What is Bitcoin — a risky asset or a safe haven? While investors are still debating the right answer, BTC/USD has reached a new all-time high, benefitting from a "double win" amid the ongoing US government shutdown. As the S&P 500 hits its 31st record high of the year and gold soars past $3,900 per ounce, the environment is becoming increasingly favorable for tokens.

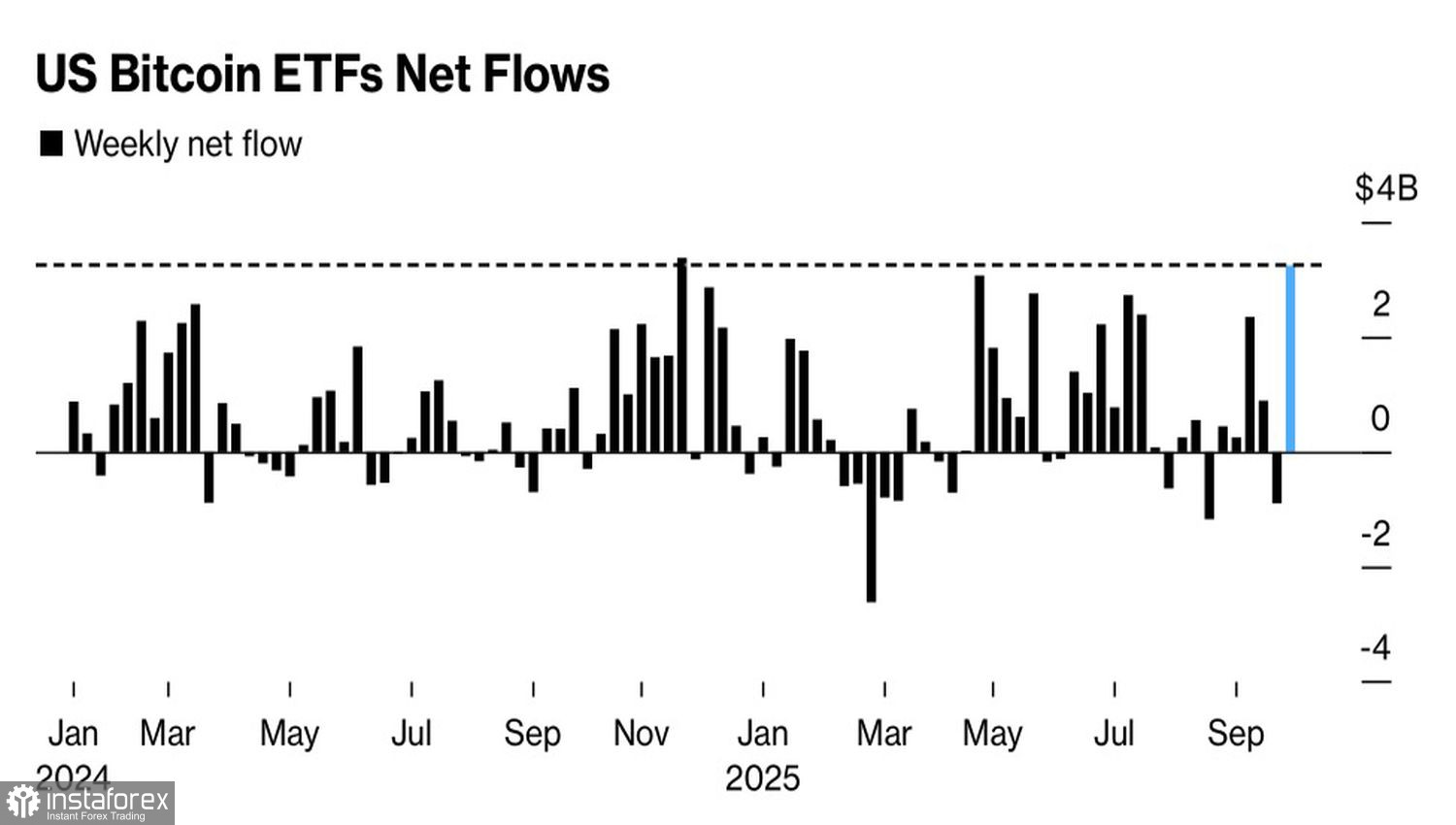

Back in late September, Bitcoin was losing ground due to troubles with crypto treasuries and declining trading activity. But nature abhors a vacuum. By the week ending October 3, investors had poured $3.2 billion into a group of 12 crypto-focused ETFs — the second-largest weekly inflow in history. Open interest in the BlackRock Shares Bitcoin Trust ETF hit a record $49.8 billion.

Capital flows into Bitcoin ETFs

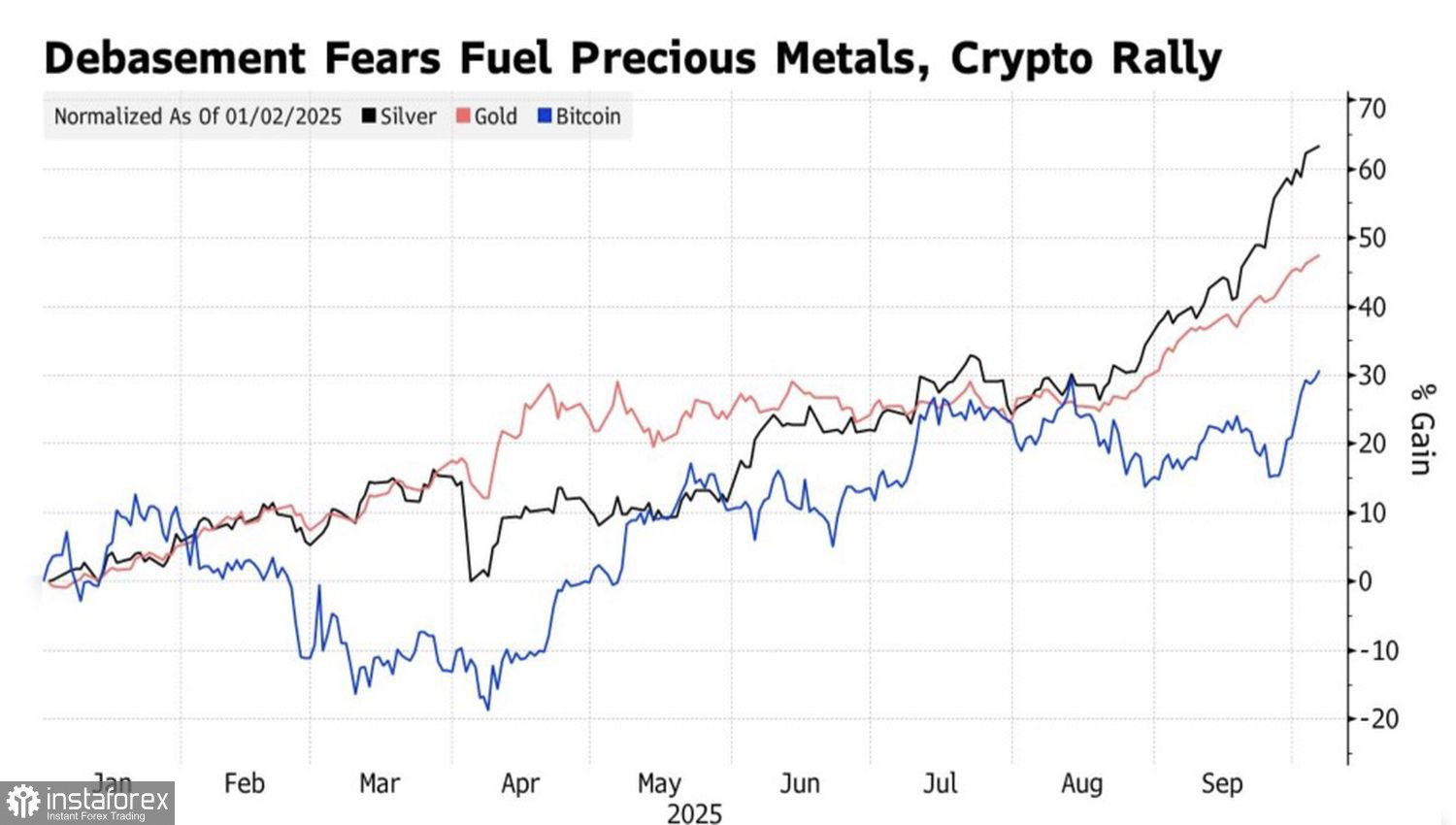

Many investors now view Bitcoin as "digital gold." And the strong performance of precious metals is lighting the way for BTC/USD bulls. Since the beginning of the year, gold has gained 50%, silver 65%, and platinum 80%. While cryptocurrencies had been lagging behind, they are now starting to catch up.

The appeal of this asset class lies in growing fears that the massive debt issuance by the US, Japan, and Europe will undermine financial stability and drag down the global economy. Meanwhile, the US shutdown is expected to slow GDP growth not just in America, but worldwide.

Performance of gold, silver, and Bitcoin

In late September and early October, investors began to question whether Bitcoin still belongs in the "risky asset" category. Its correlation with US stock indices declined amid weaker demand from crypto treasuries. Indeed, as companies like Strategy and others underperform BTC/USD, raising capital through new stock issuances to buy crypto becomes increasingly difficult. As a result, token purchases fell.

However, thanks to the shutdown, previous correlations between Bitcoin and the S&P 500 are re-emerging. Correlation is on the rise, and investors are once again choosing how to use Bitcoin in their portfolios — either as a risk asset or a safe haven. In either case, BTC/USD is gaining ground.

Thus, October has created the perfect environment for Bitcoin to resume its upward trend. It's no surprise that the second month of autumn is traditionally strong for crypto. In 9 out of the past 10 Octobers, BTC/USD has posted gains. This trend even gave rise to the term "Uptober" in financial circles.

From a technical viewpoint, the daily Bitcoin chart shows a renewed bullish trend. Long positions formed after breaking through the 113,400 and 114,700 levels should be maintained and added to on pullbacks. The initial upside targets for BTC/USD longs are set at 130,000 and 136,000.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română