Trade Breakdown and Strategy for the British Pound

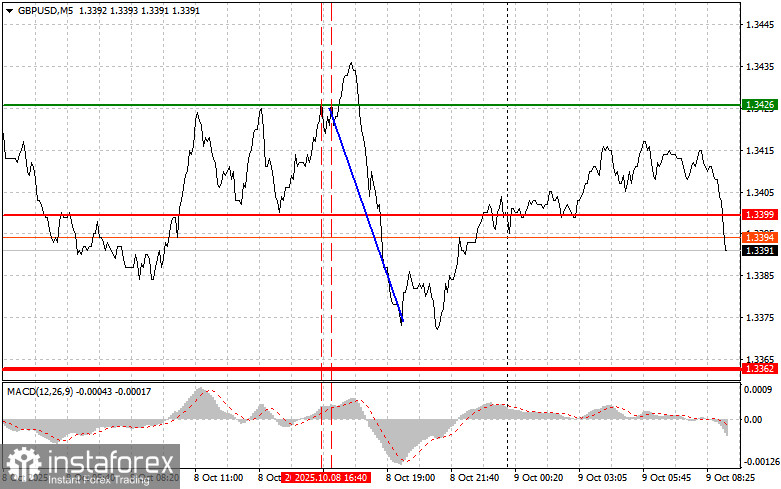

A test of the 1.3436 level occurred when the MACD indicator had already moved significantly above the zero line, which limited the pair's upward potential. A second test of the same level while the MACD was in the overbought zone triggered Sell Scenario No. 2 and resulted in a sharp GBP sell-off of more than 50 pips.

U.S. economic data continues to point to a slowdown in growth while inflation remains above the Fed's 2% target. Despite this, the Federal Reserve appears committed to supporting the economy, as noted in yesterday's FOMC meeting minutes. This outlook pressured the dollar, giving the pound a small opportunity to regain some ground by the end of the day.

This morning, aside from the speech by Bank of England Monetary Policy Committee (MPC) member Catherine L. Mann, no other economic data is scheduled for the UK. That doesn't mean British financial markets will be without dynamics — on the contrary, analysts will be watching Mann's comments closely for clues about the BoE's future monetary steps.

Particular attention will be paid to her views on the current state of the UK economy, inflation forecasts, and the labor market. Her tone may shed light on internal BoE debates over how to balance economic stimulus and inflation control. In times of macro instability, her assessment of threats and opportunities for the British economy could significantly influence investor sentiment and expectations for the central bank's next move.

For the intraday trading strategy, I will focus primarily on implementing Buy and Sell Scenarios No. 1 and No. 2.

Buy Scenarios

Scenario 1:

I plan to buy the pound today at the entry point, around 1.3418 (the thin green line on the chart), targeting a move up to 1.3454 (the thick green line). At 1.3454, I will exit longs and open short positions on a pullback, aiming for a 30–35 pip reversal. This trade setup depends on a hawkish tone from Mann during her speech.

Important: Before buying, confirm that the MACD indicator is above the zero line and just beginning to rise.

Scenario 2:

I will also consider buying GBP if the 1.3399 level is tested twice with the MACD in the oversold zone. This should limit the pair's downside potential and trigger a reversal upward. In this case, I will be looking for the price to reach the opposite key resistance levels at 1.3418 and 1.3454.

Sell Scenarios

Scenario 1:

I plan to sell the pound after a breakout below 1.3399 (thin red line on the chart), which should result in a swift bearish move. The key target for sellers is 1.3362 (thick red line), where I will exit short positions and consider reversing long for a 20–25 pip bounce. GBP sellers are expected to capitalize on any opportunity.

Important: Before selling, confirm that the MACD indicator is below the zero line and starting to move lower.

Scenario 2:

I will also sell GBP if the price tests the 1.3418 area twice while the MACD is in the overbought zone. This will cap the upside momentum and could lead to a reversal back down toward 1.3399 and 1.3362.

Chart Legend:

- Thin green line – entry price to consider long positions

- Thick green line – projected Take Profit level or area to manually exit longs, as further growth is unlikely above this level

- Thin red line – entry price to consider short positions

- Thick red line – projected Take Profit level or area to manually exit shorts, as further decline is unlikely below this level

- MACD Indicator – use overbought and oversold zones to time entries properly

Important Notes for Beginner Traders:

If you're new to the Forex market, approach all trades with caution. It's best to stay out of the market ahead of major economic reports to avoid getting caught in news-driven volatility. If you do choose to trade during such events, always use stop-loss orders to limit potential losses.

Trading without stop-loss protection can quickly lead to the full loss of your capital, especially when trading with large position sizes and no money management strategy.

And remember: successful trading always starts with a clear and well-defined plan — such as the one outlined above. Making spontaneous trading decisions based on short-term price action is a losing approach for intraday traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română