Just a couple of weeks ago, analysts at Goldman Sachs predicted that gold could soon reach the $4,000 mark. Yesterday, that prediction came true. Spot gold prices exceeded $4,000 per ounce for the first time and are now holding around $4,036. This milestone comes amid growing concerns that the ongoing government shutdown could have a severe impact on the U.S. economy.

It's a historic moment for gold, which was trading below $2,000 just two years ago. This year alone, gold has surged more than 50%, driven by global trade uncertainty, questions surrounding the independence of the Federal Reserve, and concerns over U.S. financial stability. Heightened geopolitical tensions have also played a significant role in boosting demand for safe-haven assets, while central banks have increased their gold purchases in recent months.

The latest rally in gold has become particularly noteworthy, as investors seek protection from potential market shocks due to the budgetary deadlock in Washington. The Federal Reserve's shift toward a softer monetary policy stance has further supported gold's upside, as the metal does not yield interest. Investors responded accordingly by increasing allocations to exchange-traded funds (ETFs). In fact, in September, physically-backed gold ETFs saw their largest monthly inflow in over three years. Additionally, the weakening U.S. dollar—driven by expectations of Fed rate cuts—has made gold relatively more affordable for foreign buyers, further fueling demand.

Altogether, the convergence of these factors has created an ideal environment for continued growth in gold prices. However, investors should remain aware that the gold market is also subject to volatility. Decision-making should involve considering various potential scenarios. It's crucial to stay diversified and avoid relying on gold alone as a capital preservation tool.

Historically, major gold price spikes have often coincided with broader economic and geopolitical stress. Gold surpassed $1,000 per ounce after the global financial crisis, $2,000 during the COVID-19 pandemic, and $3,000 during the Trump administration's tariff announcements that shook global markets in March.

Now, the precious metal has crossed the $4,000 threshold amid renewed turmoil—including U.S. President Donald Trump's verbal attacks on the Federal Reserve. These include direct threats toward Fed Chair Jerome Powell and attempts to remove Governor Lisa Cook from office—arguably the most significant challenge yet to the Fed's independence.

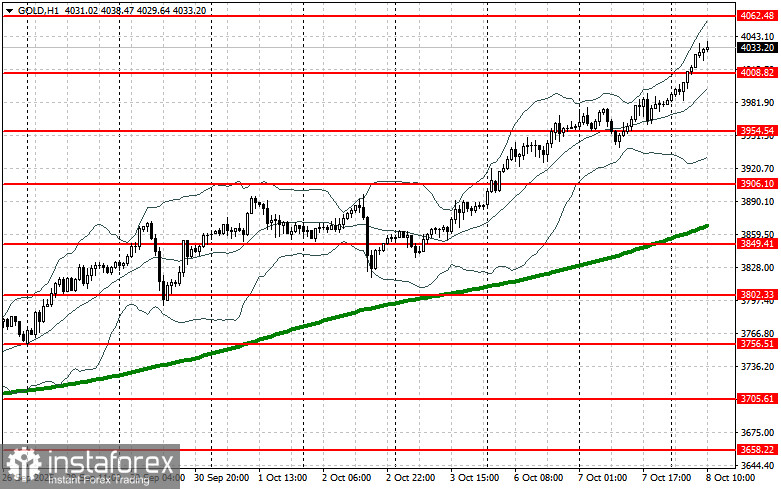

From a technical standpoint, buyers now need to break through the nearest resistance at $4,062. A successful breakout above this level would open the path toward $4,124, above which further progress is likely to be difficult. The ultimate bullish target could be the $4,186 area.

If prices begin to retreat, bears will aim to regain control around $4,008. A confirmed break below this level would deal a significant blow to the bulls and could pull gold down toward $3,954, with further downside potential toward $3,906.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română