Trade Review and Strategy for the Euro

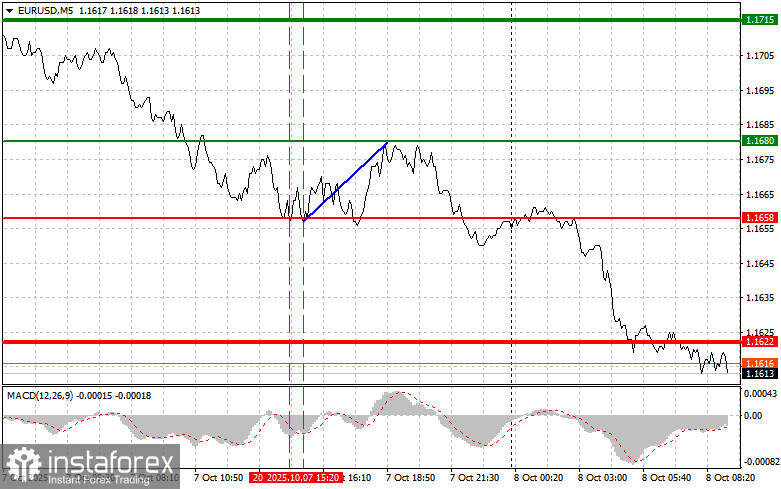

A price test at 1.1658 occurred when the MACD indicator had already moved significantly below the zero line, which limited the pair's downside potential. For this reason, I did not sell the euro. The second test of 1.1658 happened while the MACD was in the oversold zone. This allowed Buy Scenario #2 to unfold, resulting in a 20-pip upward movement.

Comments by Federal Reserve officials about the potential for rising inflation if interest rates are cut too quickly contributed to the U.S. dollar's strength and a significant decline in the euro. Investors, anticipating tighter monetary policy in the U.S., actively sold the euro and other riskier assets, seeking safety in the dollar.

Today's focus will be on German industrial production data and a speech by European Central Bank President Christine Lagarde. These events are likely to influence the euro's short-term trajectory and overall market sentiment.

The release of Germany's industrial output figures for August is a key marker for assessing the health of the eurozone economy. Weaker data could heighten concerns about slowing growth and prompt the ECB to adopt a more accommodative stance, which would put pressure on the euro. Conversely, upbeat data may boost market confidence in the euro area's stability and lend support to the single currency.

Investors will closely watch Lagarde's speech. Any indications of a potential policy shift, an inflation outlook, or changes to the growth forecast could create volatility in the foreign exchange market. In particular, comments suggesting the possibility of interest rate cuts will draw added attention, especially as signs of slowing inflation continue to emerge in the eurozone.

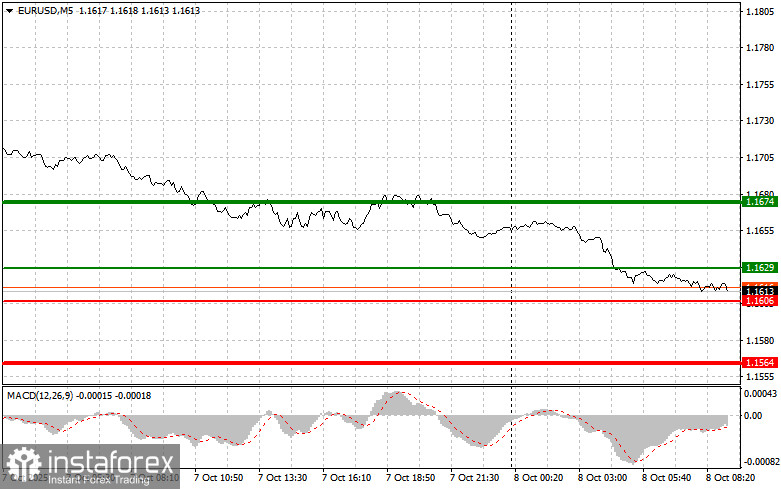

For today's intraday strategy, I intend to rely mainly on the execution of Scenario 1 and Scenario 2.

Buy Scenarios

Scenario #1: I plan to buy the euro today if the price reaches the 1.1629 entry point (thin green line on the chart), targeting a rise to 1.1674 (thick green line). At 1.1674, I will exit the long trade and also look to sell the pair on a potential rebound, expecting a 30–35 pip pullback. Note: I will only pursue this plan if the MACD is above the zero line and just beginning to rise.

Scenario #2: I also plan to buy the euro if the price tests the 1.1606 level twice in a row while the MACD is in the oversold zone. This should limit the downside and trigger a reversal to the upside, allowing price to return toward the 1.1629 and 1.1674 levels.

Sell Scenarios

Scenario #1: I plan to sell the euro if the price reaches 1.1606 (thin red line), with a target at 1.1564 (thick red line). At this level, I will exit the short trade and look to buy on a rebound, expecting a 20–25 pip pullback. Note: Before entering, I will ensure the MACD is below the zero line and just starting to decline.

Scenario #2: I will also look to sell if the price tests 1.1629 twice and the MACD is in overbought territory. This would limit the bullish potential and suggest a reversal to the downside, with expected support at 1.1606 and 1.1564.

Chart Annotations:

A thin green line represents the suggested entry price for long trades.

A thick green line marks the target area for taking profit on long trades, as movement beyond this level is unlikely.

A thin red line shows the entry level for short positions.

A thick red line indicates the zone where profits may be taken on short trades because further decline is less likely.

The MACD indicator should guide your entry decision based on overbought or oversold conditions.

Important Notes for Beginner Forex Traders:

If you are starting out on the forex market, exercise extreme caution when entering trades — especially before major data releases. The best approach is often to stay out of the market during those times to avoid sudden price spikes.

If you choose to trade during news events, always use a Stop-Loss to minimize potential losses. Trading without it — especially in high volumes and without proper money management — can quickly lead to a complete loss of your capital.

Finally, remember that no strategy guarantees constant success. Developing and following a consistent trading plan, such as the one provided above, is crucial for achieving long-term results. Acting spontaneously based on short-term market noise is almost always a losing approach for intraday traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română