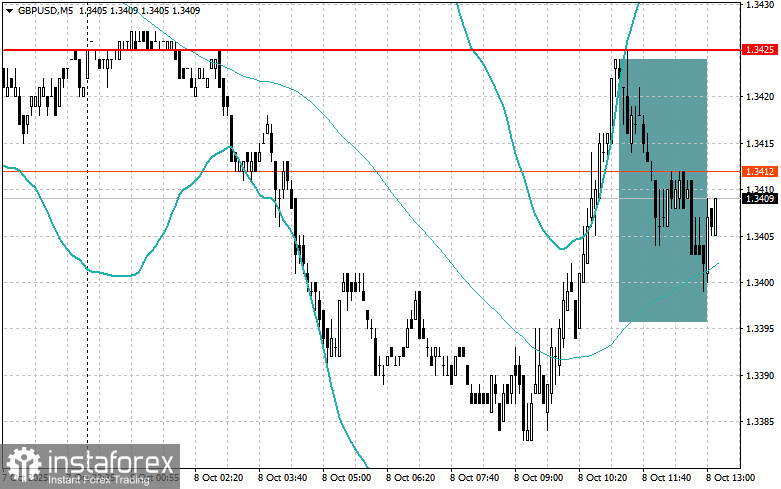

Only the British pound was traded today through the Mean Reversion strategy, but even there no major reversal occurred. I did not use the Momentum strategy for any trades.

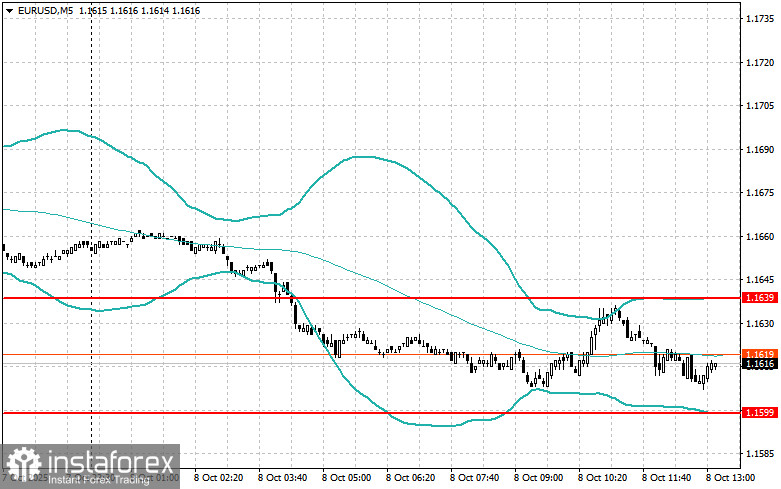

A sharp drop in German industrial production led to a steep fall in the euro, but the bearish market failed to gain further traction. The pound also slightly recovered against the dollar, indicating traders' rather cautious approach toward buying the U.S. dollar.

In the second half of the day, a fairly large number of interviews and speeches from Federal Reserve representatives are expected. Special attention should be paid to statements by FOMC members Michael S. Barr, Neel Kashkari, and Austan D. Goolsbee. The market is particularly awaiting comments regarding inflation and future prospects for monetary policy. The short-term dynamics of the U.S. currency will depend on their remarks. Traders will carefully analyze the rhetoric of Fed representatives, trying to catch even the slightest hints of further rate cuts. If such hints do not appear, the dollar may resume its growth. It is important to note that opinions within the FOMC may differ. Barr, Kashkari, and Goolsbee may express different views on the current economic situation and optimal strategies. Therefore, traders will closely monitor the content of their official statements.

Also today, the minutes of the September Fed meeting will be published. This document contains detailed records of discussions and debates held during the FOMC meeting at which the decision to cut rates was made. Studying the minutes provides critically important insights into Fed officials' views on economic prospects, inflation, and labor markets.

In the case of strong data, I will rely on the Momentum strategy. If the market shows little reaction, I will continue to use the Mean Reversion strategy.

Momentum Strategy (Breakout) for the Second Half of the Day:

For EUR/USD

- Buying on a breakout of 1.1640 may lead to growth toward 1.1680 and 1.1710;

- Selling on a breakout of 1.1610 may lead to a decline toward 1.1575 and 1.1530.

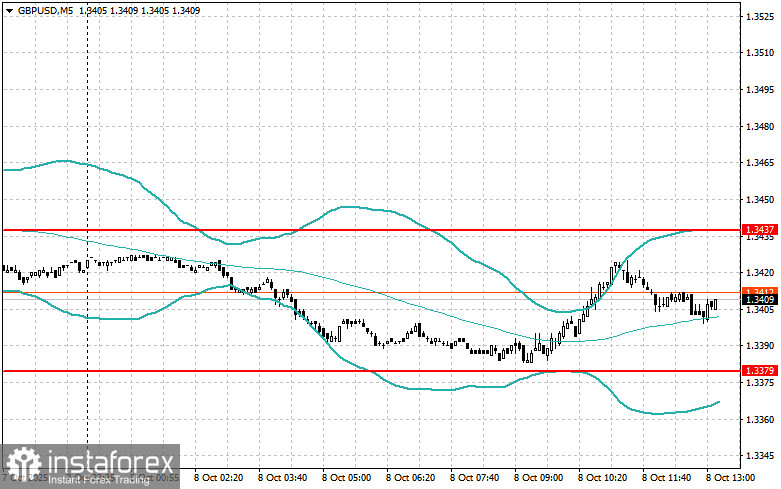

For GBP/USD

- Buying on a breakout of 1.3440 may lead to growth toward 1.3460 and 1.3500;

- Selling on a breakout of 1.3400 may lead to a decline toward 1.3380 and 1.3360.

For USD/JPY

- Buying on a breakout of 153.00 may lead to growth toward 153.40 and 153.65;

- Selling on a breakout of 152.75 may lead to a decline toward 152.35 and 152.00.

Mean Reversion Strategy (Reversal) for the Second Half of the Day:

For EUR/USD

- I will look for selling opportunities after a failed breakout above 1.1639 with a return below this level;

- I will look for buying opportunities after a failed breakout below 1.1599 with a return back to this level.

For GBP/USD

- I will look for selling opportunities after a failed breakout above 1.3437 with a return below this level;

- I will look for buying opportunities after a failed breakout below 1.3379 with a return back to this level.

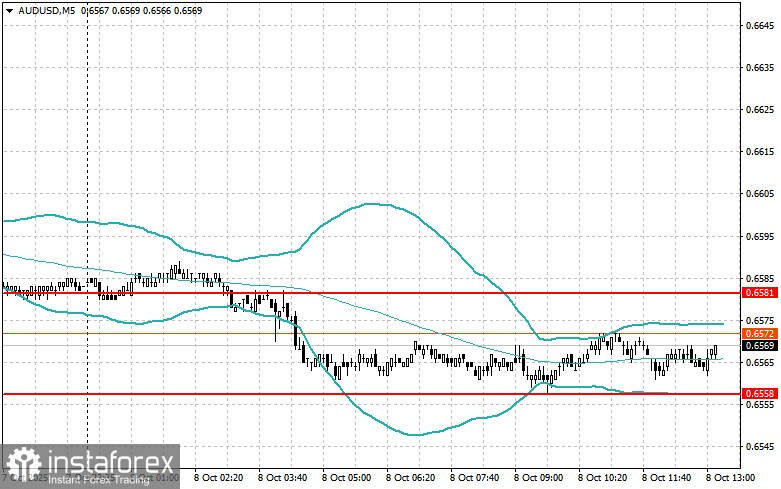

For AUD/USD

- I will look for selling opportunities after a failed breakout above 0.6581 with a return below this level;

- I will look for buying opportunities after a failed breakout below 0.6558 with a return back to this level.

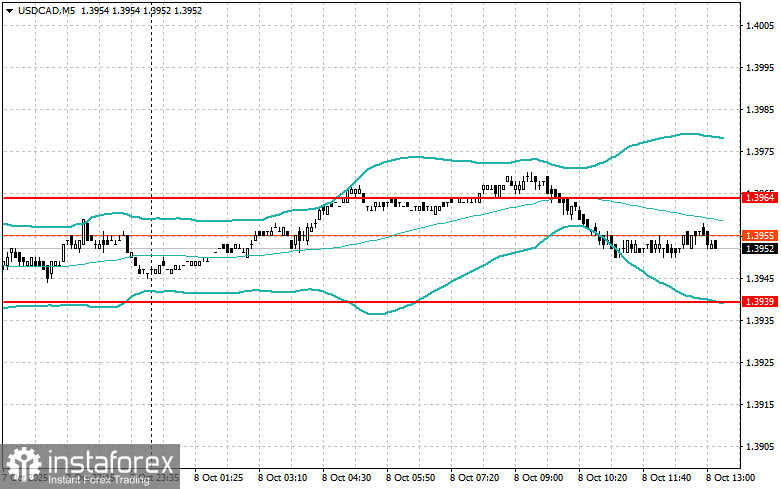

For USD/CAD

- I will look for selling opportunities after a failed breakout above 1.3964 with a return below this level;

- I will look for buying opportunities after a failed breakout below 1.3939 with a return back to this level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română