The British pound, euro, and Australian dollar were traded today using the Momentum strategy. I did not trade anything using Mean Reversion.

Given the current pressure on risk assets, it is not surprising that the dollar continues its winning growth streak. This is especially evident in pairs with the euro, pound, and Japanese yen. Even positive data on Germany's trade surplus failed to help the euro rise. The European currency remains under the influence of a number of negative factors, including concerns over slowing eurozone economic growth, uncertainty regarding the European Central Bank's future monetary policy, as well as political tensions in the region.

Considering the U.S. government shutdown and the absence of new fundamental statistics, the focus in the second half of the day will shift to speeches by Fed officials. A speech from Fed Chair Jerome Powell is expected, which will draw special attention, since more and more FOMC members are taking different positions. Market sentiment will depend on his rhetoric and assessment of the current economic situation. Traders hope to receive clear signals about the Fed's future plans, but given disagreements within the regulator and the lack of key U.S. statistics, it is quite likely that Powell will resort to cautious wording to avoid panic and preserve room for maneuver.

In the case of strong statistics, I will rely on the implementation of the Momentum strategy. If the market does not react to the data, I will continue to use the Mean Reversion strategy.

Momentum Strategy (breakout) for the second half of the day:

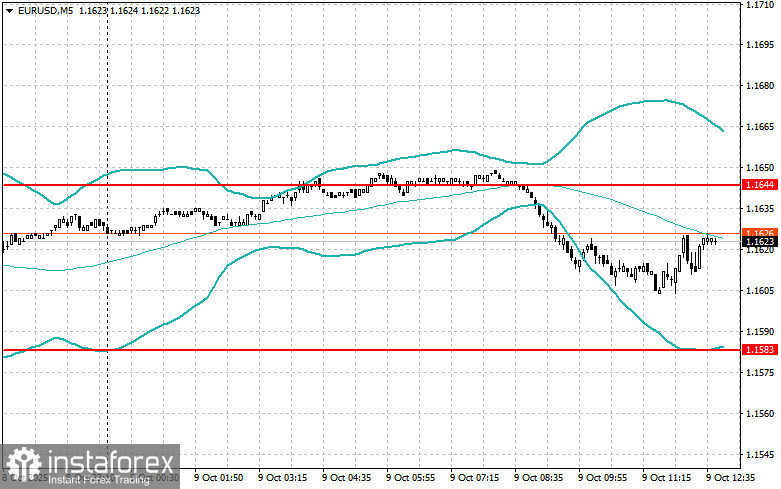

EUR/USD

- Buying on a breakout above 1.1634 may lead to growth toward 1.1661 and 1.1690;

- Selling on a breakout below 1.1610 may lead to a decline toward 1.1575 and 1.1530.

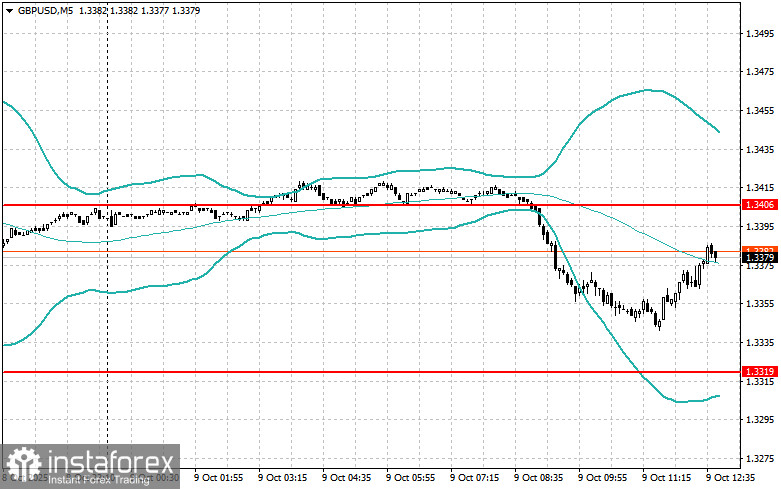

GBP/USD

- Buying on a breakout above 1.3395 may lead to growth toward 1.3424 and 1.3450;

- Selling on a breakout below 1.3375 may lead to a decline toward 1.3350 and 1.3326.

USD/JPY

- Buying on a breakout above 152.80 may lead to growth toward 153.20 and 153.45;

- Selling on a breakout below 152.40 may lead to a decline toward 152.10 and 151.70.

Mean Reversion Strategy (rebound) for the second half of the day:

EUR/USD

- Will look for sales after a failed breakout above 1.1644, on a return below this level;

- Will look for purchases after a failed breakout below 1.1583, on a return above this level.

GBP/USD

- Will look for sales after a failed breakout above 1.3406, on a return below this level;

- Will look for purchases after a failed breakout below 1.3319, on a return above this level.

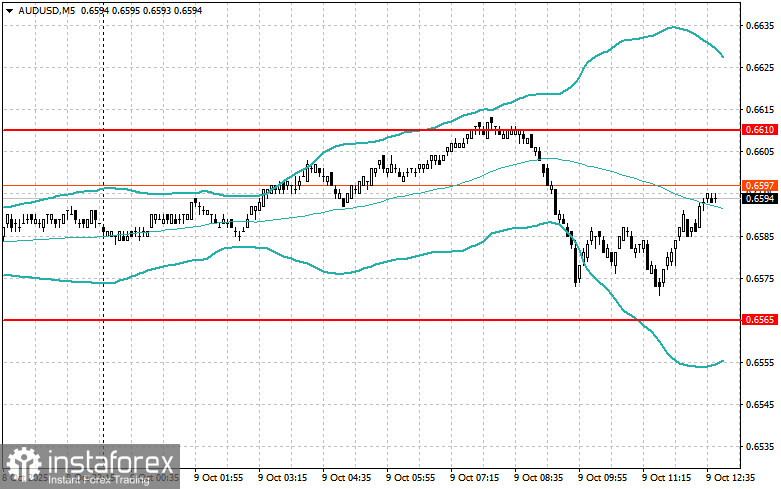

AUD/USD

- Will look for sales after a failed breakout above 0.6610, on a return below this level;

- Will look for purchases after a failed breakout below 0.6565, on a return above this level.

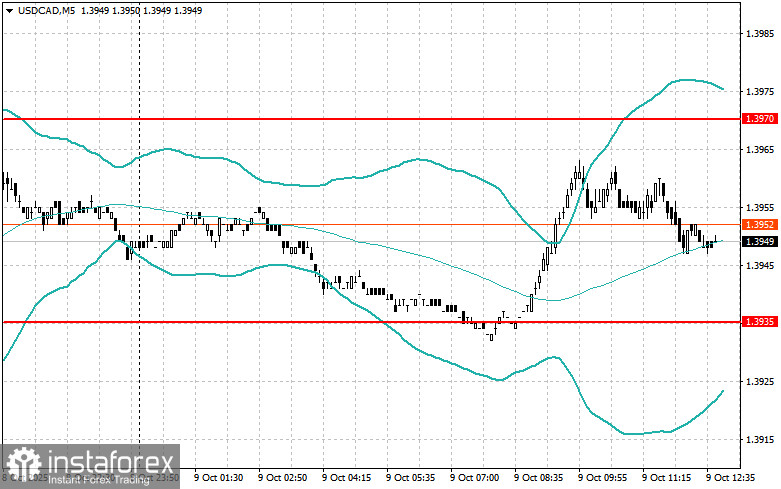

USD/CAD

- Will look for sales after a failed breakout above 1.3970, on a return below this level;

- Will look for purchases after a failed breakout below 1.3935, on a return above this level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română