The EUR/USD currency pair traded lower throughout Monday, which is, at the very least, surprising. Let's remember that in 2025, the United States faces a multitude of challenges. Each passing week brings new developments that practically scream at the market to continue dumping the U.S. dollar. Of course, the dollar is not the currency of a developing country. It cannot and will not fall endlessly. However, one must agree that the fundamental and macroeconomic backdrop remains such that betting on dollar growth is simply unreasonable.

Just last week, it became clear that nearly all published U.S. data surprised traders in a negative way. The key disappointment came in the ADP report, as NonFarm Payrolls were unavailable. The main takeaway for traders was that the U.S. labor market continues to slow. Admittedly, most market participants may have chosen to wait for the official NFP report, given that ADP is considered secondary. However, this doesn't justify the dollar's failure to drop last week.

The ISM business activity indices also fell short of expectations. Although a slight increase was seen in the manufacturing sector, the index remains below the 50.0 "watershed" level. As for the services sector, it plunged by 2 points and is now teetering on the edge of contraction.

As a reminder, the U.S. Bureau of Labor Statistics is currently not collecting or releasing data. Therefore, there will be no U.S. inflation report this week. On what basis will the Federal Reserve make its monetary policy decision at the end of the month? That remains entirely unclear. Given the current circumstances, the outcome of the decision is a mystery shrouded in darkness.

The level of uncertainty is now growing not just due to Donald Trump's leadership, his trade wars, the White House's protectionist policies, and his continued attacks on the Fed (the list is endless), but also due to the absence of critical macroeconomic data.

We believe that this uncertainty is precisely why the market is hesitant to act—participants don't know what to expect. And ironically, this very uncertainty should be the primary reason for selling off the U.S. dollar. What investor would want to invest in an economy where the current inflation level is unknown? Where the president provokes a second government shutdown, makes unilateral decisions, and is willing to fire half of the federal administration to pressure the opposition? In our view, this type of uncertainty should drive the dollar down into the abyss.

Incidentally, a weaker dollar works in Trump's favor. On the other side, a strong euro is unfavorable for the ECB and the EU as a whole. It's entirely plausible that some form of currency intervention has begun on the part of the ECB to prevent further euro appreciation.

Of course, currency interventions are informally prohibited, but the ECB is under no obligation to disclose its actions to Trump or anyone else. In short, something is clearly off in the currency market.

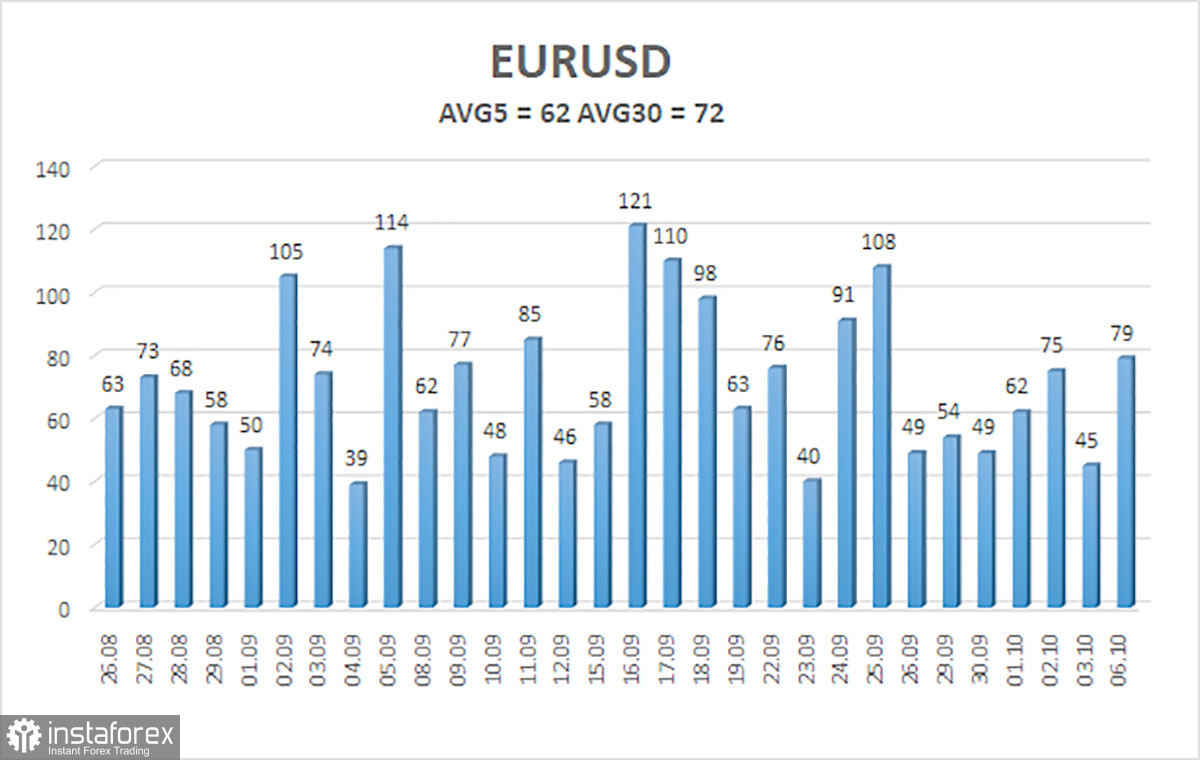

As of October 7, the average volatility of the EUR/USD pair over the past five trading days is 62 pips, which is classified as "moderate." For Tuesday, we expect the pair to move between the levels of 1.1651 and 1.1775.

The higher linear regression channel is pointing upward, indicating that the uptrend remains intact. Moreover, the CCI indicator has entered oversold territory, which may trigger a new wave of upward movement in the trend.

Nearest Support Levels:

S1 – 1.1658

S2 – 1.1597

S3 – 1.1536

Nearest Resistance Levels:

R1 – 1.1719

R2 – 1.1780

R3 – 1.1841

Trading Recommendations:

The EUR/USD pair continues to correct downward, but the overall uptrend remains visible across all higher timeframes. The U.S. dollar remains heavily influenced by Donald Trump's policies, and he shows no intention of "stopping at what's been achieved."

The dollar had its burst of growth over the past month, but it now appears to be time for a sustained downturn. If the price remains below the moving average line, short positions may be justified with targets at 1.1658 and 1.1651, based solely on technical grounds. Long positions remain valid if the price is above the moving average line, with targets at 1.1841 and 1.1902 in line with the ongoing uptrend.

Explanation of Illustrations:

- Linear Regression Channels help determine the current trend. If both channels point in the same direction, the trend is strong.

- The Moving Average Line (settings: 20.0, smoothed) indicates the short-term trend and trading direction.

- Murray Levels mark target levels for price movements and corrections.

- Volatility Levels (red lines) represent the expected price range for the pair over the next 24 hours, based on current volatility indicators.

- The CCI Indicator enters the oversold region below -250 or the overbought region above +250, signaling a possible trend reversal.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română