital gold back in vogue

Bitcoin has once again proven it is too early to write off. Over the weekend, the largest cryptocurrency set a new record, rising to $125,689 per token, the first time since mid-August. By Monday morning in Singapore, quotes remained near the $124,000 mark. The reason is not crypto-mania, but rather very tangible issues: another US government shutdown. While officials wrangle over the budget, investors are fleeing en masse to safe havens, including BTC. Why is digital gold climbing, what resistance levels lie ahead, and how can traders ride this wave? More in the article.

The US shutdown has not only halted the publication of labor market reports but also created a perfect storm in financial markets. The absence of official economic data, falling government bond yields, and a weak dollar have spurred demand for assets believed to hedge against money "debasement." The so-called "debasement trade"—a flight from currency into real and digital assets—now appears not just logical, but a necessary survival strategy.

Against this backdrop, gold confidently surpassed $3,900 per ounce, but the weekend's main star is undoubtedly bitcoin. The cryptocurrency is up more than 30% year-to-date, leaving behind its previous high of $124,514 set on August 14. And, oddly enough, it's not just the shutdown that's fueling this, but also the overall revival in the US stock market, where equities are setting records amid a wave of artificial intelligence deals.

Investor optimism is further stoked by flows into bitcoin ETFs, which are once again gaining momentum. There's a sense of confidence in the market: if the current momentum holds, resistance is seen at $135,000, while the $150,000 target "is already visible," as analyst Rachel Lucas points out. However, she cautions that leverage is building in the market, and any sharp correction could trigger a wave of liquidations.

The situation takes on special flavor in October, a month long dubbed "Uptober" in the crypto community. History speaks for itself: over the past decade, Bitcoin has ended October higher nine times out of ten, and this month looks set to continue the trend. As market strategist Joshua Lim noted, with everything from stocks to Pokemon cards hitting new all-time highs, it's no surprise that BTC is once again at the forefront of the anti-dollar narrative.

Political rhetoric is also providing support. The Trump administration's pro-crypto stance has created a friendly climate for digital assets, while companies like Michael Saylor's MicroStrategy continue to bulk up their Bitcoin holdings, setting a trend for corporate accumulation. As a result, not only is BTC rising, but correlated assets like Ether—now trading at $4,522—are gaining as well.

As Geoff Kendrick of Standard Chartered emphasizes, "this shutdown really matters": unlike during the 2018–2019 period, Bitcoin is now moving much more in sync with global trends, rallying specifically when the dollar and treasuries are falling.

So, the market is viewing BTC not just as a speculative tool but as a real alternative to government currencies, especially when the US government fails to function. Against the backdrop of a weaker dollar and lower rates, Bitcoin is once again becoming the primary barometer of eroding trust in the traditional financial system.

What does this mean for traders? First, the market remains in a strong momentum phase, and any move toward $135,000 can be used as a take-profit point or for partial unloading. Second, corrections into the $118,000–$120,000 range will be attractive for entering long positions.

To capitalize on today's market opportunities and trade Bitcoin in real time, open an account with InstaForex and download our mobile app!

BlackRock targets AI infrastructure: $40 billion for future of data centers

While the world speculates about where the next wave of AI growth will take place, BlackRock seems to already have the answer—in data centers. The investment giant is preparing for a deal that could reshape the market: its Global Infrastructure Partners division is in talks to acquire Aligned Data Centers for $40 billion. For reference: just nine months ago, this company attracted a "modest" $12 billion to accelerate the build-out of data centers to support AI needs. In this article, we discuss why BlackRock is betting on AI infrastructure, what makes Aligned unique, and how this deal could change the balance of power in the technology space.

When the world's largest asset manager shows interest in a little-known data center operator, it's worth considering: is this coincidence or strategy? Judging by the scale of the deal, it's clearly the latter.

According to Bloomberg, BlackRock Inc., through its Global Infrastructure Partners unit, is in the final stages of talks to acquire Aligned Data Centers. This is a company that has gone from a niche player to a key element of artificial intelligence infrastructure in just a few years. A $40 billion valuation makes this potentially the largest deal in the sector's history.

The logic behind such interest is both simple and brilliant: the world is undergoing an infrastructure renaissance. While investments previously flowed into algorithms and models, today's money is moving to where those models "live"—data centers, power grids, and data storage.

According to a Goldman Sachs report, companies working in the AI segment have issued $141 billion in corporate bonds this year alone, surpassing last year's $127 billion. This meansthat the investment cycle is shifting from software to hardware, and BlackRock intends to take the helm of this transformation.

Founded in 2013, Aligned Data Centers began building sustainable, energy-efficient data centers long before neural networks became mainstream. The company now operates 78 facilities in North and South America, with partners including Macquarie Asset Management. In January, Aligned raised $12 billion in debt and equity for a significant capacity expansion, building a total of 5 gigawatts of infrastructure, enough to power half of New York City at the height of summer.

Now BlackRock is willing to pay more than three times this amount for a company whose majority of assets have yet to come online. Analyst Ari Klein explains this paradox simply: "Investors are not paying for the current state of the company, but for what it can build tomorrow."

In practice, Aligned already operates over 600 megawatts of capacity, with another 700 megawatts under construction. This makes it a notable player, but far from a leader. By comparison, CoreWeave Inc., a partner of OpenAI and Nvidia Corp., has 470 megawatts of active capacity but is valued at $65 billion and generates $1.91 billion annually. Aligned does not have these figures yet, but calculations show that with an average rate of $210 per kilowatt per month, its potential annual revenue could reach $3.4 billion if all projects are completed.

BlackRock sees this not just as an investment but as a foundation for the coming era of digital infrastructure. While technology companies promise to invest "hundreds of billions, if not trillions" into physical AI capacity, it's firms like Aligned that are becoming the new oil of the 21st century. And BlackRock, by all appearances, intends to own the field.

For traders, the implication is clear: the infrastructure sector is not just a supporting segment but a new arena for capital growth. The surge in AI technology interest will inevitably trigger explosive demand for capacity, meaning that the stocks of companies building and servicing data centers will attract heightened market attention.

From a strategic perspective, it makes sense to consider long-term positions in infrastructure and energy companies participating in AI projects, as well as to monitor BlackRock-linked assets that stand to benefit from the market's consolidation. For those looking to act now, it is worth remembering that when the giants make their moves, the market opens doors for those ready to follow.

Tesla prepares surprise: affordable model or another marketing firework?

It appears that Elon Musk is once again planning to outsmart the market. Tesla has announced a mysterious event for October 7, hinting at the launch of a new, more affordable electric vehicle. With a brief 9-second video, the company has effectively sparked another wave of speculation. Investors are already guessing: will we finally see the long-awaited "people's Tesla," or is this just another marketing ploy to stoke interest in the brand? In this article, we will examine what to expect from the upcoming presentation, why Tesla is betting on making the Model Y more affordable, and what opportunities this opens up for traders.

The announcement came at a symbolic moment—just days after the $7,500 EV tax credit expired in the United States. This bonus had long been one of the main drivers of sustained EV demand, and its disappearance could noticeably cool the market. Tesla is now forced to act quickly; customer interest will have to be maintained through pricing and technological edge rather than tax incentives.

Previously, the company stated it was working on a more cost-effective version of the Model Y, which should be around 20% cheaper to produce than the current updated model. The first prototypes were assembled this summer, though mass production will begin only in the fourth quarter of this year. Sources indicate that Tesla plans to ramp up production to 250,000 vehicles annually by 2026—a bold goal, but entirely in line with Elon Musk's style.

Interestingly, the teaser was released immediately after Tesla's quarterly report, which showed record deliveries for the third quarter. Demand was largely boosted by the very tax credit that ended on September 30. Now, with government support gone, Tesla is trying to prove that its business model can be sustainable without subsidies. If the company indeed unveils an affordable model, this could be a game-changer not only for Tesla but for the entire EV market.

Musk's marketing strategy, as always, is simple yet ingenious: minimal information, maximum hype. A video, a couple of hints on X (formerly Twitter)—and the market is already abuzz with speculation. Some analysts are convinced that Tesla will unveil the budget version of the Model Y on October 7, while others are expecting a fundamentally new vehicle that will solidify the brand's leadership in the mass segment.

Yet, risks should not be overlooked. Lowering production costs could reduce margins, and a slow production ramp-up might cause a temporary dip in sales. Moreover, competitors such as BYD, Hyundai, and Volkswagen are actively targeting the mid-price segment, meaning that Tesla will have to fight not only for investor attention but for consumer wallets as well.

Nonetheless, the company's potential is enormous. If Tesla confirms its readiness to launch a truly affordable EV, it could trigger a new wave of growth in the stock. This scenario is likely: the buzz around the launch could drive shares higher, especially if Musk convinces the market that "affordability" won't come at the expense of quality and innovation.

For traders, the coming days promise to be especially interesting. In the short term, it is worth closely monitoring Tesla shares near key resistance levels. A surge in volatility is possible in the run-up to the event and a subsequent correction afterward. In this case, a prudent strategy would be to take profits on the rally up to October 7 and look for new entry points on potential pullbacks.

In the long run, Tesla retains its strong appeal. The company continues to dominate the technological and energy transformation of the global auto industry. And if October 7 truly brings the world a "people's Tesla," investors who entered the market in advance will be able to confidently say they backed the right player.

Now is the right time to act. While the market holds its breath ahead of the October presentation, traders should prepare for a possible breakout. Open a trading account with InstaForex to seize the opportunity presented by moves in Tesla shares, and download the company's mobile app to react instantly to the news—wherever you are.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română