The outlook for Eurozone economic growth remains broadly optimistic, supported by rising real disposable incomes, low inflation, and high wages. These factors are expected to form a foundation for sustained consumer demand. Although PMI data has been mixed — with manufacturing slowing and services accelerating — consumer demand remains solid, and GDP growth, while modest, is stable.

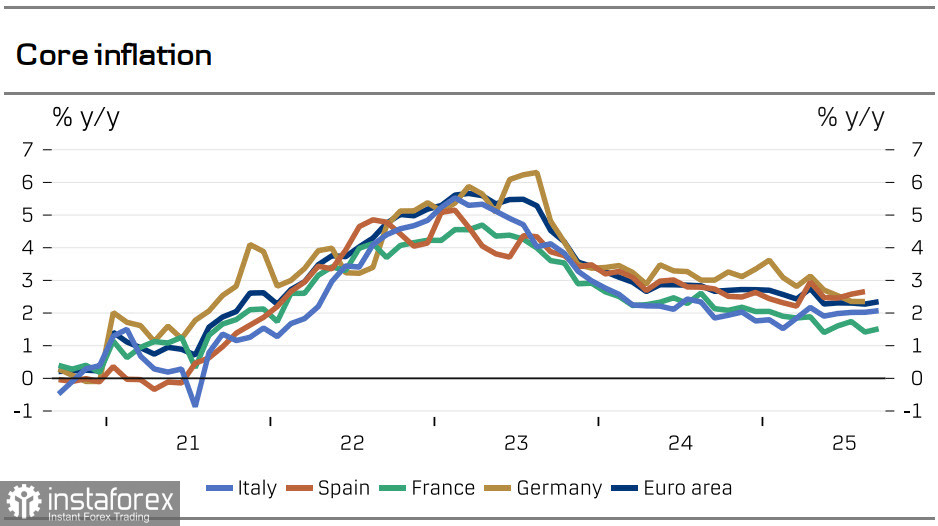

Inflation rose in September from 2.0% year-over-year to 2.2%. This increase was anticipated due to rising energy prices, while core inflation remained steady at 2.3%. At this stage, there are no reasons to expect a resurgence in inflation, which means the ECB is likely to stick to its policy outlook without the risk of needing to reassess.

The ECB's policy forecast remains unchanged. In September, the ECB kept its interest rate unchanged at 2%. Staff projections were optimistic; notably, the inflation outlook for 2027 was revised down. ECB President Christine Lagarde struck a somewhat hawkish tone, linking lower inflation to a stronger euro. Still, the market remains convinced that further rate cuts are unlikely unless there is a sharp deterioration in economic conditions. The risk of inflation falling below target is minimal.

On October 1, a notable event occurred: 28 of Europe's largest companies pledged to increase their investment in the region by 50% by 2030. While this commitment remains uncertain — especially as the trade agreement between the United States and Europe is designed to keep capital flowing into the U.S. — it nonetheless contributes to positive expectations for the European economy.

Currently, markets assume that the U.S. dollar will remain weak. However, the narrative around Federal Reserve rate cuts cannot be sustained indefinitely. A single monthly inflation report showing an uptick could quickly change market sentiment. October marks the first month expected to reflect the impact of the new U.S. tariff policy. The chances of inflation not rising are minimal, and the market will inevitably recalibrate its expectations for Fed policy accordingly.

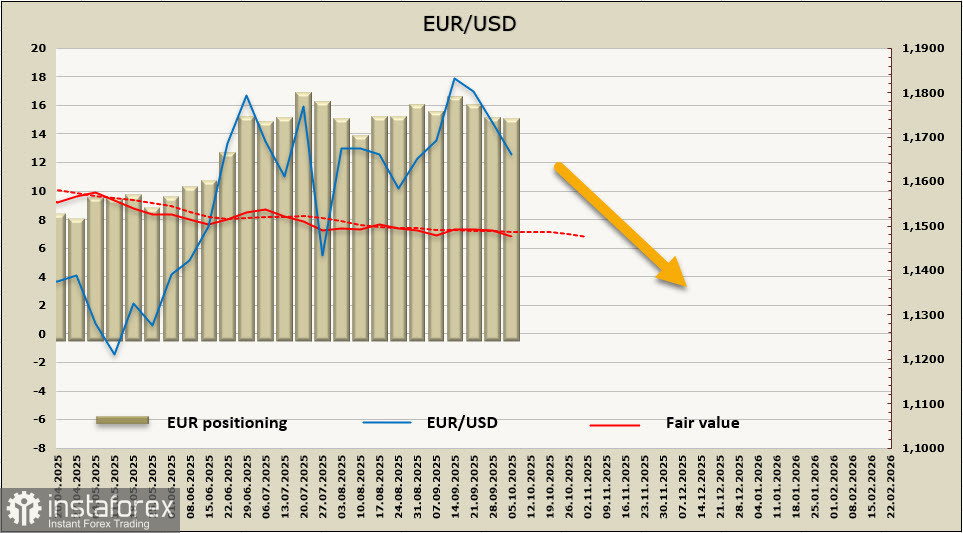

With no new CFTC data available, there is a noticeable attempt by the estimated price to break below the long-term average.

Last week, we suggested that the EUR/USD pair was unlikely to break its high at 1.1919 and that a downward correction might develop. So far, euro price action confirms that view, with the pair trading near the local low of 1.1646 on Monday morning. We anticipate a further attempt to break below this support with a move toward the next target at 1.1570/80.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română