Trade Analysis and USD/JPY Trading Tips

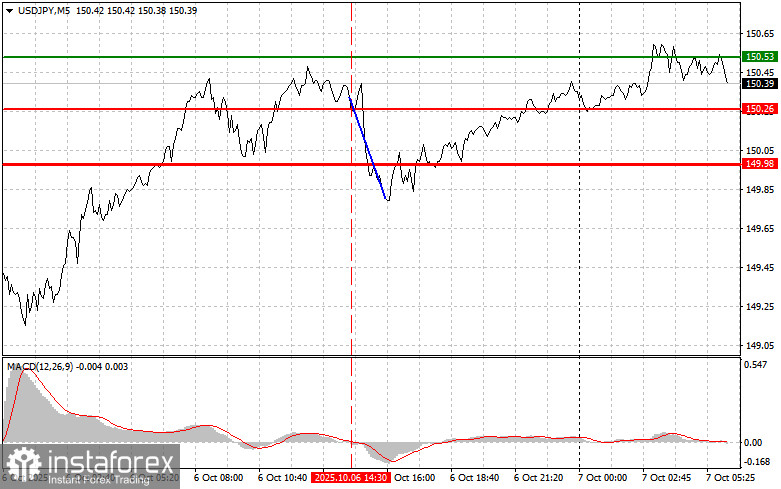

The price test at 150.26 occurred when the MACD indicator had just started to move down from the zero line, confirming it as a valid entry point for selling the dollar. This signal led to a drop in the pair of over 40 points.

A moderate decline in the dollar occurred yesterday afternoon following yet another failed round of budget talks between Republicans and Democrats, which resulted in an extended government shutdown. As is commonly known, a shutdown erodes confidence in the U.S. economy. Moreover, the shutdown has a direct impact on the flow of economic data. When government agencies cease operations, it causes delays in reports on key economic indicators, increases uncertainty, and creates difficulties for analysts and businesses. The lack of timely economic data distorts the overall picture of economic conditions.

Despite this, the Japanese yen did not record any substantial gains. News of the appointment of a new Prime Minister in Japan, announced yesterday, continues to exert downward pressure on the Japanese currency. The new leader has made it clear that they intend to maintain a soft stance regarding upcoming reforms and are ready to reintroduce economic stimulus measures. This contradicts the Bank of Japan's intention to raise interest rates.

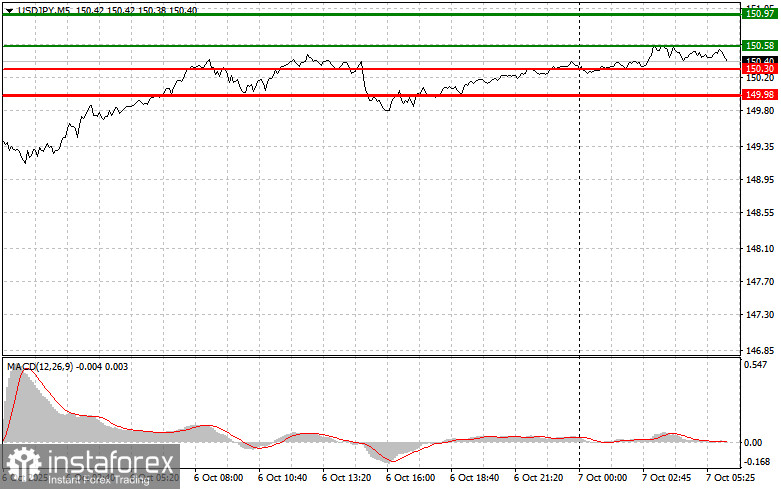

Today, I will primarily rely on Buy Scenarios #1 and #2.

Buy Scenarios

Scenario #1: I plan to buy USD/JPY today at the 150.58 level (indicated by the thin green line on the chart), with an upside target at 150.97 (indicated by the thick green line). Around the 150.97 level, I intend to exit the long trade and open a sell position in the opposite direction, aiming for a 30–35 pip pullback. Buying the pair is most effective during corrections or following significant drops in USD/JPY.

Important: Before buying, ensure that the MACD indicator is above the zero line and just starting to rise.

Scenario #2: I will also consider buying USD/JPY if the price tests the 150.30 level twice consecutively while the MACD is in oversold territory. This should limit the pair's downside potential and trigger a reversal to the upside. The expected price targets in this case are 150.58 and 150.97.

Sell Scenarios

Scenario #1: I plan to sell USD/JPY only after the price breaks through the 150.30 level (indicated by the thin red line on the chart), which would likely trigger a sharp downward move. The key target for sellers will be 149.98 (thick red line), where I intend to close the short position and immediately open a buy in the opposite direction, aiming for a 20–25 pip rebound. It's best to sell from as high a point as possible.

Important: Before selling, ensure the MACD indicator is below the zero line and just starting to fall.

Scenario #2: I also plan to sell USD/JPY if the price tests the 150.58 level twice while the MACD is in overbought territory. This would limit the pair's upward potential and likely lead to a reversal to the downside. Possible price targets in this case are 150.30 and 149.98.

What's on the chart:

- Thin Green Line: Entry price for buying the instrument.

- Thick Green Line: Proposed Take Profit level or manual profit-taking zone. Further growth above this level is unlikely.

- Thin Red Line: Entry price for selling the instrument.

- Thick Red Line: Proposed Take Profit level or manual profit-taking zone. Further decline below this level is unlikely.

- MACD Indicator: Always use MACD to identify overbought or oversold conditions when entering trades.

Important Note for Beginner Forex Traders

Beginner traders must exercise great caution when making entry decisions in the market—especially before major fundamental data releases. It's often best to stay out of the market during such events to avoid sharp market moves that go against active trades.

If you do choose to trade during news releases, always use stop-loss orders to minimize risk. Trading without a stop-loss, especially with large volumes or poor risk management, can lead to a rapid and complete loss of your trading account.

Remember: successful trading relies on having a clear plan, such as the one outlined above. Making trades based on emotion or reacting impulsively to market movements is a losing strategy, especially for intraday traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română