With just one statement, Sebastien Lecornu saved France — and Europe!

The speech by the outgoing prime minister, announcing progress in negotiations with political parties over the budget, led to a rebound in the CAC-40 index and a narrowing of the yield spread between French and German bonds. As a result, EUR/USD managed to find a footing. But how long will it last?

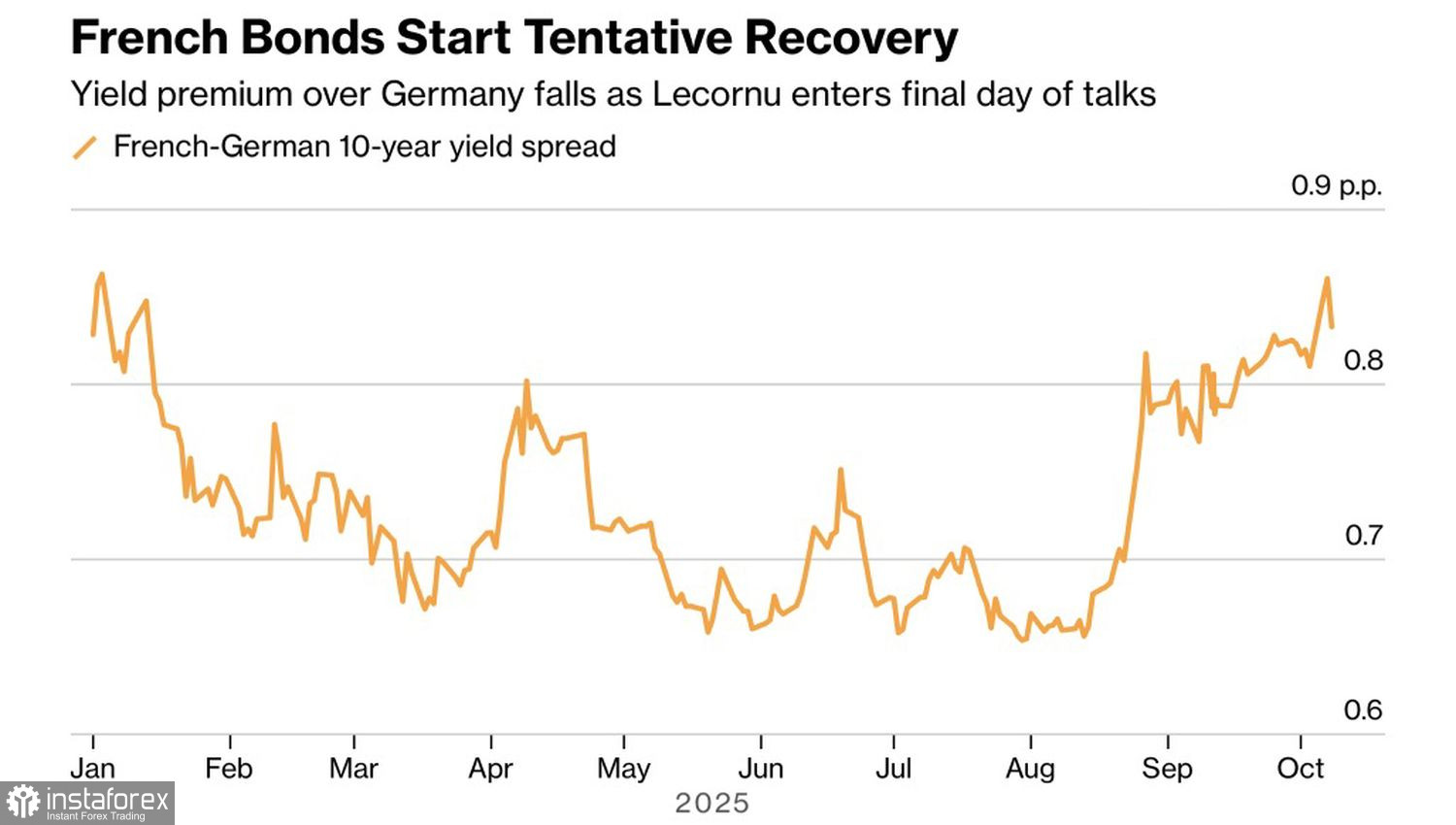

Yield Spread Dynamics Between French and German Bonds

Achieving results requires efforts from both sides. Lecornu studied the demands of both the left- and right-wing parties and indicated a willingness to compromise. While he previously announced plans to set the budget deficit for next year at 4.7%, he now speaks of a figure below 5%. According to HSBC, had the still-serving prime minister adopted a harder line on this issue, the EUR/USD would likely not have been able to reach the 1.20 mark by 2025.

It seems that the euro is afraid of extreme scenarios, whether that be parliamentary or presidential elections in France. However, it's entirely possible that just clarifying the situation and the president announcing a vote would be enough to reignite the EUR/USD rally.

It was the same with U.S. tariffs. As long as there was uncertainty, problems persisted. Once the White House started signing trade agreements, everything started to stabilize. Even if import tariffs stand at 15%, businesses simply need to know the rates and how to comply.

However, appetite grows with eating. According to a Bloomberg insider report, in early October, Washington sent new proposals to the EU aimed at achieving mutual, fair, and balanced trade. Brussels deemed them maximalist, with the requested concessions considered too steep. Will a new trade war erupt? No one knows — but escalation of the conflict would hardly suit the eurozone, the European Central Bank, or EUR/USD.

Unusual activity in the futures market suggests further volatility may lie ahead. Traders are pricing in three rounds of monetary easing by the European Central Bank in 2026. Derivatives currently estimate the scale of this easing at a modest 10 basis points. The odds of such a move are only 1%, but stranger things have happened. If that trade plays out, returns could be 30-fold.

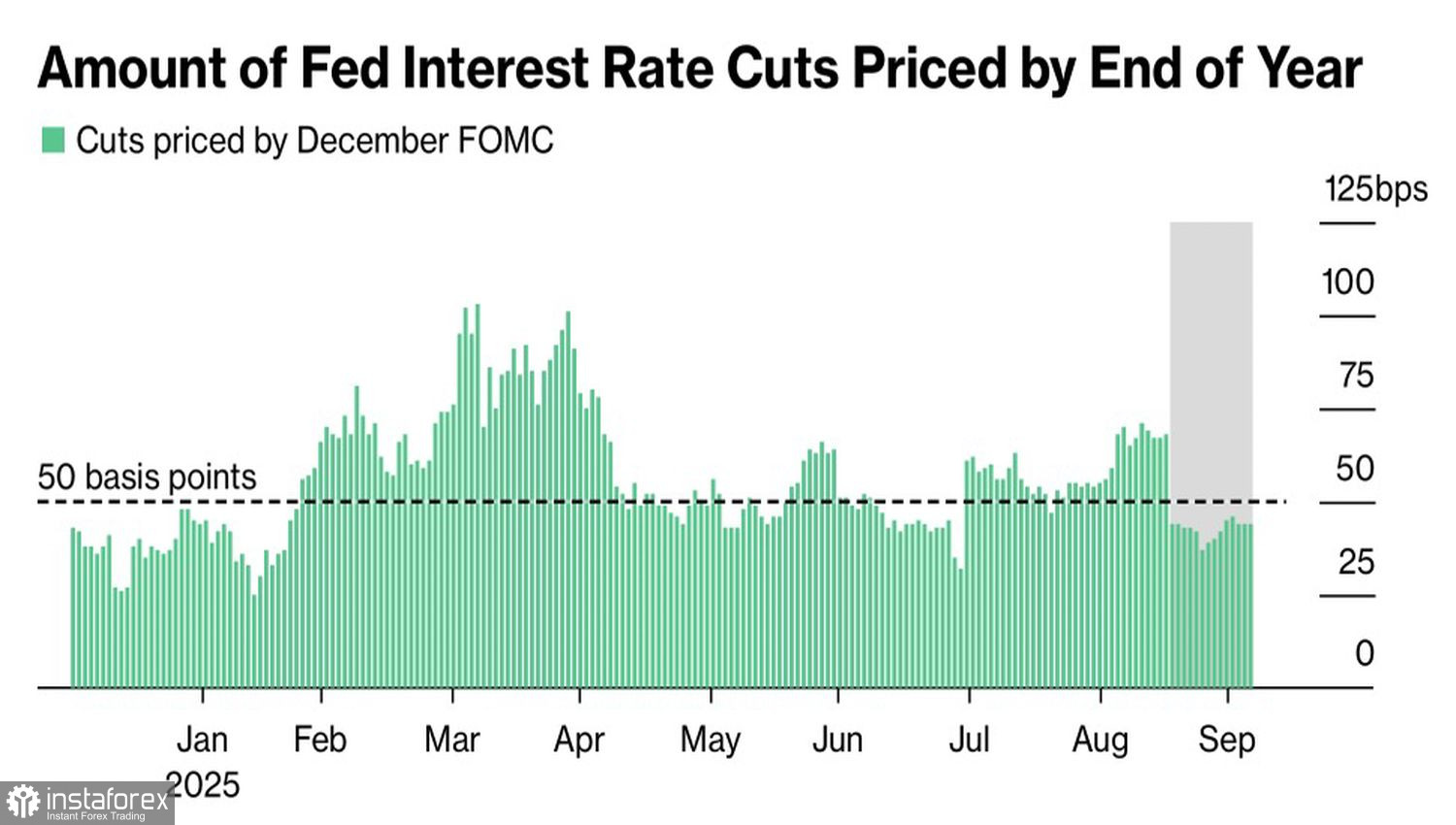

Dynamics of the Expected Scale of the Federal Reserve's Monetary Expansion

Should the ECB ease policy in 2026, or if the Fed chooses not to lower the federal funds rate during one of its 2025 FOMC meetings (either in October or December), euro bulls would lose one of their key advantages. Such a scenario is possible but unlikely. That's why the current pullback, driven by the escalation of the political crisis in France, looks more like a correction than a true trend reversal.

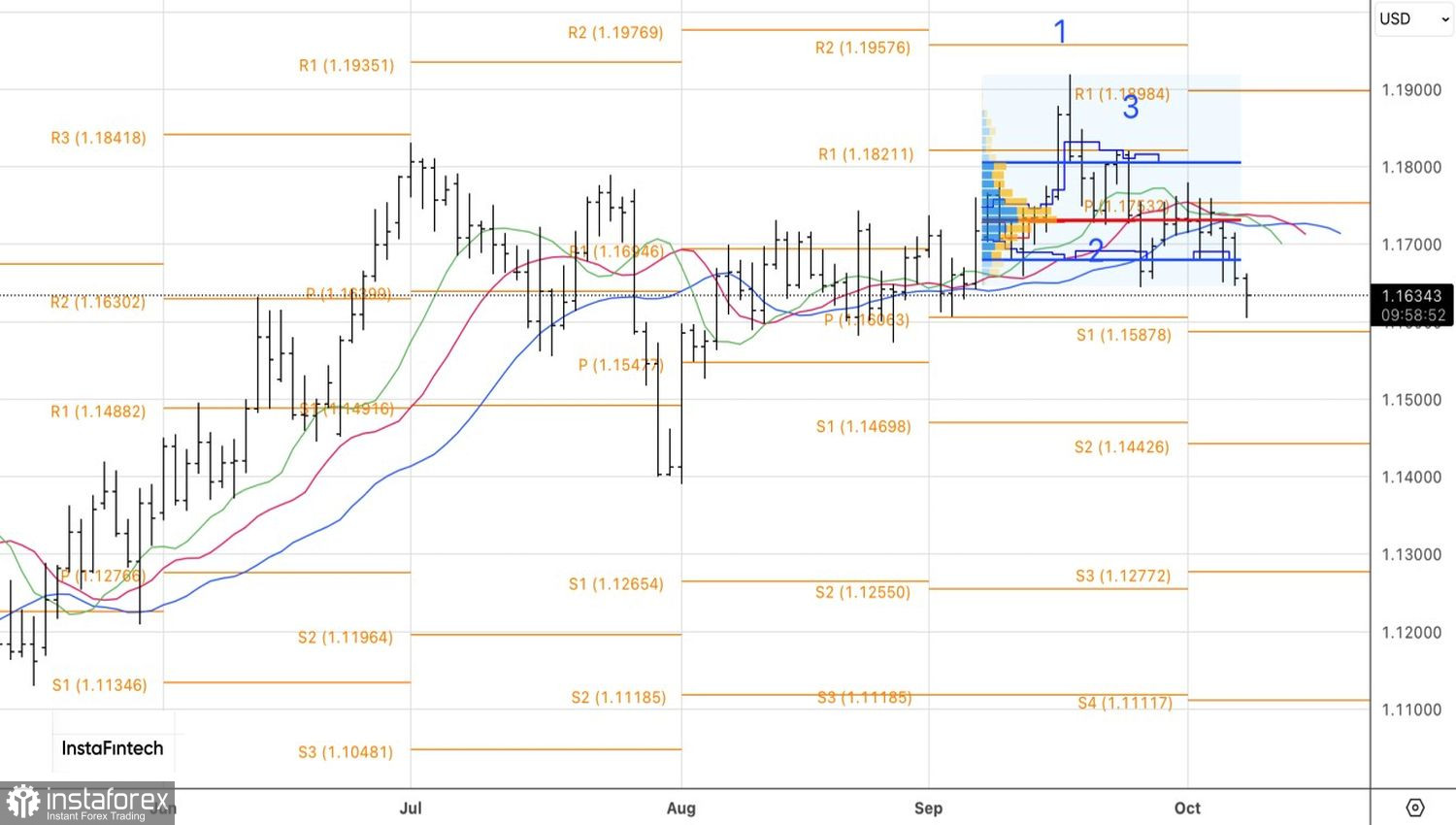

On the daily chart, EUR/USD broke out of its fair value range, only to rebound from the convergence zone created by pivot levels at 1.1590–1.1605. If the pair fails to break through this zone on its second attempt, traders should close shorts opened from 1.1710 and shift back to long positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română