Wednesday Trade Breakdown:

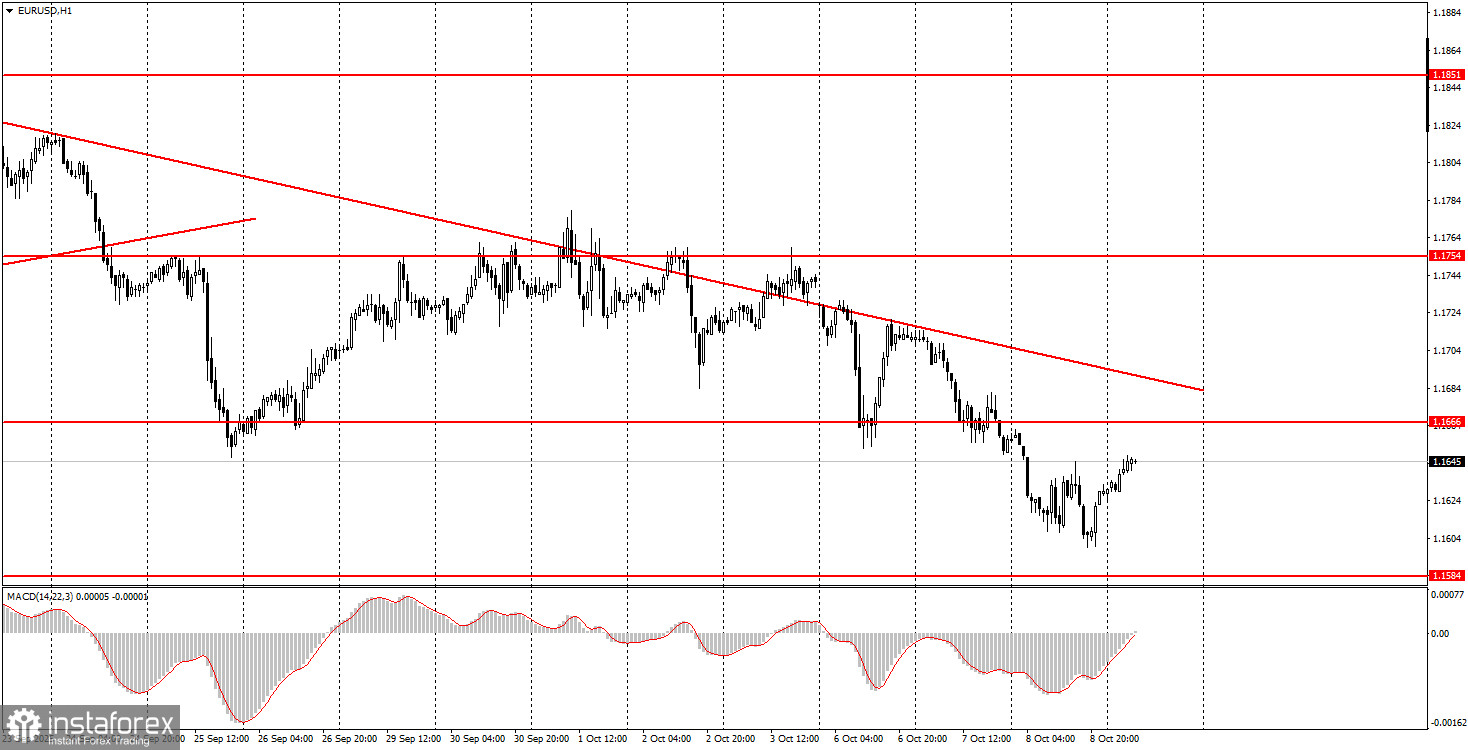

1-Hour EUR/USD Chart

On Wednesday, the EUR/USD currency pair traded in both directions while maintaining a downward bias on the hourly timeframe. The main decline occurred during the Asian session, so even the one major macroeconomic report — Germany's industrial production, which disappointed significantly — had virtually no impact on the euro.

In the evening, the minutes from the latest FOMC meeting revealed that about half of the committee members expect further monetary easing. The key interest rate could be cut two more times by year-end. However, this information had already been public knowledge since September 17, the date of the Federal Reserve's prior meeting. In other words, the notion of two more potential rate cuts isn't news at all. In our view, the Fed's stance remains dovish and will stay that way, which logically should not support a stronger dollar.

The U.S. government remains in shutdown mode, unrest continues in Chicago, and macroeconomic data are not being published. With all that in mind, how is the dollar even gaining strength? That's a "million-dollar question."

5-Minute EUR/USD Chart

On the 5-minute timeframe, the only trade signal formed overnight. The price broke below the 1.1655–1.1666 zone, allowing short positions to be opened. Though the nearest target zone wasn't reached by the end of the day, those short trades could have been closed at any point — they were profitable either way. The only issue was the timing of the signal's formation.

How to Trade on Thursday

On the hourly chart, EUR/USD has broken the trendline multiple times, but the pair has continued to fall for unclear reasons. We consider the current movement to be entirely illogical. The overall fundamental and macroeconomic background remains highly unfavorable for the U.S. dollar, so substantial strengthening of the greenback is not expected at this point. In our view, as before, the dollar can only benefit from technical corrections — one of which is currently underway.

For Thursday, EUR/USD could move in either direction. There's little clear logic behind the price action right now, and quite a lot of chaos. Today, Jerome Powell is scheduled to speak, but it's unclear what kind of reaction the market may have. You can look for trades within the 1.1655–1.1666 area.

On the 5-minute TF, the important levels to watch are: 1.1354–1.1363, 1.1413, 1.1455–1.1474, 1.1527, 1.1571–1.1584, 1.1655–1.1666, 1.1745–1.1754, 1.1808, 1.1851, 1.1908, 1.1970–1.1988.

The key event to highlight on Thursday is Powell's speech. Market participants will be focused on his comments, not only because he is the Fed Chair during a period of rate cuts, but also because it is essentially the only major event scheduled this week.

Basic Rules of the Trading System:

- The strength of a signal is determined by how quickly it forms (a bounce or breakout). The faster the signal forms, the stronger it is.

- If two or more false trades occur around a particular level, that level should be ignored for future signals.

- In a sideways market (flat), any pair may generate many false signals — or none at all. In such a case, it's better to step away from trading at the first signs of consolidation.

- Trades should be executed between the start of the European session and the midpoint of the U.S. session. All trades should be manually closed thereafter.

- On the 1-hour timeframe, only trade MACD signals when volatility is high and a trendline or trend channel confirms the trend.

- If two levels are located very close together (within 5–20 pips), treat them as a support or resistance zone.

- Once a trade moves 15 pips in the intended direction, set your Stop Loss to break even.

Chart Annotations:

- Support and resistance levels are target areas for potential buy or sell entries. Use them to set Take Profit levels.

- Red lines indicate trend channels or trendlines that reflect the current direction of the market. They help determine preferred trade direction.

- MACD (14,22,3): The histogram and signal line can be used for additional confirmation of trade direction.

Important speeches and reports (always listed in the economic calendar) can heavily influence currency pair movement. During their release, you should trade with extra caution or exit the market entirely to avoid sharp price swings against your position.

For beginners in forex trading: remember that not every trade will be profitable. Developing a clear strategy and effective money management are essential for long-term success in trading.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română