Yesterday, US stock indices closed mixed. The S&P 500 rose by 0.36%, while the Nasdaq 100 added 0.41%. The industrial Dow Jones declined by 0.14%.

Japanese equities continued to climb following the election of a pro-stimulus legislator as the new leader of the country, leading to a weaker yen and higher long-term bond yields. Gold set another record high amid increasing demand for safe-haven assets against a backdrop of political crises worldwide.

The Nikkei index rose by 0.7%, reaching a new intraday high after a 4.8% gain on Monday. Shares of Asian companies engaged in artificial intelligence advanced after a high-profile deal between Advanced Micro Devices Inc. and OpenAI. The yield on 30-year Japanese bonds reached a new record at 3.315% ahead of a government bond auction, the first since Sanae Takaichi took office as Japan's next prime minister.

US equity futures fell after President Donald Trump stated that he would be willing to negotiate with Democrats on healthcare only after the government reopens.

While global equities continue to set records, concerns about the US government shutdown and political crisis in France have prompted investors toward alternative assets such as gold and Bitcoin, driving both to new price peaks. Investors worried about the potential impact of political turbulence on traditional markets redirected their funds into precious metals, pushing gold to a new all-time high.

Demand for gold has increased not only from institutional investors but also from retail buyers seeking to protect their savings from inflation and currency depreciation. Goldman Sachs Group Inc. has raised its gold forecast for December 2026 from $4,300 to $4,900 per ounce, citing inflows from ETFs and purchases by central banks. According to the latest data, the People's Bank of China increased its gold reserves for the eleventh consecutive month in September.

Bitcoin, in turn, has also not been left out of the overall risk-off trend. The cryptocurrency, gradually acquiring the status of a mature investment asset, has shown impressive growth, reaching a new historic high. BTC has been supported by both institutional investors, who see its potential for portfolio diversification, and advocates of decentralized finance, confident in its long-term outlook.

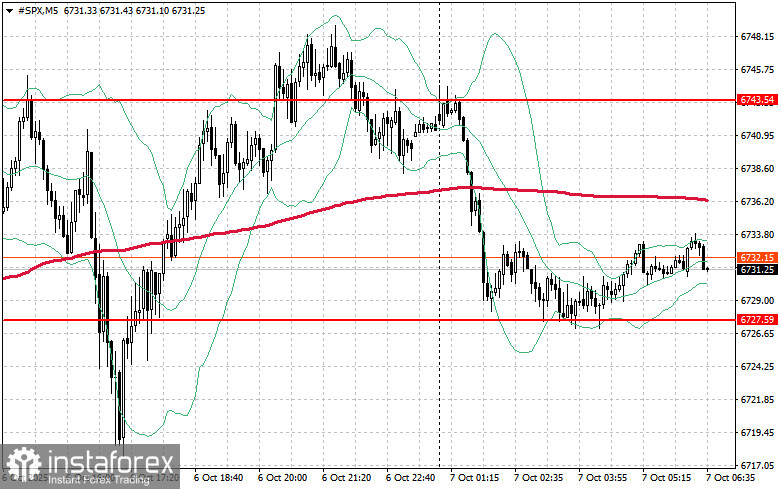

As for the technical picture for the S&P 500, the main objective for buyers today will be to break through the nearest resistance level of $6,743. This would help drive further growth and open the way for a move to the next level at $6,756. No less of a priority for bulls will be to maintain control over the $6,769 mark, which would strengthen buyers' positions. In the event of a move lower amid declining risk appetite, buyers simply must make themselves known in the $6,727 area. A break below this level would quickly push the instrument back to $6,711 and open the way to $6,697.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română