Bitcoin recently tested the $124,000 level before quickly pulling back. Selling pressure was observed during the Asian trading session, which drove the leading cryptocurrency back to the $121,500 area, where buyers once again became active. However, how long they can maintain this level of support remains uncertain.

According to recent data, inflows into spot Bitcoin ETFs have slowed but not reversed, supporting the broader market as Bitcoin trades near its historical highs. This stable, albeit moderate, stream of capital reflects continued interest from institutional investors, despite market volatility and rumors of a deeper correction. In the context of global economic uncertainty, where a lack of fresh macroeconomic data constrains the U.S. Federal Reserve, Bitcoin ETFs are increasingly perceived as a hedging tool. Large firms, such as BlackRock and Fidelity, report increases in their assets under management related to crypto products.

A recent report from Glassnode notes that more than 99% of all Bitcoin addresses are currently in profit. This remarkable statistic, recorded near the top of the market cycle, underscores Bitcoin's strength as an asset resilient to short-term shocks. Within the context of record-high prices, this imbalance signals a shift from panic selling to long-term holding strategies — a behavior typical of an increasingly mature market.

Regarding intraday strategies in the cryptocurrency market, I will continue to capitalize on significant dips in Bitcoin and Ethereum, anticipating the continuation of the medium-term bullish trend, which remains intact. Below are the short-term trading plans with clearly defined buy and sell scenarios.

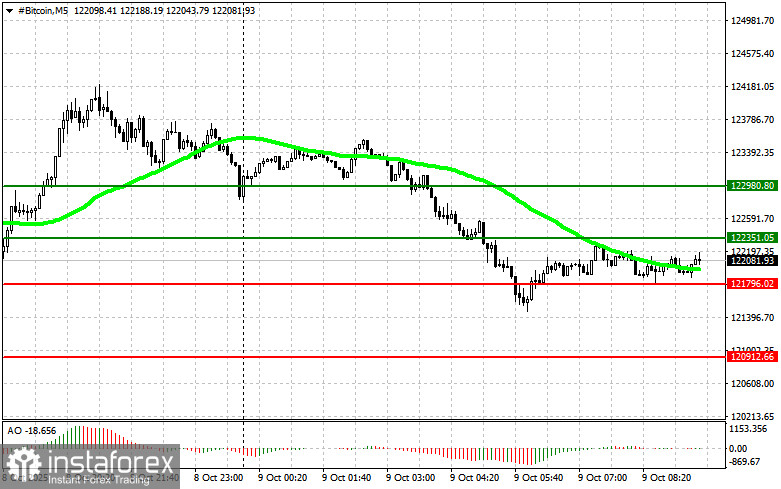

Bitcoin

Buy Scenarios

Scenario 1: I plan to buy Bitcoin today at the entry level around $122,300, targeting an upward move to $123,000. At that level, I will exit the long position and open a short on a potential pullback. Before executing the breakout trade, I will ensure that the 50-day moving average is positioned below the current price and that the Awesome Oscillator is above the zero line.

Scenario 2: I will consider buying from the lower boundary at $121,700 if there is no strong market reaction confirming a breakdown. The upward targets in this case remain $122,300 and $123,000.

Sell Scenarios

Scenario 1: I plan to sell Bitcoin today at the entry level around $121,700, targeting a move down to $120,900. At that point, I will exit the short position and reverse into a long trade on a bounce. Before placing a breakout sell trade, I will confirm that the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

Scenario 2: I will also consider selling from the upper boundary at $122,300 if there is no sustained breakout. In that case, the downside targets are $121,800 and $120,900.

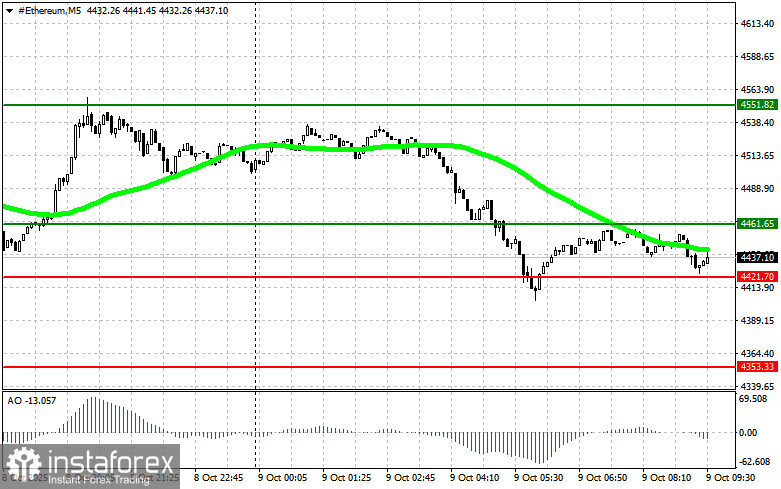

Ethereum

Buy Scenarios

Scenario 1: I plan to buy Ethereum today at the entry level of $4,461 with a target of $4,551. I will exit the long position at $4,551 and sell on a pullback. As with Bitcoin, I will first check that the 50-day moving average is beneath the entry price and that the Awesome Oscillator is in positive territory.

Scenario 2: I will buy from the lower boundary at $4,421 if the market shows no strong reaction to a breakdown. The targets in this case remain $4,461 and $4,551.

Sell Scenarios

Scenario 1: I intend to sell Ethereum at $4,421 with a downside target of $4,353. Upon reaching this level, I will close the short and take a long position on the rebound. Before trading on a breakout, I will ensure that the 50-day moving average is above the current price and that the Awesome Oscillator shows a negative reading.

Scenario 2: I will also consider selling from the upper boundary at $4,461 if the market fails to break above this resistance. Downward targets would then be $4,421 and $4,353.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română