Trade Breakdown and Strategy for the Euro

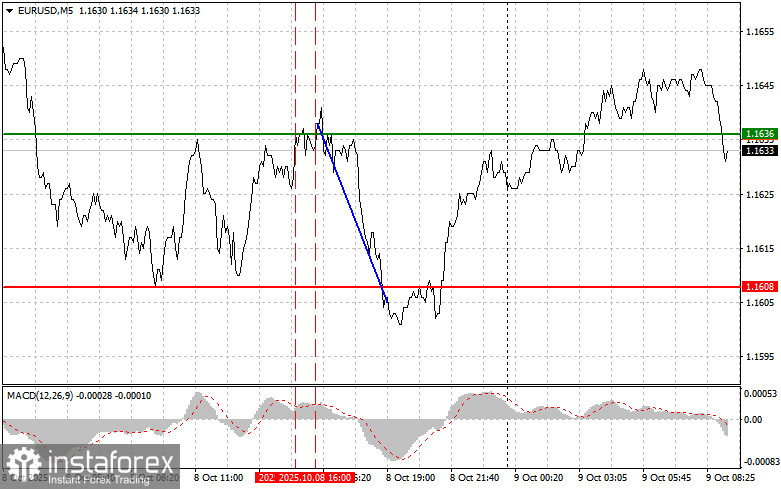

On Wednesday, a test of the 1.1636 level occurred when the MACD indicator had already moved significantly above the zero line, limiting the euro's upside potential. For that reason, I didn't open a buy position. A second test of the 1.1635 level occurred while the MACD was in the overbought zone, triggering Sell Scenario No. 2 and resulting in a 30-pip drop in the pair.

The Federal Reserve appears likely to continue its path of rate cuts through the end of the year. This was confirmed in yesterday's FOMC meeting minutes from September. However, the minutes also revealed concerns among several committee members who doubted the necessity of further monetary easing, citing fears of rising inflationary pressure in the U.S. economy. Conversely, other members are more focused on the risks of an economic slowdown, citing weak growth, trade tensions, and other headwinds that could potentially pull down U.S. activity.

Today, in the first half of the European session, Germany's trade balance report will be released, along with the European Central Bank's monetary policy minutes. Without question, traders will closely examine Germany's trade figures to assess the current state of the eurozone's largest economy. However, the European Central Bank minutes will be far more significant, as they could offer insights into the logic and motivations behind the bank's latest decisions.

It's worth noting that the ECB left interest rates unchanged in its last meeting. Therefore, analysts and market participants will look for clues on future rate moves. A dovish tone could weigh heavily on the euro.

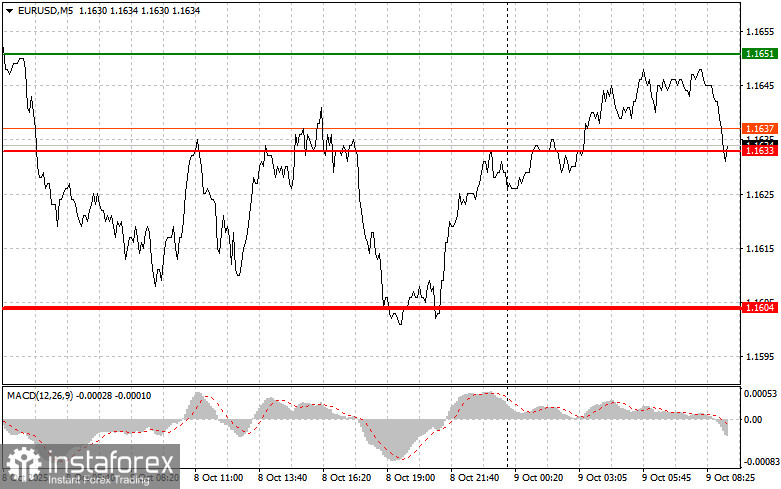

When it comes to intraday strategy, I will focus mainly on executing Buy and Sell Scenarios No. 1 and No. 2.

Buy Scenarios

Scenario 1:

I will buy the euro at 1.1651 (the thin green line on the chart), targeting a rise to 1.1679 (the thick green line). I plan to exit long positions at 1.1679 and then open short positions on the rebound, aiming for a 30–35 pip correction.

Important: Before buying, ensure the MACD indicator is above the zero line and just starting to rise from it.

Scenario 2:

I will also consider buying the euro if the price tests the 1.1633 level twice in a row while the MACD is in the oversold zone. This will likely limit the pair's downside potential and trigger a bullish reversal. Targets in this case remain 1.1651 and 1.1679.

Sell Scenarios

Scenario 1:

I will sell the euro at 1.1633 (the thin red line on the chart), targeting a decline to 1.1604 (the thick red line). At this point, I plan to exit the short trade and go long on a bounce back — aiming for a 20–25 pip move in the opposite direction.

Important: Before selling, ensure the MACD is below the zero line and just starting to decline from it.

Scenario 2:

I will also look to sell the euro if it tests the 1.1651 level twice in a row with the MACD in the overbought zone. This will constrain the pair's bullish potential and should trigger a reversal toward 1.1633 and 1.1604.

Chart Legend:

- Thin green line – entry price to consider long positions

- Thick green line – projected Take Profit level or area to manually exit longs, as further growth is unlikely above this level

- Thin red line – entry price to consider short positions

- Thick red line – projected Take Profit level or area to manually exit shorts, as further decline is unlikely below this level

- MACD Indicator – use overbought and oversold zones to time entries properly

Important Notes for Beginner Traders:

If you're new to the Forex market, approach all trades with caution. It's best to stay out of the market ahead of major economic reports to avoid getting caught in news-driven volatility. If you do choose to trade during such events, always use stop-loss orders to limit potential losses.

Trading without stop-loss protection can quickly lead to the full loss of your capital, especially when trading with large position sizes and no money management strategy.

And remember: successful trading always starts with a clear and well-defined plan — such as the one outlined above. Making spontaneous trading decisions based on short-term price action is a losing approach for intraday traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română