Trade analysis and advice for trading the Japanese yen

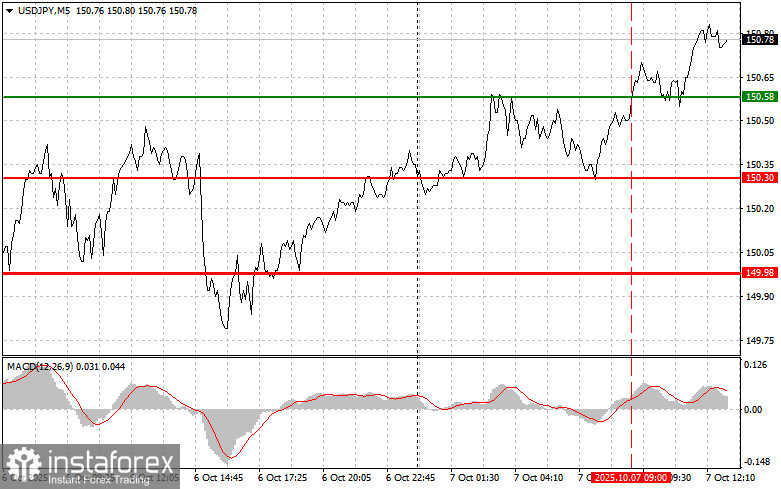

The price test of 150.58 in the first half of the day coincided with the MACD indicator having already moved significantly above the zero line, which limited the pair's upward potential.

In the second half of the day, market attention will shift to U.S. trade balance data and consumer credit figures. A reduction in the trade deficit could positively influence the dollar, especially if the actual value exceeds expectations.

Consumer credit volumes, on the other hand, serve as an important barometer of consumer sentiment and spending willingness. An increase in consumer credit may indicate optimism and confidence in the future, which usually supports economic growth. However, excessive credit growth could create risks related to high household debt and potential reductions in consumer spending in the future.

Additionally, it is worth following interviews with FOMC members Raphael Bostic and Michelle Bowman. A cautious, dovish tone from policymakers could trigger a new wave of USD/JPY gains.

For intraday strategy, I will mainly rely on scenarios #1 and #2.

Buy Signal

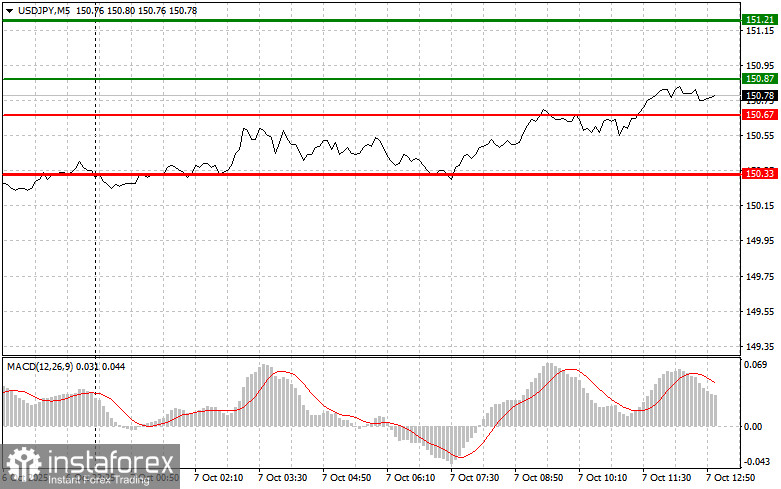

Scenario #1: I plan to buy USD/JPY today at an entry point around 150.87 (green line on the chart) with a target of 151.21 (thicker green line on the chart). Around 151.21, I will exit the long positions and open sales in the opposite direction (expecting a 30–35 point reversal). The pair's rise can continue following the morning trend. Important! Before buying, ensure the MACD indicator is above zero and just beginning to rise from it.

Scenario #2: I also plan to buy USD/JPY if there are two consecutive tests of 150.67 while the MACD indicator is in the oversold area. This would limit the pair's downward potential and trigger a market reversal upward. Growth toward the opposite levels of 150.87 and 151.21 can then be expected.

Sell Signal

Scenario #1: I plan to sell USD/JPY today after breaking below 150.67 (red line on the chart), which will trigger a quick decline in the pair. The sellers' key target is 150.33, where I will exit short positions and immediately open long positions in the opposite direction (expecting a 20–25 point rebound). Downward pressure may persist if data are weak.Important! Before selling, ensure the MACD indicator is below zero and just beginning to decline from it.

Scenario #2: I also plan to sell USD/JPY if there are two consecutive tests of 150.87 while the MACD indicator is in the overbought area. This would limit upward potential and trigger a downward reversal. A decline toward the opposite levels of 150.67 and 150.33 can then be expected.

Chart Legend

- Thin green line – entry price for buying the trading instrument.

- Thick green line – suggested level to set Take Profit or manually fix profit, as further growth above this level is unlikely.

- Thin red line – entry price for selling the trading instrument.

- Thick red line – suggested level to set Take Profit or manually fix profit, as further decline below this level is unlikely.

- MACD indicator – when entering the market, focus on overbought and oversold zones.

Important: Beginner Forex traders must exercise great caution when entering the market. Before major fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you trade during news releases, always use stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

Remember: successful trading requires a clear plan—like the one presented above. Spontaneous trading decisions based solely on the current market situation are inherently a losing strategy for intraday traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română